The second layer Hive Engine keeps ticking along with more and more apps build on it. Splinterlands is the main one that drives most of the volume but there are a lot of other apps and tribes. Since recently we have seen some NFTs apps build on as well.

Here we will be looking at the volume that Hive Engine does in terms of deposits and withdrawals on the platform. It is a nice indicator of the state of the platform.

At the moment there are three major gateways for deposits and withdrawals on Hive Engine:

- Hive Engine (@honey-swap)

- LeoDex (@leodex)

- BeeSwap (@hiveswap)

The fee for deposits and withdrawals was recently reduced from 1%% to 0.75% on Hive Engine while they remains 0.25% on BeeSwap and LeoDex.

The period that we will be looking at here is Jan 2021 – May 2022

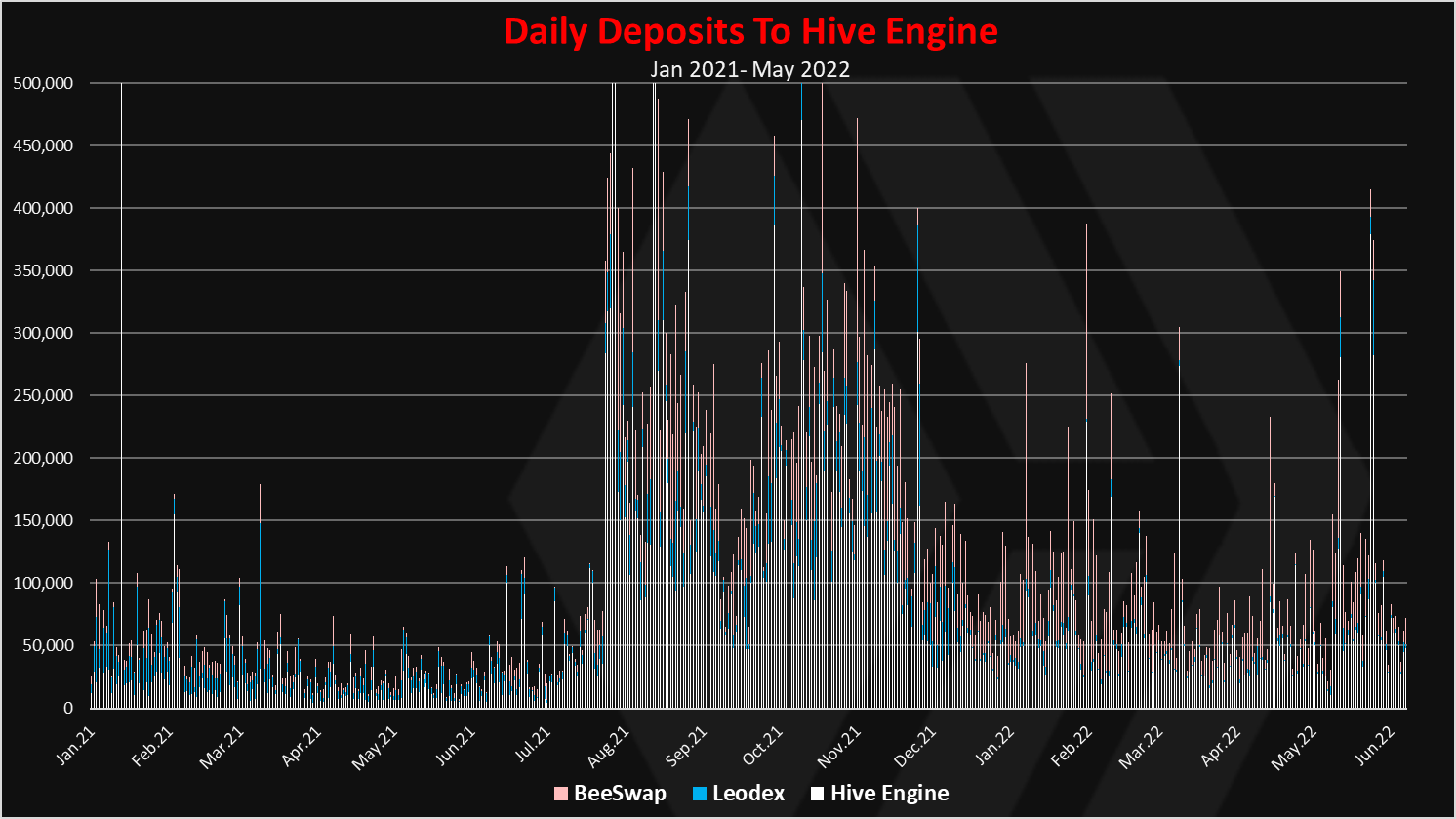

Deposits

For deposits we will be looking at the transfers to the Hive Engine @honey-swap account, @leodex and @hiveswap for BeeSwap.

Here is the chart.

The daily chart is a bit messy with a lot of spikes and ups and downs.

Prior to August 2021, the deposits were under 50k per day. Then in August they spiked a lot reaching more then 500k a day. Since then, the volume has been much higher. In the last month the average is around 110k per day.

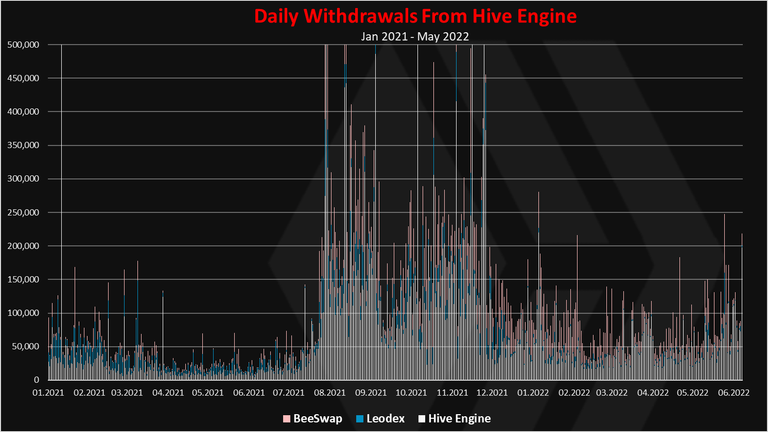

Withdrawals

Next the withdrawals. Here is the chart for the daily withdrawals.

This chart seems to be following the deposits, just with smaller intensity.

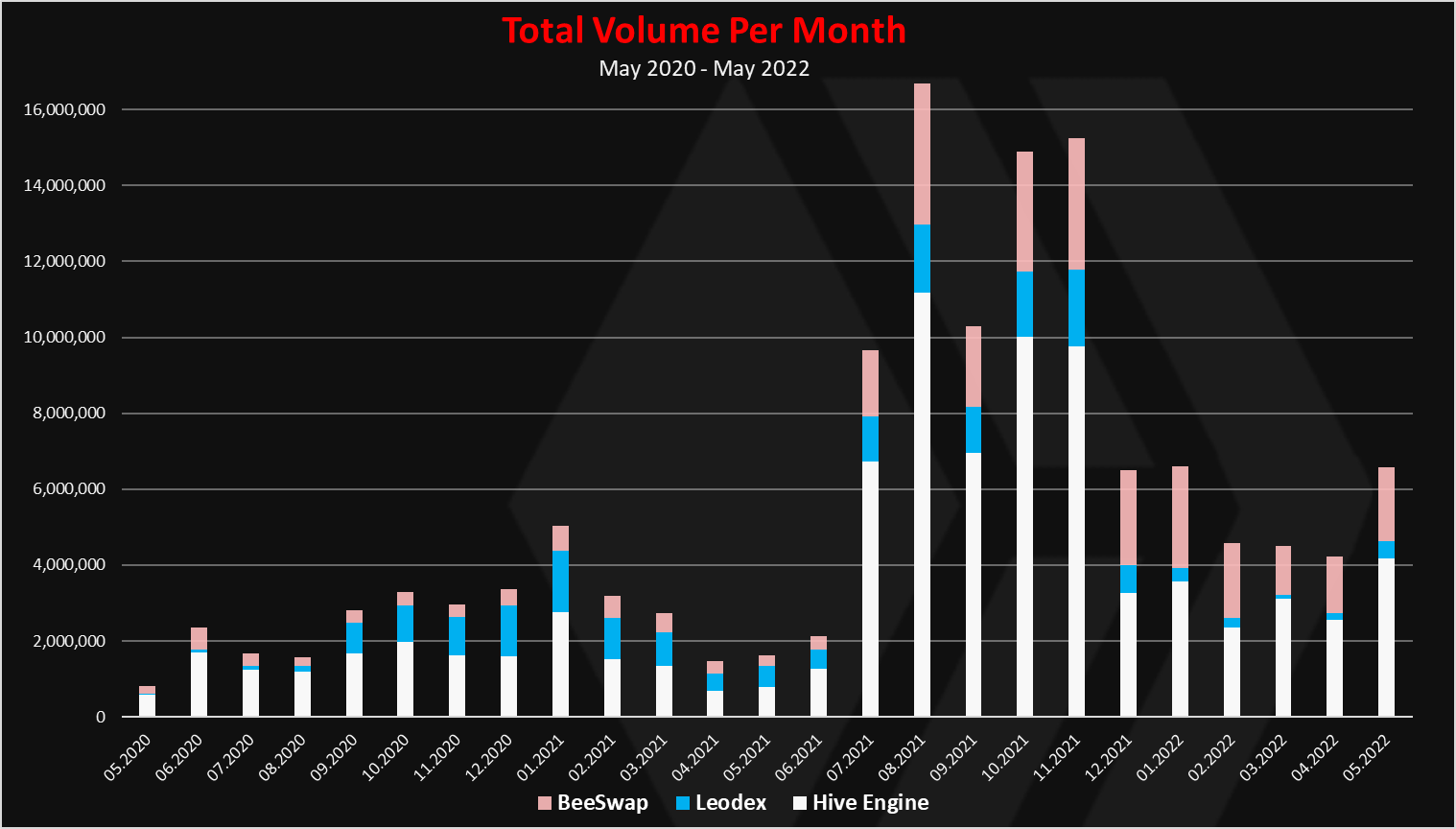

Total Volume Per Month

If we take both the deposits and withdrawals and sum them up on a monthly level we get this.

This is a bit clearer representation.

We can see the growth starting from July and then a peak in August 2021, with more then 16M HIVE deposits and withdrawals to Hive Engine. From December 2021 the volume has dropped a bit but it still remains higher then previously. In the last month May 2022, we can notice that there has been increase in the volume.

The trend mostly follows the growth of Splinterlands.

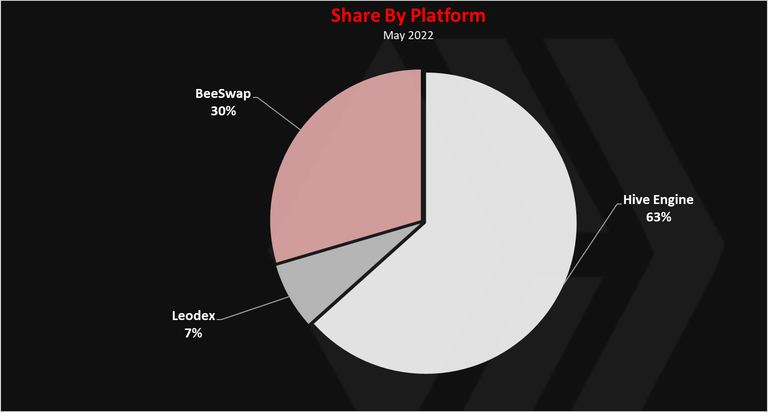

Individual Platforms Share

Here is the chart for the share of the deposits of Hive Engine, LeoDex and BeeSwap for May 2022.

The Hive Engine account @honey-swap has 63% share of the cumulative volume (deposits and withdrawals). BeeSwap is on the second spot with 30%, followed by Leodex with 7% in the period.

The official account still holds the majority share and it is the most liquid from the above. BeeSwap is doing fine with a 30% share now.

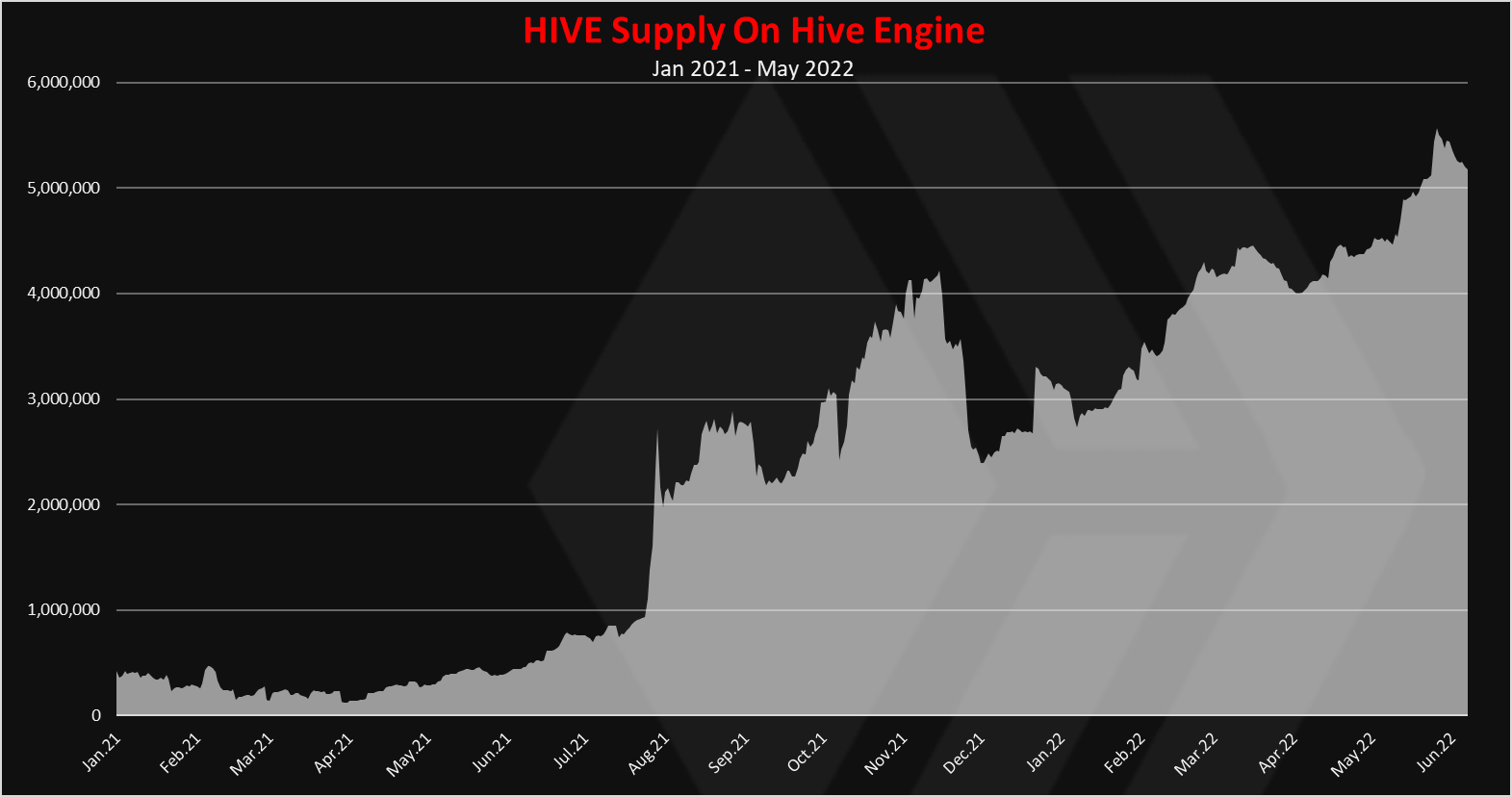

HIVE Supply On Hive Engine

Here is the chart for the HIVE stored on Hive Engine.

This is an interesting chart!

As we can see prior to June 2021 there was under 500k HIVE stored on Hive Engine. Then it started to pick up reaching an ATH in November with more than 4M HIVE. A drop afterwards, and a steady growth again with more the 5M now. At the moment of writing this, the @honey-swap is holding most of these tokens, while the other gateways are mostly out of liquidity.

With this growth Hive Engine is now positioning itself as one of the major source for HIVE liquidity and as a number five exchange for HIVE. Bittrex and Bithumb are now close to it, with 7M and 6M holdings. If it surpasses them soon, it will become then no.3 exchange for HIVE just after Upbit and Binance.

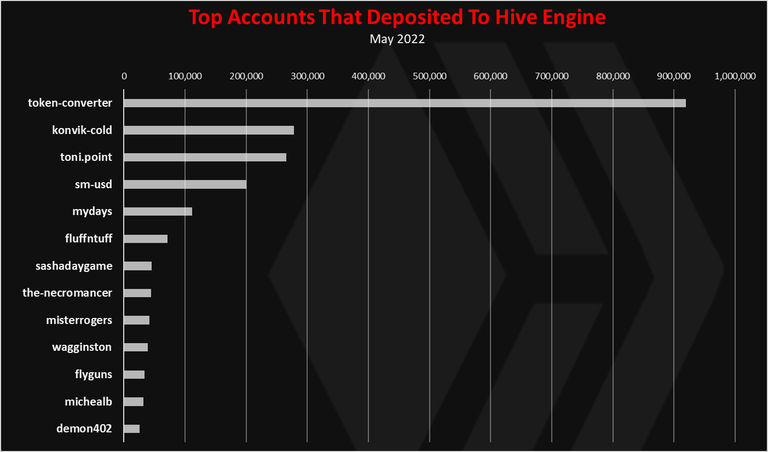

Top Accounts That Deposited

Here is the chart for the top accounts that deposited in the last 30 days.

The @token-converter account is on the top with more then 900k HIVE deposited in the period. This is an account that is connected with Splinterlands and their inner workings.

The @konvik-cold is next, although I’m not sure what exactly this accounts represents.

@toni.point on the third spot, taking care of arbitrage 😊.

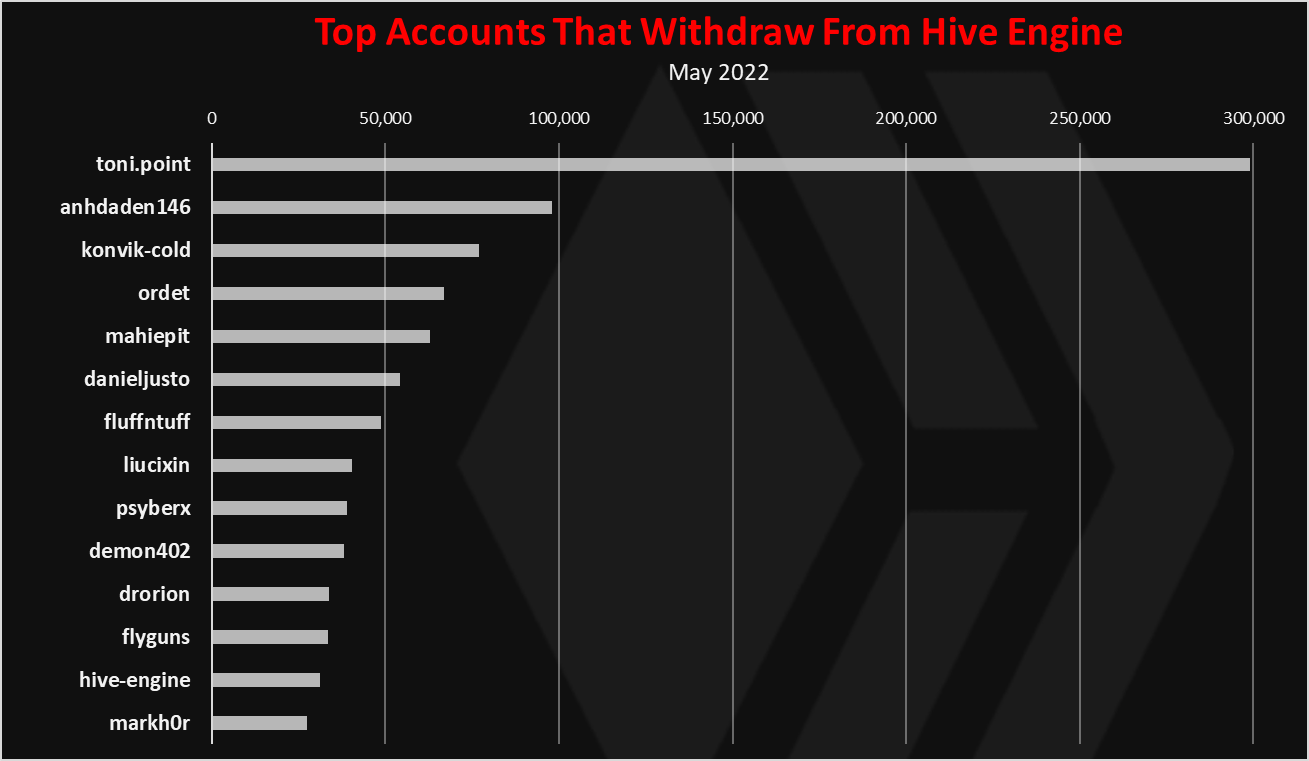

Top Accounts That Withdraw

Here is the chart for the top accounts that withdrew in the period.

@toni.point is on the top with more than 300k HIVE withdrawn in the period, making arbitrages.

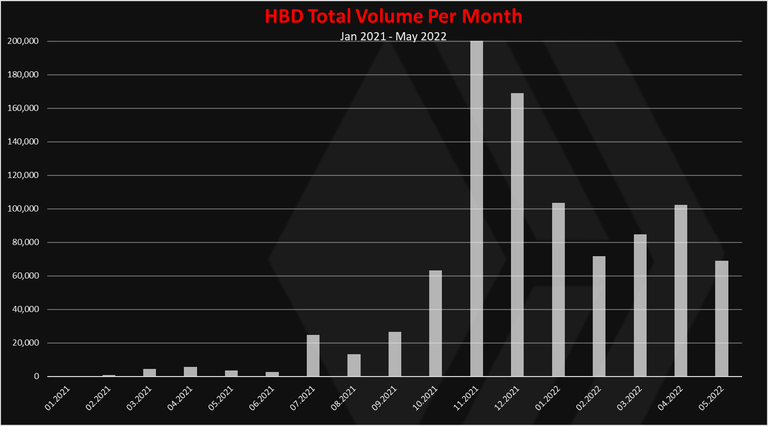

HBD

What about HBD? HBD has been growing in adoption recently. How is the volume for HBD?

Here is the monthly chart.

As we can see the HBD transactions to and from Hive Engine have been growing and reached more then 200k HBD in November 2021. A downtrend afterwards to around 60k to 80k volume per month.

There are few HBD pairs on Hive Engine with a decent liquidity like the HIVE:HBD, BEE:HBD and HBD:BUSD.

All the best

@dalz

Posted Using LeoFinance Beta