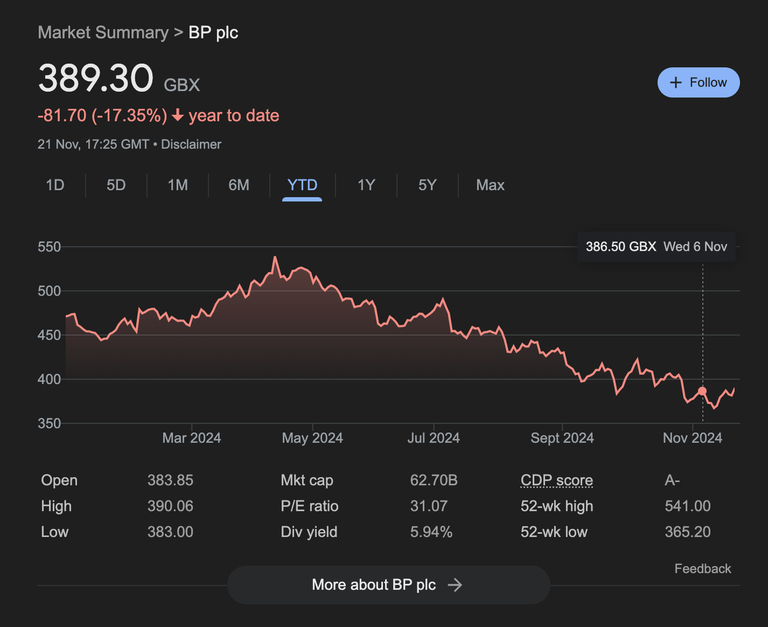

It's no use crying over split milk, or oil. BP has leaked more shareholder value than any other oil company over the past six months.

Anyone who bought back in spring 2024 would have lost 25% of their investment.

So what's been occuring....?

BP is one of the grand old names of the FTSE 100 so it's maybe surprising to see it on such a steady and persistent decline for so long.

Analysts have put this down to something of an identity crisis, which is illustrated by

former CEO Benard Looney setting the arbitrary target of reducing oil and gas production by 25% by 2030, and it seems the markets have reacted.

I mean it would seem that investors haven't been too certain about what BP is focussing on... it is traditionally an oil and gas company, but it's now piling 30% of its capital into renewables...

Or maybe...?

"BP has been increasing its investment in renewables, but has also been scaling back its renewable energy ambitions:

Investment growth

In 2022, BP invested 30% of its capital expenditure in transition growth engines (TGEs), which includes renewables, bioenergy, hydrogen, and EV charging. This is up from 3% in 2019. BP plans to increase its investment in TGEs to around 50% by 2030.

So it's going to scale back it's investment in renewables, but also increase it to 50%, so what are they committed to DECREASING the size of the company...?

I mean this TERRIBLE Communications.

And possibly this is what has spooked investors... If you're only middling and oil and gas, and only middling at renewables, then you are not very investible.

And then there's the fact that I don't quite trust an oil company to lead the way in renewables investment, it seems like it's almost hedging its bets rather than embracing the shift to a renewable energy base....?

Or maybe BP has got it right...?

I mean transitioning is difficult, we are talking about a once in a century shift in the energy base for our entire global population.

Is it any surprise that a company would be cautious...? And YES this means less focus on expanding exploration of the cheap but polluting stuff, but now it's committed such a huge amount of capital to renewables maybe this puts it in a better position to compete going forwards, especially with the UK government looking to invest heavily in Green Tech, and this is a British company, after all.

It might just be a good time to invest in BP...?!?

Posted Using InLeo Alpha