The Financial Intelligence Sector has issued a Directive 9 warning directed at local exchanges in SA. A while ago SA was placed on the Financial Task Force grey list which called out SA for money laundering and corruption which could be linked to terrorist activities. It is common knowledge terrorist activities are taking place in SA so not really a big surprise. Still this will effect the normal investor if he is storing his crypto tokens off the exchange which should be how everyone is thinking and doing.

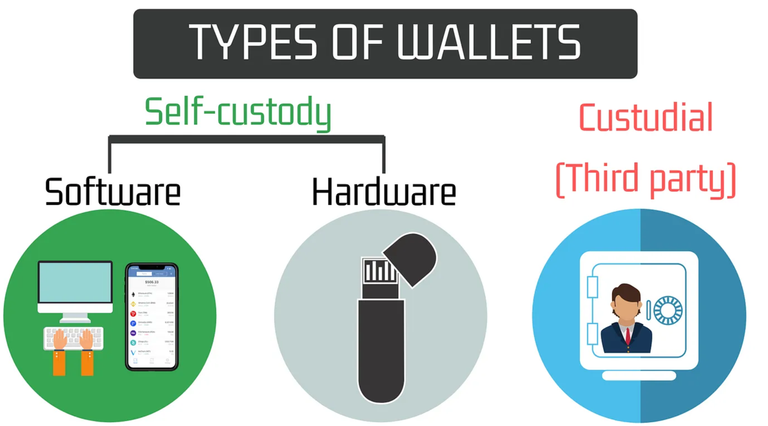

The Directive 9 is about those crypto users who use self custodial wallets like a cold wallet. Going forward anyone depositing funds via a cold wallet or self custodial wallet onto a local exchange will need to supply their identification documents and the source of funds.

From what it sounds like is there may be a story or two to tell with a history of such transactions that have been flagged as suspicious. I do not think this is FUD, but more likely a necessity of the times we are living in.

Personally I do not use the local exchanges for obvious reasons and would like to stay in the shadows. If anyone wanted to launder money or remain anonymous there are far easier ways of dong so and it does not have to be done via crypto.

Going forward exchanges will red flag any transaction over R5000 that has been received from a self custodial wallet which is around $270. This is the FUD part as who would be sending $300 if they were laundering or funding terrorism? R10K or $600 used to be the red fag mark for the tax man so this $2700 is ridiculously low and are now trying to get information on local investors at the same time.

I have mentioned before I find this whole thig ridiculous as everyone should be using cold wallets and not staking on the exchanges. If you deposit funds onto a SA exchange and purchase crypto in order to move it to another exchange or crypto platform then theoretically you are breaking the foreign exchange laws in SA. Every SA crypto investor is breaking the law as who in their right mind would stay on an exchange that has limited crypto tokens?

My friend who I helped invest in COTI had to use a local exchange before moving to HTX before eventually ending up staking in the COTI Treasury. If he was law abiding wanting to remain compliant this would not be possible.

I do see bigger problems for SA crypto investors going forward once the prices do start to rise especially if R5K is the new flagging mark. This is why I do believe having more off ramp options in other countries like having a Dubai bank account is going to be important. Just think for every transaction you would have to verify the funds for the origin of that crypto which would open up a new can of worms.

Posted Using InLeo Alpha