So yesterday I may have not have done my due diligence.

I was just kinda like, "Meh, FED chair Powell made some hawkish remarks." But after browsing crypto news I found a half dozen other pieces of relevant information.

link

You don't see that everyday...

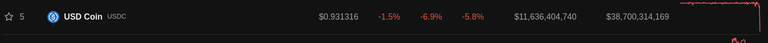

Rare arbitrage opportunity with BTC trading at $21k on Coinbase and Bitfinex but $21.3k on Binance. Must be significant in some way or another.

It was significant.

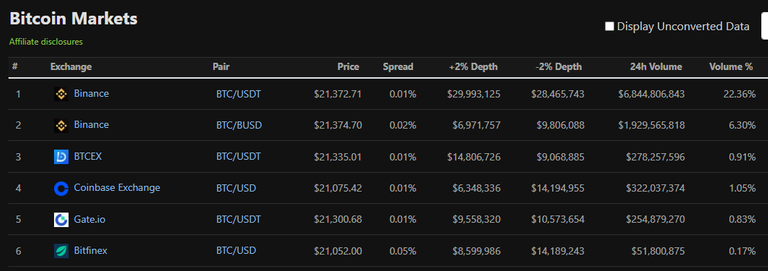

Seeing Bitcoin dumped on Coinbase is always a bad sign, and the situation escalated quickly and immediately fulfilled the bearish case scenario I laid out yesterday. Bitcoin fell exactly to $20k and filled the CME futures gap, just like I've been saying we need to be prepared for since January. Hive also firmly fell into the 30-33.7 cent range that I talked about and currently hovers right above the top of that range.

US Government Abruptly Transfers $217,000,000 in Bitcoin to Coinbase: PeckShield

Then I see this little gem and it all makes sense. Silk Road Bitcoin was essentially illegally dumped onto the market. Of course I say 'illegally' loosely here because the USG makes the law so of course they would make the claim that it's perfectly legal.

However I firmly maintain that Bitcoin that was stolen from drug dealers and then dumped onto the market is theft from the Bitcoin and crypto community at large. The government has no right to that money and should send it to null. Of course this is wishful thinking and we know they'd never do that on purpose. Will be interesting to see if other communities force the issue by nullifying stake stolen by governments with their guns and lethal-force tactics.

This is the perfect explanation for why there was an arbitrage opportunity on Coinbase yesterday with Bitcoin on Coinbase being worth less than Bitcoin elsewhere. USG doesn't care if they take the loss. Easy come, easy go... which even more enforces my point that it was never their money to begin with. I still find it comical how badly these 'criminals' secure their ill-gotten gains. It should not even be possible for the government to steal it, and yet here we are.

The real question we have to be asking here is if there is anything sinister behind this move. Why wouldn't USG auction off the Bitcoin to the highest bidder as they always do? Is there a political agenda in play to tank the price of BTC on purpose? Maybe, but that's purely speculation and potentially even baseless conspiracy theory at this point. Although it is highly suspect that they would just take a loss on purpose like that. Just keep it in mind for future reference.

Pro-XRP Lawyer Says SEC’s Lawsuit Against Ripple Edging Closer to Summary Judgement

The one bit of good news is that John Deaton seems to think the Ripple lawsuit could end within days or weeks (I'm skeptical, especially considering Brad Garlinghouse says by EOY). Of course if Ripple loses this will turn into bad news just as easily and compound the current issues. Deaton is quite the optimist and thinks the SEC's case is very weak due to their overreaching stance that "all sales of XRP are securities investment contracts". This would include sales on exchanges and even between users, which is obviously absurd. Imagine buying a token and then selling it and then being charged with securities fraud. The SEC has lost their minds. Let's hope their overconfidence plays into our favor.

Crypto-focused bank Silvergate is shutting operations and liquidating after market meltdown

The big piece of news is that the Silvergate bank situation has catalyzed even faster than expected and will shut down operations. This is not particularly surprising but the market certainly doesn't like it, that's for damn sure. Silvergate is apparently still solvent and will be able to pay back all their debts, and I've read that this move is just a preemptive liquidation to avoid bankruptcy litigation. Don't see that one everyday in the fractional reserve system... or crypto for that matter.

It's important to note here that even though Silvergate wasn't holding any crypto they still somehow inherited systemic risk from exposure to FTX. This is the last nail in the coffin of the FTX contagion and the perfectly level at $19.5k (2017 ATH). Pretty crazy coincidences honestly.

In any case, the reason why Silvergate failed is because a lot of their money was parked in safe investments like bonds and the like. When FTX imploded everyone panicked and there was a bank run on Silvergate. In order to pay back their liabilities Silvergate was then forced to sell their "safe investments" at a loss before they reached maturity. This was enough to put them out of business even though they personally did nothing wrong. Simply the panic from FTX imploding caused a bank-run on the most popular crypto bank running operations in the background.

I find this situation particularly interesting because Silvergate wasn't holding any crypto, but crypto imploding still destroyed their entire business model. Pretty weird, right? This is something we'll have to factor into the future. The crypto economy definitely learned a lesson here. Very counterintuitive situation indeed.

Largest Creditor of Bankrupt Mt. Gox Exchange to Hold Onto Returned Bitcoin – Huge Selling Pressure Averted?

The MT GOX drama still lingers.

This article says the largest creditor will HODL so no big deal.

But still it's a looming threat to spot price seeing coins unlock in mass.

We have to wonder what will happen on ETH when stake unlocks as well.

Biden wants to double capital gains and clamp down on crypto wash sales: Reports

Biden wants to "tax the rich" by doubling capital gains for millionaires ($1M+/year) from 20% to 40%. I assume that other tax brackets would remain the same (0% up to $40k and 15% from $40k to around a quarter million).

On paper this sounds fine because it's not going to affect a lot of people, but as we all know the government has a nasty habit of getting and inch and taking a mile. Once something like this goes through they just greedily keep lowering the bracket to acquire more tax revenue.

Also Biden is talking about closing the wash-trading loophole that allows crypto holders to sell their crypto at a loss and buy it back instantly. This loophole stems from the fact that crypto is largely classified as "property" and because property is usually illiquid with high overhead it doesn't require securities wash trading laws. Biden wants to "fix" this and tax an extra estimated $26 billion dollars per year. Of course such estimates are ridiculous because they assume that market participants aren't going to find workarounds (like just waiting one month before buying back in).

Another workaround is quite simple for wash trading.

All that is required is an investment in two different cryptocurrencies for an equal amount. Imagine you had $100k worth of Bitcoin and $100k worth of Ethereum. All you have to do is sell the Bitcoin into Ethereum and the Ethereum into Bitcoin. Both of these are tax events in which losses can be harvested. The end result is you still have $100k worth of each token and no wash trading has occurred. This loophole can not be closed. Biden is an idiot. No surprises there.

What does surprise me is that I had heard that the wash-trading loophole had already been closed. I guess that information was incorrect. However, none of this matters because crypto is programmable money. No matter what law gets thrown at it devs can code circles around it. That's exactly why the SEC employs a rule-by-enforcement strategy and refuses to provide regulatory clarity.

Conclusion

FUD FUD FUD FUD FUD FUD FUD!

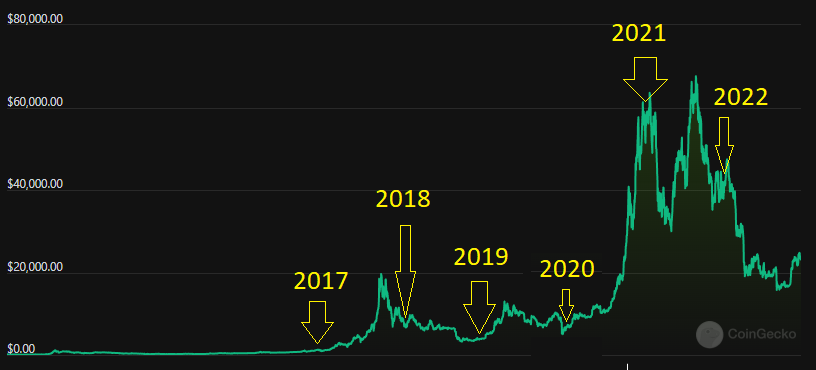

The news yesterday was absolutely abysmal. Might be the worst FUD day in the history of ever. However, I think we should all have a bit of gratitude that Bitcoin and the rest of the market are still towering above the local lows from the FTX contagion. In all likelihood we'll find support somewhere around here and push forward just like we always do. March is looking like it's going to end up like the V-shaped recoveries that we've seen in 2018, 2020, and 2022. We'll bottom out soon enough if we haven't already. Volume is good and the bulls are waking back up to buy at this discounted price. Two steps forward, one step back. Always.

The price has never dipped like this in March without spiking back up out of it.

Take note.

Posted Using LeoFinance Beta