Hello everyone, hope everyone here is well and kicking.. Is been a while, haven't been able to make some post due to some busy schedules and some engagements that got me tight and busy but it has to do with self improvement and that's our core mandate as humans...We need to always strive towards improvement.

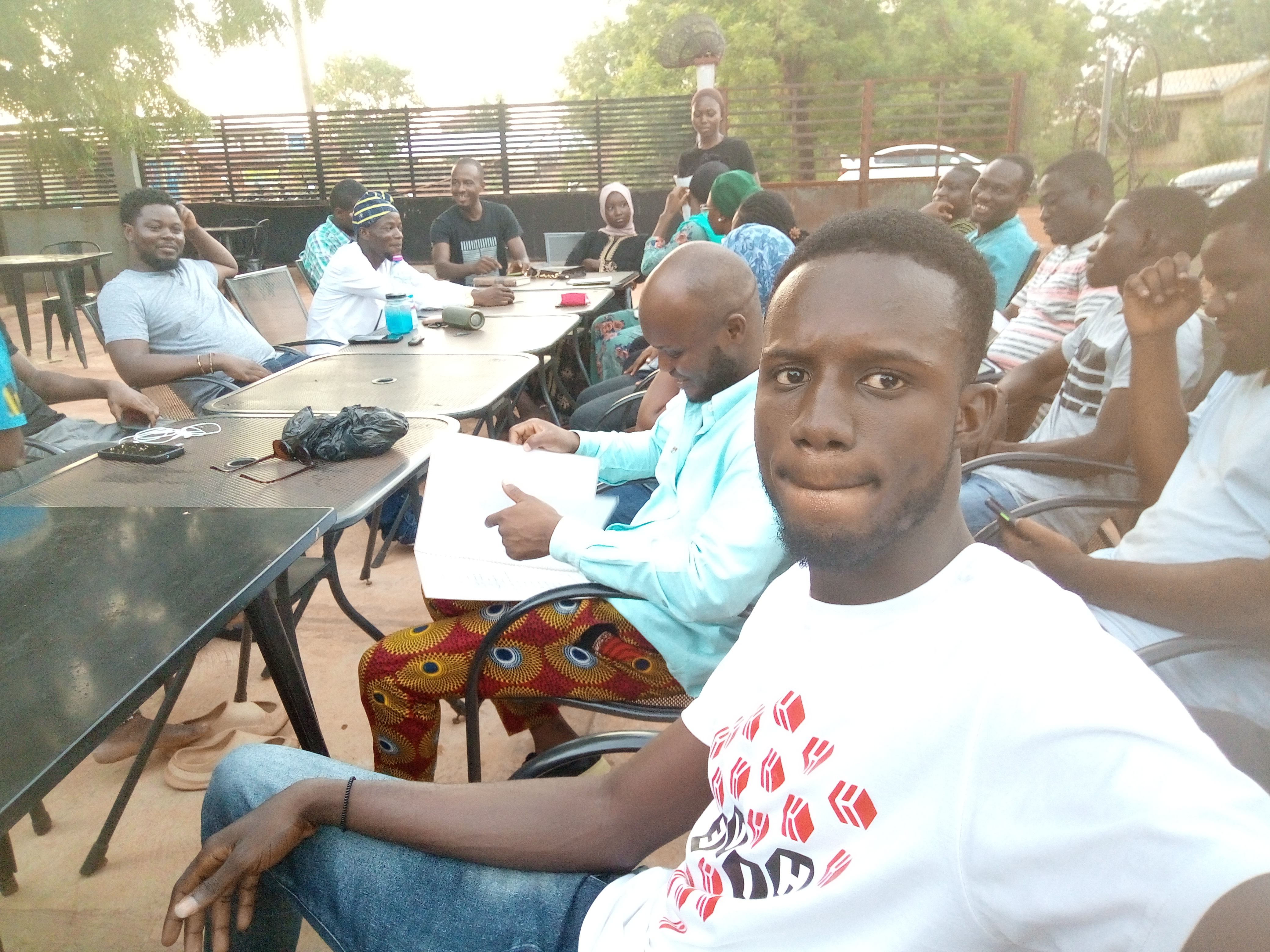

Got myself engaged with the Tamale Connect team organized and funded kind courtesy Ghana think foundation and this meet-up aimed at Bringing like minds together in and around Tamale to discuss issues most especially Financial literacy and its effects on our businesses, work and livelihoods.

This meet-up happened in the Township of Tamale at Mojor Bar and Grill.

Ghana think foundation is a non governmental organization based in Ghana that seeks to mobilize, organize and deploy talents for the primary benefits of Ghana and whole world.

Ghana think foundation in partnership with sister organizations have successfully run a lot of projects some which has ended and a number of them still running.

They run volunteer programs, Barcamp Ghana ,Junior Camp Ghana Komseko (Youth social entrepreneurship program ) just to mention a few.

Barcamps Tamale is a free networking forum bringing like minds together for a day of learning, Sharing and networking.

Financial literacy has some different areas that when discussed cannot be left out and that is earning, investments,expenditure and savings.

The connect gathered like minds in and around Tamale to discuss issues regarding financial literacy and share experiences so people could learn from each other.

People shared experiences as how to how much they earn, how they invest and how they save and most especially how they can save.But out the topics discussed, the most important issue pathetic attached to people lives got to do with how to save money and that's very worrying to them because people think you need to earn much to be able to save money but other people had a different mindset of saving of which they said savings has to do with habits and the choice to save but not neccesarily earning much to save

We also tried understanding that one cannot spend more than he earns because when he does, you will definitely be in debts and that's what people find difficult trying to practice.

This engagement was very insightful and educative and we need more of these programs coming on board so that people can learn from each.

One of the lessons learned is that one must not earn much to be able to save but you just need to develop the habit of saving.

All in all,it was a great meet-up and kudos to Ghana Think Foundation for always making this happen.

Thanks so much for reading !!!