Last week in discord I was asked to please review the following debit cards which is actually not a bad idea knowing what our options are. I have already made up my mind of what I need to do and that is sometime in the next few months visit Dubai and open a bank account. Portugal was also an option, but is nowhere as good as what Dubai offers.

The 3 debit cards I was asked to look up were Crypto.com, KuCoin and Tap. Crypto.com I know is not so great, but promised I would check it out anyways. I think what I will do is do a post covering maybe these 3 and one other in order to compare properly. This is beneficial to all of us as knowledge is what sets us free or something to that extent.

What you have to remember is there is a cost to using any crypto debit card and the last card on this post is Nexo and is rated in the top 3 by price and service and the fees are broken down for you to understand how expensive this really is.

Crypto.com

Crypto.com is a prepaid debit card that works on certain levels which is determined by w much CRO you have staked. CRO which is the Crypto.com token is currently valued at $0.1496c each with an ATH of $0.92c.

Midnight Blue - No staking required, but also no benefits on offer. You can withdraw $200 free via an ATM monthly and after that there are fees to consider. Network transaction fees also apply when moving crypto off the network. My view is this is not great and would avoid.

Ruby Steel - 5000 CRO stake required which is roughly $750 ad this offers you a 1% back on purchases. Free Spotify subscriptions for the first 6 months. (Avoid)

Royal Indigo/Jade Green - 50K CRO staked $7.5K. Offers you 2% cashback on all purchases oh and the first 6 months of a Netflix and Spotify subscription. Tried not to laugh as this sounds shocking. (Avoid)

Icy White/Frosted Rose Gold - 500K CRO staked $75K. 3% back on purchases plus free airport lounge access and 100% rebates on Spotify, Netflix and Amazon. The problem is the staking as you need to check is it worth tying up the stake? If CRO moves to it's ATH you would have lost out on $390K by not unstaking and trading.

Obsidian - 5 million CRO staked or $$750K and they only allow you $1k in free ATM withdrawals per month. The usual perks like Spotify etc and rewards from Crypto Earn which I would guess is an APR earned via staking.

Sorry, but I have to give the crypto.com debit card offering a big thumbs down as this is not what I would call anything special wanting me to join. If you had a shed load of CRO already then maybe it would be a different story.

KuCoin/ KuCard

This I can remember was not so bad, but was limited to the Euro. Yes it is still only supported by the Euro and is only available for those residing in the European Economic Area (EEA). For those wondering this is the EU plus Iceland, Liechtenstein and Norway. The KuCard will cost you 10 Euros to order one.

The good thing about KuCard is there is no staking required and as long as you have crypto in your KuCoin wallet the card will access the following BTC, USDC, USDT, ETH, XRP, and KCS when making a purchase. I am not sure about USDT from January 2025 as I saw somewhere that this has been banned by the EU crypto regulation. Fees do apply for transactions and there is cash back on all purchases, but those are capped.

A monthly fee of 0.83 Euros along with a 1.25% Crypto to FIAT service fee plus a 2 Euro ATM fee. Withdrawing 200 Euros locally will cost you around 3.75% which is 7.50 Euros. I think the simplicity of having a card linked to a large exchange is a no brainer and definitely one to consider.

TAP

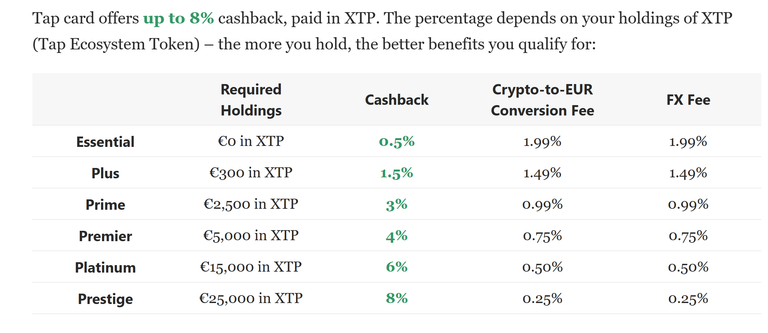

I think this highlights how bad the Crypto.com offering was with $75K only offering 3% and with TAP one only needs to hold $25K in value and not limited to the price of the token itself to earn 8% cash back.

The TAP debit card costs 5 Euros and for every month it is inactive or unused it will cost you 3 Euros.

Tap Card is available to the following countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom.

Lets visit the negatives first and get them out the way as I like this card for what it offers. You have to preload the crypto on the debit card first and does not pre load like most other cards. The crypto to FIAT costs are steep at 2.39%. The positives are the ATM services are free and why maybe the conversion to FIAT is so high as these are built in and thus not that free. Daily ATM limit of 1500 Euro and 15K Euro daily spend limit. One downside was the reviews it had with regard to customer service which was not top notch and the time varied between 3 hours and 14 minutes up to 3 days for various responses.

Nexo

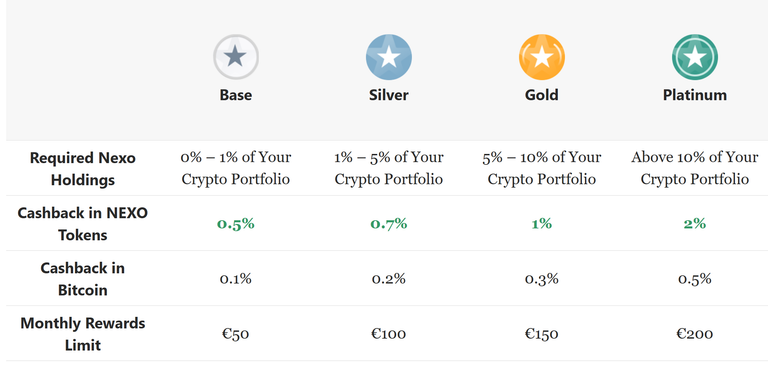

This has been regarded as the best Crypto debit card available and can understand why.

Firstly you will need some crypto ($500) on the NEXO platform before ordering your debit card. The cost is free and you can get 2 cards if required. Nexo supports the following countries.

Austria, Belgium, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Nexo debit card also becomes a credit card which you can simply change the settings before using allowing the card to use your crypto as collateral. The first 2000 Euro's are free for ATM withdrawals which is also your daily ATM limit with a maximum spending daily limit of 10K Euros.

With having a Nexo crypto debit card you automatically get a Malta based bank account with your own IBAN number. This is actually not such a bad idea really if you are on the list of countries eligible.

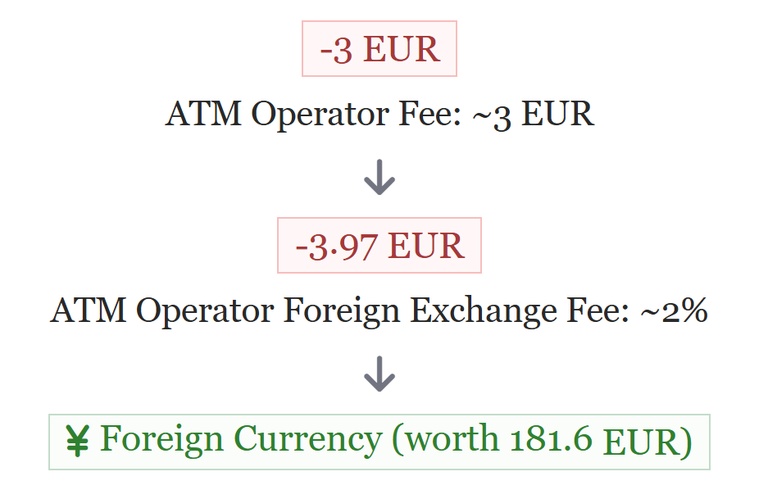

This is the important part and I was a little stunned by the example given, but if you need a crypto debit card there is a cost. I suppose if you have been accumulating and did well in the bull cycle then this would not seem like that much. Also if you are using the card to void taxes then a 10% fee would then be cheap.

8.47 Euro for a 200 Euro ATM withdrawal is pricey but only after you have used the 2000 Euro monthly freeby. So you would save the 3.97 Euro fee on the first 2000 Euros.

This is pricey in anyone's language as you are coughing up 10% in fees for converting to other FIAT currencies. NEXO is regarded as the best option for crypto debit cards and it does stand out head ad shoulders over all the others I have seen thus far. You do wonder how much the crypto debit cards are really charging if this is considered the best option. KuCard does stand out for ease of use, but I do also like having the option of turning my debit card into a credit card which NEXO offers and thus would most likely swing towards NEXO if I was eligible which I am not. South Africa has limited options and I would not go with any as that would mean doing KYC which could be bad news.

I think this has definitely enforced my belief that having a Dubai bank account is the best option from what I have learned thus far. When I withdraw with an international card at an ATM in SA I pay a flat rate of R50 which is around 2.8 Euro's and not paying a percentage on the total amount. Having a Dubai bank account is confidential and thus private without any tax man knowing what I have.

Posted Using InLeo Alpha