Mega Bullish on Rune for at least 12 months.

Probably even 24 months.

After that? Who knows?

One of the biggest risks with collateralized lending on the blockchain is that they always tend to be extremely risky. Even if the loan is overcollateralized by 300% the chance for liquidation is still quite high during a bear market. The peak of the bull market has always been a time of over-extension and a feeling of invulnerability. Inevitably this type of attitude has a tendency to crush most crypto users during 80%+ retracements, with many alts being more like 90%+. Risk of liquidation is all too real.

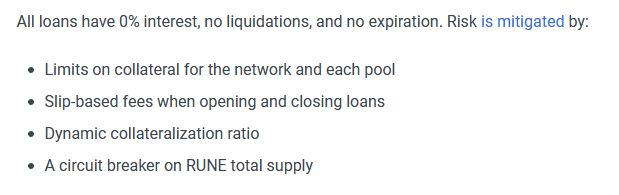

ThorChain is attempting to remedy this issue with 0% APR loans that can't be liquidated. Sounds too good to be true, amirite? Yeah well, it probably is. However, in the short term the strategy they're employing is almost bound to be a winner that will pump the token price to the moon.

I'm not going to pretend like I know exactly how this works.

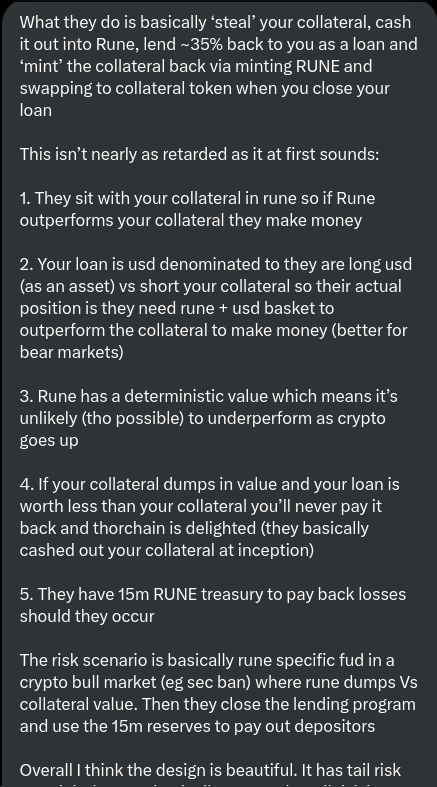

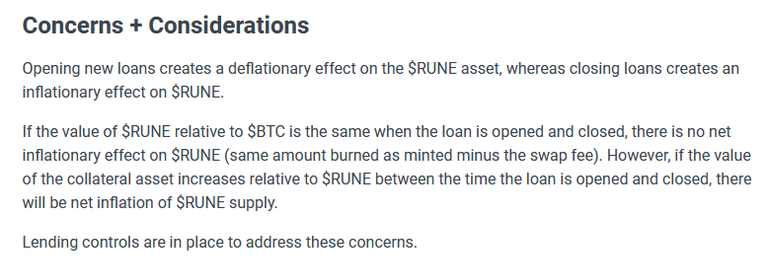

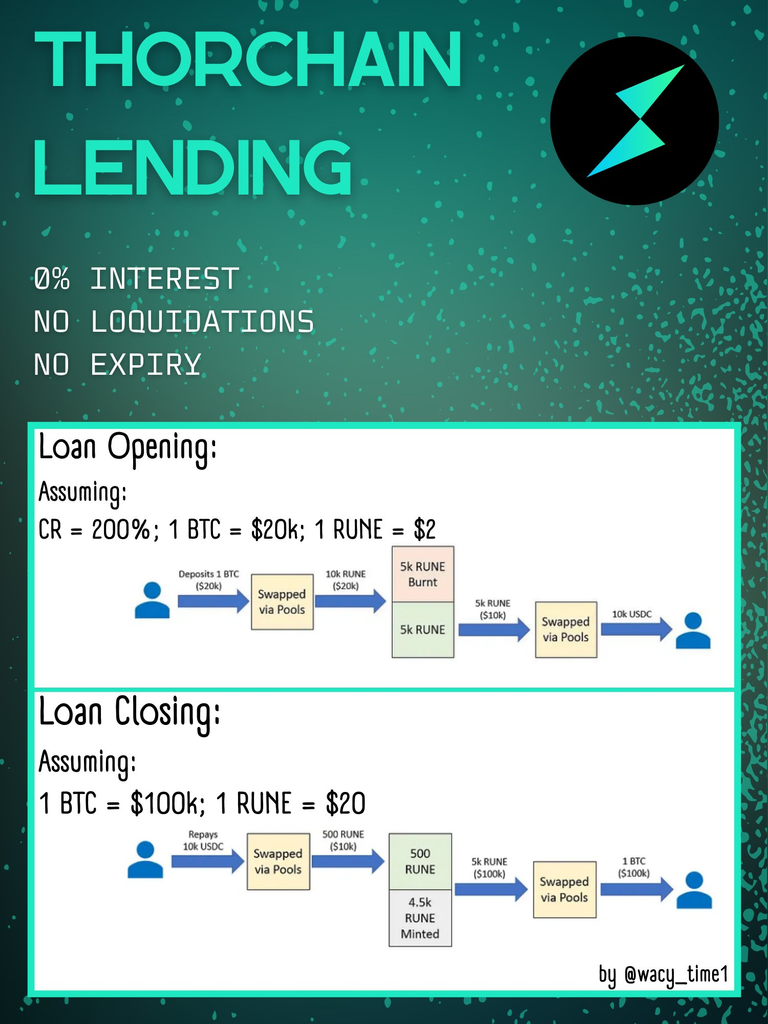

After all, I only just heard about it yesterday. However, it looks like what ThorChain is doing here is naked shorting every single type of collateral that goes into these contracts, which is then used to buy and burn RUNE. Then, when the loan gets repaid, RUNE is minted and then dumped back to retrieve the collateral which in in turn sent back to the user. I'm not sure how anyone thinks this idea is a great idea long-term, as it assumes that Rune is always going to outperform the other collateral assets, including Bitcoin.

Speaking of Bitcoin...

This is the only Lending Protocol that works on the native Bitcoin network.

ThorChain chads have a nasty habit of blatantly lying in this way. The first time we caught them doing this is when they claimed that ThorChain was the only place Bitcoiners could go to earn yield on their native BTC. Again, this was a lie. The BTC exists in ThorChain LPs, and those LPs have already been hacked many times. Pretending as if ThorChain does not introduce counter-party risk is a complete fantasy, and yet the marketeers continue to embellish the truth. Business as usual I suppose.

Obviously if the manner in which we are understanding this strategy is correct: Bitcoin held as collateral within this system absolutely does not exist as Bitcoin, but rather as bought and burned RUNE. The frontend will trick users into thinking they actually have Bitcoin, but what they actually have is an IOU from the ThorChain network saying they pinky promise to return the BTC. It doesn't take a genius to realize that the chance this protocol survives a single bear market (potentially 2026) is very low.

However, I'm getting strong LUNA/UST vibes from this entire situation. We all know how that ended: complete systemic failure and the ultimate collapse to zero. But before complete systemic failure ensued LUNA pumped like x100 or whatever. Therefore I think a protocol like this, even if heinously flawed in the long term, will pump RUNE to something like x50-x200 over the next 2 years. What happens to it during the bear market is anyone's guess. Could it survive or even thrive? It's possible.

Mitigating risk factors

#1: Collateral ratio

If we compare a system like this to something like LUNA/UST there are actually some glaring differences to set it apart. First of all the collateral required to take out one of these loans is going to be quite hefty. The chance that the collateral is worth less than the loan is slim and most likely to happen within a crippling once-a-cycle bear market. This fact has interesting implications.

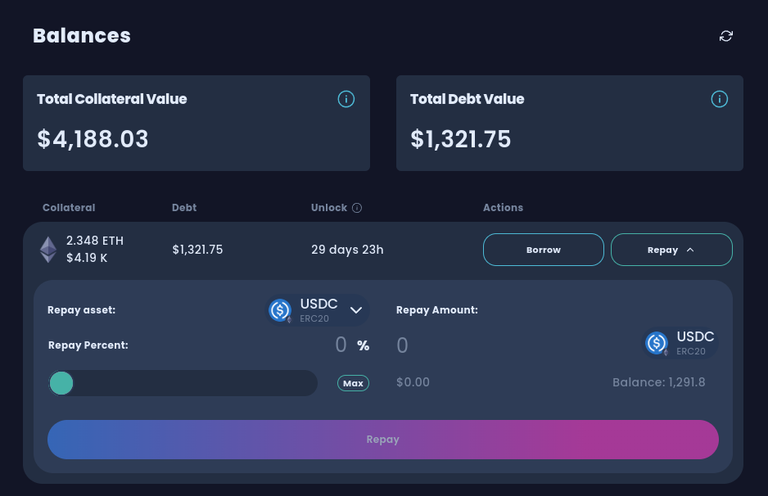

For example let's say you took out a $1000 loan with $4000 worth of BTC, but then the value of the BTC crashes 75% and your collateral is now only worth $1000? We can see in this situation that the chance of the loan being paid back is essentially zero. Why would anyone pay back this loan at such a time? There's no incentive to do such a thing. Thus, it's reasonable to expect that during a bear market loans will just sit underwater and Thorchain will not have to worry about them until number actually starts going up.

The real issue here is that Thorchain is naked shorting BTC, and BTC tends to outperform pretty much everything during the bear market. So not only will it outperform RUNE during the bear, but RUNE price will probably be suppressed for an extra year when all the other numbers are going up because it suddenly becomes worth it to pay back the loans. RUNE would be getting minted and dumped on the market during that time, which is bad for RUNE because it heavily implies that RUNE won't be able to outperform any of the collateral, which is the entire point of this system. But again, this is potentially a 2027 problem and certainly not a now problem.

The circuit breaker

This thing is essentially guaranteed to trigger sooner or later, and what would that mean for the lending protocol? Well it means that people who thought they had Bitcoin collateral within the system suddenly aren't even allowed to pay their loan back. The Rune will not be minted and the BTC will not be returned. Funny way to market "zero risk" loans. Yeah sure, the liquidation risk is zero but the systemic failure risk, or even just the circuit breaker risk, is not.

This means that while the chance of an outside entity liquidating the loan is zero, the real threat is that the user themselves will not be allowed to liquidate it. Considering that some of these loans will be overcolleralized by something like x2-x4 their value it could end up resulting in devastating losses or the money simply being locked up till the circuit breaker gets reset/modified.

Considering the marketing strategy being employed by this product I have to assume that at least 50% of the users are going to have no idea how it actually works and get fooled by this idea that they can collateralize their assets at zero risk. It will likely be a lot higher than that; maybe even 90% of users will have no idea how it works and trust what the frontend tells them. Let's be honest they should have known it was too good to be true and figured this stuff out in advance. But can we really blame the user?

Conclusion

Collateralized loans are basically one of the coolest things DEFI has to offer. In fact, as far as I'm concerned, it's the only utility that DEFI has managed to offer that has any staying power whatsoever. All other protocols have either failed (AMM yield farming) or been incredibly lack-luster.

If I'm being honest I actually think this 0% APR 0% liquidation system is pretty impressive and innovative. It's simply my job to pick it apart and see how it can fail. This is not very hard to do considering that ThorChain is actively, purposefully, and transparently shorting every type of collateral while going long on RUNE in the process. If I'm being honest this probably isn't that bad of a strategy IF they didn't allow Bitcoin to be collateralized, but they do. This could easily be their undoing in the long run, as Bitcoin performs very strongly over the long haul.

The one saving grace of this system is that it prevents systemic failure during the actual bear market, which is exactly the time in which the vast majority of crypto assets tend to systemically fail. As with many financial instruments, this one somewhat depends on permanent long term growth. ThorChain would hope that the TVL of these contracts would only continue to increase over time so that the price impact would always be a net positive. Maybe it will due to the counterbalance and avoidance of the bear market.

The funny thing about this loan protocol is that ThorChain NEVER wants users to pay back their loan to retrieve there collateral because they are actively shorting the collateral which is worth much more than the loan itself. That is quite the curveball as far as a financial debt instrument is concerned and we really have no idea how it's going to play out within the crypto jungle.

It's also very noteworthy that a protocol like this can't be hacked like an LP might be. Normally collateral like this would be sitting around and act as a honeypot, but instead ThorChain vaporizes it and simply writes an IOU. It would also be very easy to see if and when the circuit breaker was at risk of tripping: allowing more savvy users to get their money out before everyone else realizes there's a bank run.

All in all this is a fascinating protocol that will almost certainly send RUNE to the moon during the peak of the next bull market. With the risk to RUNE itself being mitigated to the circuit breaker (and outsourced to the collateral while hypocritically marketing the collateral as 0% risk) it's almost 100% guaranteed that one will make a lot of money investing in RUNE today and simply dumping it in one or two years.

I won't be buying anymore RUNE because of this development, but I have to admit that I'm really excited now to see how my small bag performs over that time. I just hope my gains won't come at the expense of some other poor sap who has their money locked within a system they were assured was risk free by charlatans.