HIVE >> HBD Conversions are Weird

The last time I talked about Hive to HBD conversions I was trying to learn how it worked in the middle of writing the post. Now that some time has passed I feel much more comfortable with the concept and have a lot more respect for the process. It's a very cool solution, but it adds that much more complexity to the chain because conversions are not symmetric. HBD >> HIVE conversions are completely different from HIVE >> HBD conversions, and that can be confusing for anyone trying to learn how it all works. After much internal debate, I have to conclude that the extra complexity is worth it (or maybe that's just a less-noob me talking).

Conversions are an advanced feature.

The vast majority of the time, Hive users should not engage in conversions. We should simply trust the bots and liquidity providers in play to do their jobs. However, the community can act as a magnificent backstop for when shit really hits the fan and the liquidity providers run out of tokens to dump onto the market. One of those moments may come very soon considering how much HBD is being bought off the market.

HBD pumps are highly lucrative.

For example say all the bots are dumping their HBD for around $1.10-$1.15 during a big pump... if they run out, HBD can spike into the $1.25-$1.50 range. That's the free money zone where conversions basically can't lose. It's happened a couple times already and regular users can get very confused over the conversion process and even lose money because of it, so I figured I'd explain in greater detail how it all works.

In Discord last night I was talking about holding some liquid Hive in order to hedge against any kind of HBD spike. @khaleelkazi did not agree with my strategy. Said that the best thing to do would just be to sell the Hive into HBD now and dump into the pump when it happens. And while this would be the proper move in certain situations, it is not the best strategy for the outcome I'm anticipating.

I tried to explain my point a little bit but it was difficult to verbalize, and then the conversation somewhat devolved into a bet where Khal and I would degen battle it out with $10k on the internal market. Winner takes all. Memes were involved.

Marky apologizes for not being able to properly represent my skinny arms with this meme.

So yeah rather than trying to explain my point generically I figure I need to come up with a solid example of what I'm talking about here. The example that came up in Discord seemed to be pretty good, as the assumption was that HBD just hit $1.50. What do you do? How does one prepare for something like this?

Without the HIVE >> HBD conversion all you can do is buy HBD in advance and wait around for it to pump to $1.50, when it does: you dump the HBD and end up with a 50% gain. However that gain is currently stored as HIVE, which is a volatile asset. So if you really wanted to lock in the 50% and stop gambling you'd have to cash out to another stable coin like USDT and wait for HBD to get back to $1 before you could transfer the money back.

Unfortunately everyone capitalizing on the 20% HBD APR completely misses out on all these moves because the of the 3-day timelock. This is why I don't necessarily agree with removing liquidity from the market in exchange for yield. Liquidity is important and I don't necessarily believe Hive should be rewarding a smaller trading pool. This is why I often talk about upgrading the internal market to AMM and allocating those HBD yields to the AMM farm instead... but that's far beyond the scope of this post.

Getting back to the example.

Everyone knows that Hive has a much higher chance of pumping than HBD does, so holding liquid HBD as a hedge against a pump is a gimp move. In fact if HBD pumps then Hive will very likely pump as well due to all the Hive being bought and burned to create HBD during the conversion process. Therefore holding liquid Hive is a way to capitalize on quick Hive and HBD pump and dumps simultaneously.

Here's How:

Let's say Hive is sitting at 50 cents and HBD has pumped to $1.50 like in the previous example. You have 5000 Hive and no HBD. It's a shame you have no HBD as you want to capitalize on the irrational pamp, but you still have the liquid Hive available to convert which is useful.

So you convert all 5000 Hive into HBD.

- How much HBD do you get?

- When do you get it?

- How can you leverage it?

Luckily these conversions are a super cool asymmetric solution to the problem of HBD manipulation to the upside... which I now happen to understand fairly well after some fumbling frustrations that occurred last summer as I studied them.

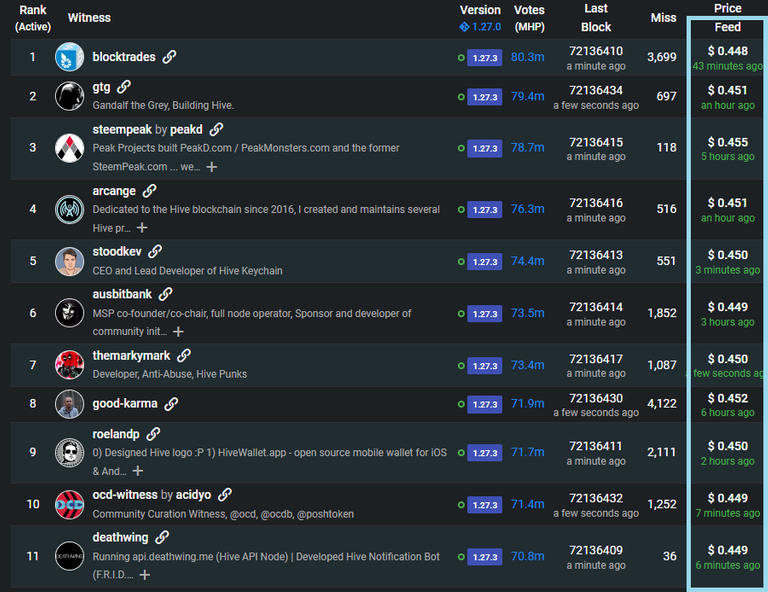

The first order of business is the price feed.

The price feed is an extremely important part of Hive's technology in which we employ consensus witnesses as oracles. An oracle in crypto is a trusted entity within the network that tells us information happening outside the network that it otherwise wouldn't know about. In this case the price feed tells Hive how much Hive is worth on external exchanges.

It's extremely important to realize that these numbers could be anything. Nothing prevents all the witnesses from claiming that Hive has a price of $10. They could do that right now if they wanted to, but they choose not to. You might be wondering what would happen if they did; I can tell you that one of the outcomes would be that x20 more HBD would get printed and distributed to blog posts than now. Maybe they should do it amirite? 😉

Another thing the price feed affects are conversions in both directions.

For example if witnesses jacked up the price of Hive to $10 on the feed, Hive >> HBD conversions would become 20 times cheaper because the collateral used to mint the tokens would be thought to have more value. Obviously this would break the HBD peg to the downside and would be really bad as a flood of HBD entered the system.

- So in our example we burned 5000 Hive.

- The price feed for Hive is 50 cents.

- This is the average median price feed over 3.5 days.

- What is the outcome?

RESULT:

- The blockchain will calculate that the 5000 Hive is worth $2500.

- The blockchain will give the user half of the money up-front.

- The blockchain will hold all 5000 Hive for 3.5 days as collateral.

- So we will receive 1250 HBD instantly as soon as the block posts.

That's the magic of HIVE >> HBD conversions

We get instant liquidity. HBD >> HIVE conversions are completely different and we have to wait the entire 3.5 days to get the money while the HBD remains locked during that period.

So what happens to the 5000 Hive?

That's the interesting part. It is held as collateral and isn't sold until 3.5 days passes. Therefore if the value of Hive goes higher than 50 cents after 3.5 days... you get yet another bonus. Let's say Hive was also mooning during this time and 3.5 days later the median price feed was $1; your collateral would now be worth $5000 instead of $2500, and you only owe back $1250 for the 1250 HBD. So instead of paying 2500 Hive for the 1250 HBD you'd end up only spending 1250 Hive and getting returned a total of 3750 Hive. However there is a 5% fee for this conversion so you'd actually end up paying 1312.5 Hive/HBD and get returned 3,687.5 Hive (not 3750).

A 5% fee seems kinda steep...

The charge for HIVE >> HBD conversions is pretty heavy. 5% is a lot on a relative scale. At the same time the 5% exists to incentivize real market makers to operate within the dead zone without the need for conversions. HBD >> Hive conversions have no penalty, as HBD is supposed to be pegged to $1 intrinsically and pegging the downside supersedes pegging the upside (although both are important as we have seen).

There are rumors floating around that once we've tested 5% long enough Hive will tighten the band to a smaller gap, but for now the 5% is a good place to test this relatively new feature within the jungle of crypto while maintaining a conservative and robust position.

How do we leverage the 1250 HBD?

Oh, that's easy... just dump it for Hive and convert that Hive into HBD all over again. By creating a nested loop of collateral positions it's possible to convert near all 5000 HIVE into HBD. In fact after just 3 conversion loops 87.5% of all the Hive will be converted (50% + 25% + 12.5%). However what does this look like when the price of HBD has mooned to $1.50 like the previous example?

First we get our 1250 HBD...

But because the value of HBD is bubbled... when we sell it at the jacked up $1.50 price we get more than 2500 Hive (which is the expected half of the initial 5000). Instead, on the internal market Hive won't be trading for $0.50 like it is on Binance, but rather "$0.3333" or more accurately 1:0.33333 HIVE:HBD. This will get us 3 Hive per HBD instead of 2 Hive for $1 due to the jacked up HBD price. So when we dump the 1250 HBD we'll end up with 3750 Hive, which can then be converted to HBD all over again.

To recap:

- First we convert 5000 Hive into 1250 HBD.

- Trade 1250 HBD for 3750 Hive.

- Convert 3750 Hive into 937.5 HBD.

- Trade 937.5 HBD for 2,812.5 Hive.

- Convert 2,812.5 into 703.125 HBD.

- Trade 703.125 HBD for 2109.375 Hive.

- ETC ETC ETC

After we complete these three nested loops we started with 5000 Hive and we are left with 2109.375 Hive after everything is said and done. However, there are three collateral positions that will unlock in 3.5 days. We already calculated the first one at 3,687.5 if Hive price doubles over 3.5 days. But that's a pretty exuberant assumption. If Hive remained at 50 cents we'd get back 2,375 Hive from that position.

- 1st: 2375 Hive returned (owing back 1312.5 HBD)

- 2nd: 1781.25 Hive returned (owing back 984.375 HBD)

- 3rd: 1335.9375 Hive returned (owing back 738.2813 HBD)

So what happens is that the HBD that is owed back to Hive 3.5 days later is destroyed within the Hive collateral that we provided, and everything leftover is returned. In this case we got back 5,492.1875 Hive from our three collateral positions after 3.5 days assuming no price change in Hive, in addition to the 2109.375 Hive that was left over from the final sale that was never converted. We started with 5000 Hive and ended up with 7601.5625 Hive 3.5 days later. Not too shabby; free money.

Unfortunately if the price of Hive goes down in 3.5 days it's possible to lose money on conversions. This is why conversions are best left to the professionals, but when HBD is around $1.25 I've noticed that it's almost impossible to lose money on conversions. That amount of Hive being converted and destroyed will almost always lead to higher spot price for Hive, giving us the double-win on both HBD and the Hive that gets returned from the collateral positions.

Wait a minute...

All this information may lead one to ask the most obvious question:

What happens when Hive crashes in value so much that the collateral doesn't pay for the HBD that they borrowed?

We call this "bad debt" in the loan game, and I assume what happens is that the person who minted the HBD and didn't have enough collateral to pay back the loan simply gets away with it. Luckily the ability to exploit a mechanic like this is basically impossible because of what it would entail.

A bad actor would have to mint millions of HBD in conversions and then put up double that amount in collateral knowing that every last cent of collateral they put up will vanish. Then they have to dump millions of coins on exchanges to lower the price by over 50%... and then they have to somehow turn a profit even though they just lost millions of Hive and only have a couple million HBD leftover. It's easy to see that this kind of behavior would be extremely risky, and we'd be able to see it happening on chain for over 3 days. Probably a good way to get your account frozen by witnesses if the exploit actually warranted it. What witness is going to process your transactions after you pull something like that? Huge risk; very little reward if any.

In any case

We can see that when the price of HBD is something like $1.50 and it maintains that price even as we are dumping coins onto it: It's very easy to keep the nested conversions going because we get more than half of the money back. In fact, if HBD spiked all the way up to $2 we can essentially do infinite nested conversions with the same stack over and over again until the price drops.

Thus it is basically impossible for HBD to go higher than $2 given these mechanics. $2 acts as the ultimate soft-cap. $1.50 would be extremely difficult to maintain, and $1.25 is a level that I've seen to be free money on the table in all scenarios. This is a massive upgrade considering that SBD spiked to $13 in the 2017 bull run on Steem. All that extra value is funneled into the governance token where it belongs.

Internal market front ends:

https://wallet.hive.blog/market

https://hivehub.dev/market/advanced

https://beta.hivedex.io/

https://alpha.ecency.com/market#advanced

These are a list of frontends for the Hive/HBD market.

Some of them are better than others.

I kinda like https://beta.hivedex.io/ by @mahdiyari because it looks a lot like Binance. Just realized I wasn't voting his witness node. Fixed that...

Conclusion

Once again I try to write a 1000 word post and this happens.

Very sad.

In any case I hope this better explains the conversion process. Don't take this post as gospel as there may be some errors but I think I got it mostly correct this time around.

It's weird to think about it like this, but HIVE >> HBD conversions are basically Hive's first decentralized loan smart contract. We borrow HBD directly from Hive using Hive collateral, and the loan is paid back in 3.5 days. HBD appears out of thin air and we can spend it instantly, while Hive is sold 3.5 days later. It's possible that this feature could evolve into so much more going forward (IE a futures market).

The reason I write this post today is because I believe that HBD may be a big reason why Hive moons during the next bull market. The more people that realize that 20% APR and 5% debt ratio is like the best deal they are ever gonna get, more and more users should begin to rotate into HBD. This will pump Hive hard. It pumped LUNA x100 over 12 months before the UST death-spiral. Luckily the way Hive works (3.5 day price feed average + 30% debt ratio haircut) creates a scenario in which Hive can't death spiral due to the haircut. We can still get that x100 without crashing to zero like LUNA did (although we could crash 90%-99% lol). We've been there before, and we will be again. Hedge properly.

Whatever happens, it's good to know that this option is available. If Hive starts receiving the levels of adoption we expect it to over the next few years, the volatility will get very intense. Legitimate demand is popping up for HBD all over the world in the face of hyperinflation (or simply the looming threat of it). Games are being built here that need it for stable pricing in addition to all the other dapps being constructed. If we get even a single good exchange listing for HBD... that alone could x10 the price of Hive at these beginner levels.

But I'd like to follow that statement up with the message I've been preaching for a while now: Do not ask how the network can make money for you. That is a known path to poverty. Provide value/liquidity to the network when the need is obvious, and the money will flow as a secondary effect directly into your pocket. I've seen it play out many times now exactly as stated. The network rewards those who provide value.

Posted Using LeoFinance Beta