You'd never know it by looking at the charts.

But crypto users are completely tapped out, running on fumes, and it shows. In retrospect when we look at the charts many will assume that 'obviously' the worst time was right after the FTX collapse. That's when price was lowest after all. However the people's version of history is always quite different than those who actually write the books.

Many forget about crabs in a bucket theory.

When Bitcoin outperforms the market altcoiners tend to get desperate. We see this all the time. During the year of the maximalist (this year in the cycle) Bitcoin tends to outperform and alts will bleed against it. Even if alts aren't going down and trading flat it doesn't matter. If people see Bitcoin going up but not their preferred coin, this becomes a psychological problem that has real consequences.

This effect was particularly bad in 2019.

It was actually worse back then than it is today, but we still see the same type of pattern. Crypto users don't get mentally tapped out at the bottom of the bear market. They get exhausted after, during the slow boring grind sideways. There are always a ton of psych-outs where the market will pretend to be in a rally and potentially a full blown bull market, but inevitably it always deflates, each time leaving crypto users feeling helpless and potentially very bored and anxious that it will never end. We had one of these moments just recently when the summer rally and support lines basically just fell away. Everyone cheered when BTC hit $25k up from $16k, but everyone loses their minds when we retest $25k for the second time after being in a higher range for a while.

The most recent dip in crypto has people absolutely scrambling.

You can feel it on platforms like crypto Twitter, and we can see it right here on Hive. How many Hive users recently just had an idea that requires a hardfork in order to make number go up during the bear market? I call these bear market ideas,, and they should never be implemented, ever.

It's times like this I envy Bitcoin.

Does anyone realize how much we look like jackasses when every time the bear market rolls around everyone and their mother pitches an idea to completely change the way this network operates? Bitcoiners that try to pull that bullshit get laughed right off the stage, which is very much the appropriate response. It is so dangerous for powerful and respected users on this network to continually to be so fickle in the wake of a bear market. Please stop pitching these ideas: they hurt our reputation and will almost certainly have the opposite of the intended outcome.

The false narrative goes something like this:

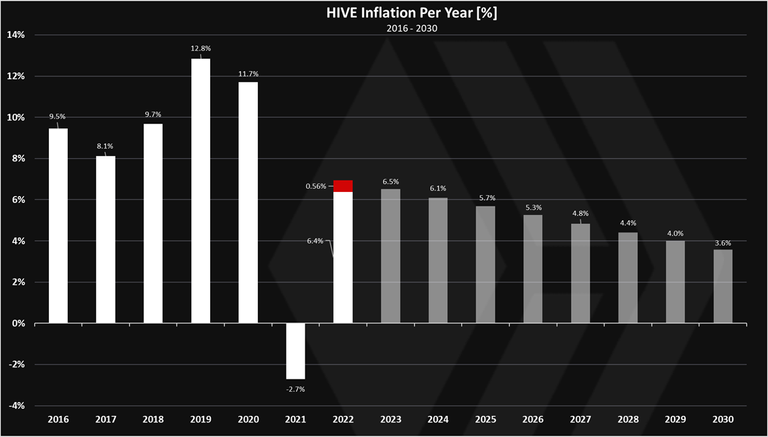

Printing money is bad in a bear market because printing money means there are more tokens in the circulating supply. More money in the circulating supply means token dilution, and thus one token will be worth less than before. This is bad and we should move to print less tokens, or divert the tokens we are printing to long-term holders so they don't get dumped on the exchanges.

TERRIBLE IDEAS

ALL OF THEM. FUCKING AWFUL. STOP PITCHING THIS CONCEPT PRONTO.

I'm super serial right now guys. I'm over it. Cut the shit. Every one of these ideas has a common theme that makes them invalid. Not only do they attempt to tame the market cycle: something which no professional economist, government, or bank has EVER accomplished, but also they attempt to tame the market cycle ONLY during the bear market.

The market cycle has TWO SIDES: TWO.

I repeat: two sides. If you pitch an idea trying to make number go up during the bear market, THEN AT THE VERY LEAST YOU MUST PITCH THE COUNTER-CONCEPT TO MAKE NUMBER GO DOWN IN THE BULL MARKET. You are absolutely not to be taken seriously otherwise. This is simple elasticity 101. If you want to make the token less volatile, then it must be made less volatile in BOTH directions.

Because guess what?

Even if you pitch an idea that makes number go up now during the bear market... well what stops that idea from making number go up during the bull market as well? Then the NEXT bear market comes and wrecks us all over again because the volatility is still EXACTLY THE SAME. Nothing changed. We're still going to lose 90% of the token price during the next bear market. This is not an improvement.

Oh I haven't even started this rant yet.

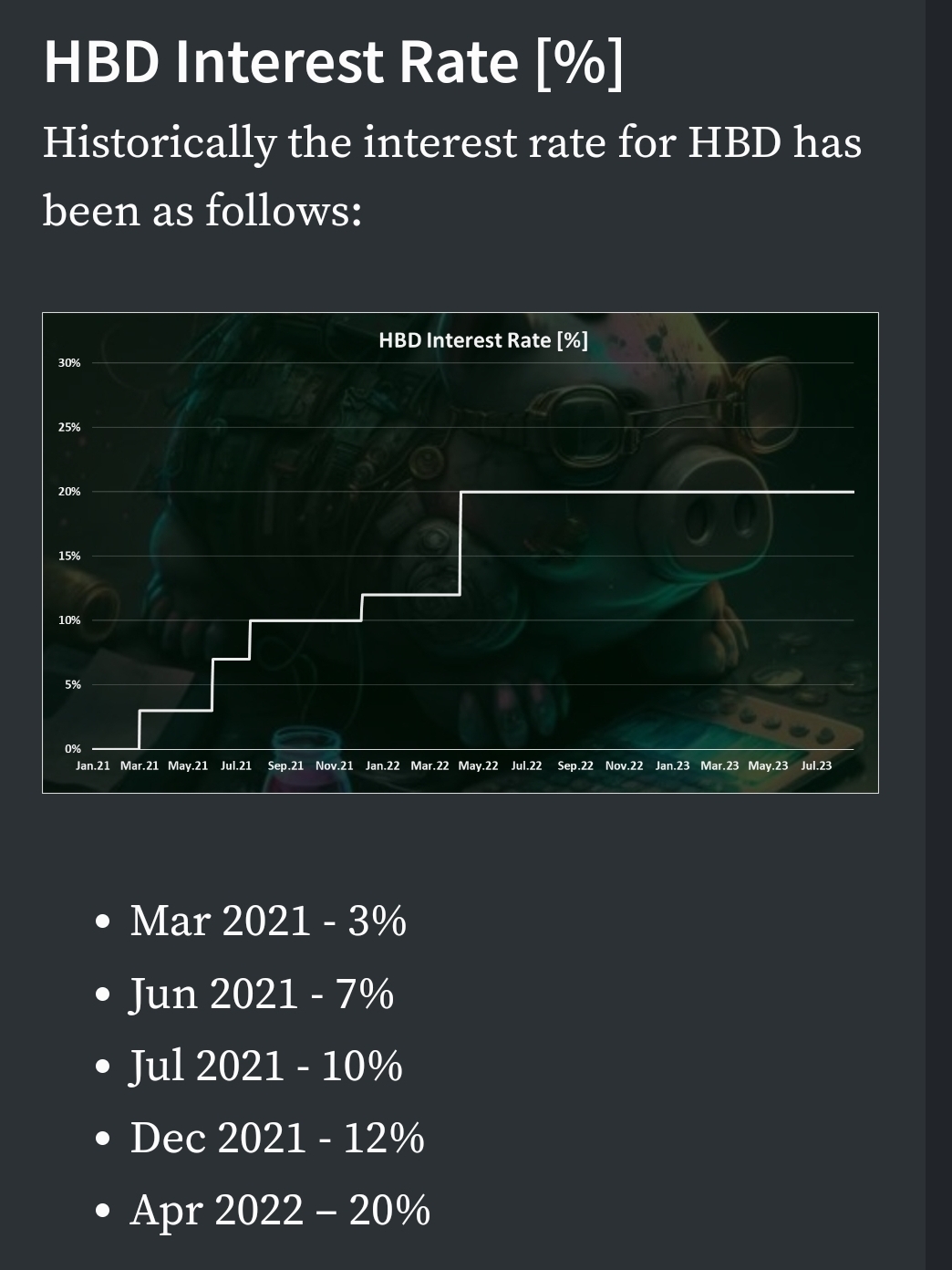

Because a lot of the ideas that get pitched are going to do THE EXACT OPPOSITE of what the person pitching them thinks they are going to do. Yes, 20% yield on HBD is high. What of it? Again the concept here is that if we lower HBD yield right now then less Hive of going to be printed and number will go up. WRONG. SO WRONG. HEINOUSLY WRONG. PLEASE CEASE AND DESIST.

If we lower the HBD interest rates then some percentage of people holding HBD for the high interest rates are going to decide that holding HBD at lower interest rates is no longer worth it. They will IMMEDIATELY dump their HBD, which in turn will IMMEDIATELY drop the peg under a dollar, which will IMMEDIATELY financially incentivize the network to convert HBD into HIVE, which will then IMMEDIATELY be dumped on the exchanges and lower the price of Hive. See how that works?

Manipulating emissions is a delayed reaction.

I keep trying to tell people this and literally no one listens. Governments and economists understand this concept just fine, but crypto users are absolutely clueless. You print money during a recession to boost the economy and get out of the recession. You tighten policy to put a lid on it and make sure inflation doesn't get out of control during the good times when the economy can handle it. This is standard operating procedure and the optimal outcome. Crypto people pitch the exact opposite idea over and over again and it is so very cringe and short-term thinking.

An APR is measured annually.

That's what the 'A' stands for in APR. 20% APR. Annual. If we reduce the HBD APR to 12% tomorrow, how much Hive did we save? How much less Hive got printed tomorrow because we reduced the APR by 8%? ZERO. ZERO less Hive was printed. We still have the exact same amount of Hive in circulation during this snapshot of the network, because that's how numbers work. It takes A YEAR for 12% APR to actually be 12%. This is not a hard concept to understand, or so I thought when I first started making these points. So one has to GUESS where we are going to be A YEAR FROM NOW when tinkering with emission rates measured on a yearly scale. Welcome to basic economics. It's not easy. Why else would professional economist be a paying job?

If we lower the APR on HBD, Hive will get dumped on the markets now: today, and that 8% difference in yield will not actually materialize for an entire year. The time to lower interest rates was at the peak of the bull market in 2021. Now is literally THE WORST time to talk about lowering it. If anything we should be talking about increasing it, but we can't because obviously 20% is already pretty nuts. We've already trapped ourselves in a web of bad economic policy. All we can do is sit here and and wait for the market to turn. Lowering emissions is not an option during bad times: this will only make the problems worse in the short-term. I guarantee it.

We expect too much of witnesses.

And honestly it's alarming. First and foremost a witness is expected to be a dev (for the most part). They are also expected to be a politician, as governance decisions are being made at this level for everyone else in a republic-like system called DPOS. And now we see that witnesses have control of interest rates, so they also have to be economists. But wait Hive is also kind of like a business, so witnesses need to be businessmen as well.

That is literally 4 full time professional jobs at the same time. None of the witnesses can do it. None of them. The only way to do it is to have witnesses be companies of multiple people with different skillsets, which is where I see this network eventually going, but these initial stages are quite the thing. It's not pretty, especially from the outside looking in.

Conclusion

This happens every market cycle, and it needs to stop. I have the utmost respect for the users trying to make this ecosystem more sustainable, but I guarantee a lot of these ideas will have the exact opposite intended effect. As a rule of thumb if you didn't have the idea during the bull market then it shouldn't be considered during the bear market either. Scrambling to change the system based upon where we are in the market cycle is a terrible strategy and highlights the fact that we, as a network, are willing to change the rules whenever it suits us. And people say Bitcoin is "old tech". Yeah well sometimes reinventing the wheel is a really terrible idea. In fact, most of the time this is true. Vast majority. Stability and dependability matter.

During bear markets in crypto people get into this penny-pitching mindset that serves no one's best interest. We keep looking at the core code and wondering how we can tweak it with a hardfork to create the perfect most efficient use of our resources. It's the equivalent of refactoring code in a program that works fine and doesn't need to be refactored. Yes, it could be more efficient, but the ultimate resource is time. Our time would be better spent elsewhere focusing on building out rather than introspectively wondering if this or that thing needs to be changed. It doesn't. It works. Leave it alone: you're going to break it. Don't try to 'fix' it. Asking frantically, "CAN DEVS DO SOMETHING!?!" when number go down is never the correct response.

I guarantee everyone here that the best way to build value on Hive has absolutely nothing to do with a hardfork. Ever. A killer dapp will never come from a hardfork. Slowly cranking out infrastructure is boring and tedious. I'm absolutely not envious of the job the Blocktrades does or other core dev, and I'm very glad they are around to do it because it needs to get done. Notice how none of them are pitching ideas like this and instead are focused on scale and the API and HAF and real tech that might make a real difference eventually. Unfortunately it takes years for infrastructure such as this to actually be built upon by others to create the value we'd like to have tomorrow. Patience is a virtue.

At the end of the day I'm not even worried about any of these bad policies being implemented. Blocktrades is way to smart for that. He's way too conservative as well and doesn't like to gamble with the network, which is great. How long was I screaming from the rooftops that Hive needed an AMM internal market incentivized by printing more emissions? Blocktrades personally told me that it was too risky for various reasons. I was thinking, "hm, maybe," at the time: and now 99.9% of all the AMM defi tokens have crashed to zero. Go figure. On top of that the current Hive/HBD orderbook has exponentially more liquidity now than it did back then due to the stabilizer and other factors. Yep. Pretty good. Color me impressed.

The real thing I'm worried about is that well respected people on this network keep pitching these ideas about drastically changing the rules of the platform every single bear market. It's such bad optics. Not only will the core devs never implement the ideas, but it just makes us look like we have no idea what we are doing, which we don't. Hopefully we figure it out one day and stop drowning in this blatant scarcity mindset. Soon™