BTC Wrapped on Hive will be better and less centralised than BTC on the Lightning Network.

This is quite a bold claim coming from our very own @brianoflondon but then again he does seem to be the authority around these parts on the Lightning Network. We continue to push forward with smart contracts on the Hive blockchain, but how does it work? I suppose it's time to start dipping our toes now that a prototype is up and running.

If you've followed Brian's posts at all and his trials and tribulations with running a Hive >><< BTC bridge across the lightning network you'd know that the LN is a complete shitshow full of grand delusion. It's complicated. It's expensive. It's not sustainable. It scales up instead of out: It's centralized. It's buggy and glitches often. It can be risky, and there are new known threat vectors like cycling attacks.

With all this in mind it's not exactly preposterous to say that Hive could actually create a better iteration than that by leveraging DPOS. Of course it is certainly blasphemy if uttered to the cult of maximalism.

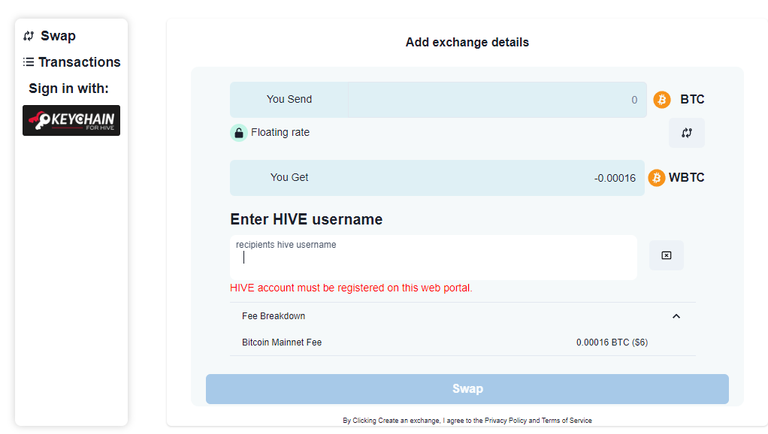

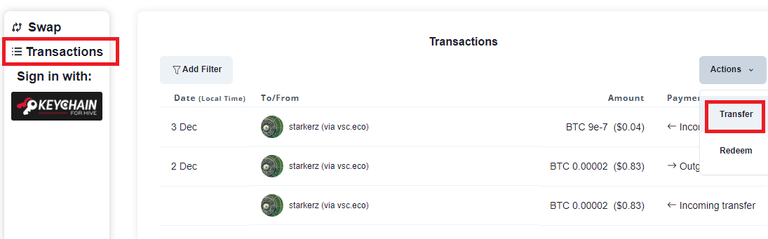

https://wrap.vsc.eco/

@starkerz did me a solid by sending me a tiny bit of wrapped Bitcoin on the centralized prototype. At this point my understanding is that it currently all runs on a single node and we have to trust @vaultec, which is obviously fine in these early stages... just don't go transferring your life savings just yet.

So what?

Well first of all simply the ability to trade sats back and forth using nothing but Hive keys is pretty badass, but also the system Vaultec is building here seems to be a lot more scalable than anything those BTC maxis are going to cook up. That's the magic of DPOS I guess.

More importantly this is an obvious precursor to the ability to create liquidity pools to Bitcoin. This is something we have desperately needed for a while now with the regulators hammering away at every "problem" as though it's a nail. I would like a divorce from centralized authority; please and thank you.

What do liquidity pools for Bitcoin mean?

Unlike the Lightning Network which has zero other tokens available for trade... Hive has two other assets on the mainline. Hive and HBD. This means we can extend out the second layer and build HIVE/BTC and BTC/HBD trading pools. Exactly how those would work is a bit above my paygrade at the moment, but the ability to transfer wrapped BTC on Hive certainly allows for such development.

Brief Rundown of the operation.

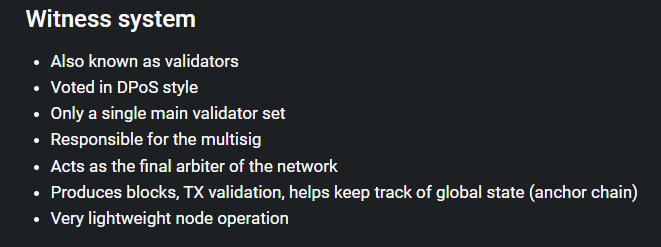

So the question we have to ask ourselves is how something like this differs from Hive Engine and whatever else. Looking at the proposal itself for VSC provides a lot of the information we're looking for.

Initially my first question was,

"How is it possible to know what Bitcoin is doing?"

Are VSC nodes running Bitcoin nodes?

Sounds expensive.

Maybe it's just oracles?

The easiest way to explain is it's essentially a compressed copy of the Bitcoin blockchain into a relatively light weight smart contract.

Interesting!

I won't pretend to know what a "compressed copy" of Bitcoin is, but it would make sense if VSC nodes only paid attention to wallets that were actively involved in the wrapping process and other smart contracts on Hive. Again I have no idea how it actually works but it would make sense that a light weight contract could be employed without any major sacrifices to security.

Based on this limited documentation it appears as though anyone might be allowed to host collateral on their VSC node and issue wrapped tokens, but the overcollateralization of the Bitcoin could have limitations imposed by DPOS reputation. I've missed a couple talks explaining exactly how all this works so I'll have to make sure to put my study cap on going forward.

The security itself is 'simply' an extension of DPOS voting. Those with the most votes will control multisig keys on Bitcoin and wherever else. In theory the only way the system fails is if over 50% of the trusted nodes collude the cheat the system. So far this has been a system that works quite well despite all the conjecture to the contrary. If the liquidity pool honeypots get too big we may have to come up with other ways to mitigate the risks, but that is hardly a 'now' problem.

Conclusion

It's nice to see an actual working prototype that leverages DPOS and multisig to collateralize assets directly on the Bitcoin blockchain to create valuable secured derivatives on Hive. By all accounts this is just a small subset of what VSC contracts can actually accomplish in the long term, but that of course is all unrealized potential. An orchard is just a bunch of trees until the fruit is actually picked.

Smart contracts are a critical piece of the puzzle when it comes to what Hive needs but has been missing out on all this time. The question remains how do we secure these contracts without wasting tons of resources like EVM chains are infamous for. I'd like to think that VSC is presenting us with a real solution that we can build on and scale into the future.