I got the title from one of my favorite Music albums of 2014/2015 with the same name, by James Bay. Financial emergencies are not a pretty thing, and they make one realize how truly vulnerable we are despite suggestions by current states. Am sure many have come across the statement 'one health issue away from poverty' or something similar.

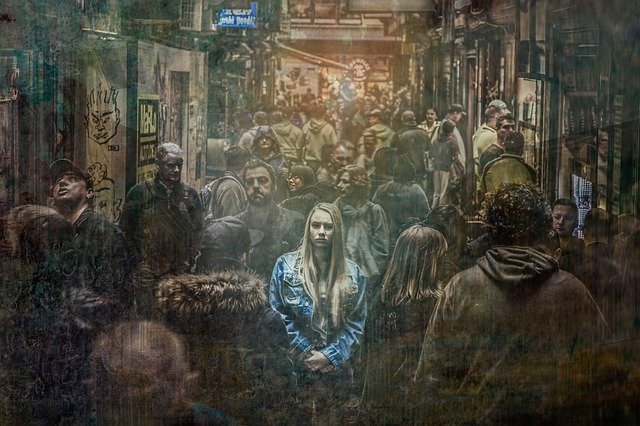

This isn't pretty, and sometimes life can have its own plans despite our best efforts. It certainly can come without warning too, especially devastating on those who are completely unprepared to handle. Sometimes we try to ignore the storm when it comes, but far too often it can backfire or completely overwhelm us.

Running away from critical situations should they appear isn't the solution. Fortunately, most responsible people wouldn't do this. The only unfortunate part is that when this happens unawares, we are figuring out ways to prevent the situation from deteriorating rather than properly managing it.

From personal experience, it has been the chronic illness of a loved one that has had some strain on my resources (not that am complaining at all). In my case, a strong family support system has helped mitigate the effects of its financial consequences so I can't exactly claim to be in dire straits.

My point though is that there is a need to prepare for a potential storm even in the absence of one. Like the saying goes, only the paranoid survive. When I seriously started to consider certain financial predicaments other people face, I realized that some possible solutions are very realizable and actually quite easy to practice.

From a financial perspective, a little savings compounded over time can go a long way in an emergency situation. We are often faced with the difficulties that accompany efforts to save such as discipline, low disposable income or other financial situations that may warrant urgency. Yet many have come to the realization that it is possible to actually compound little amounts over time in order to get significant gains. It may require some sacrifice though such as cutting back on a bad habit costing money, or completely cutting back on luxuries.

Crypto has especially shed new light on the concept of saving. We now have the ability to save across border that defeats potential obstacles such as inflation and devaluations, and also offers better long term incentives than a traditional financial institution. Am not saying crypto is the best way to save your money long term (although the argument is there), but it does offer an option for those really seeking to booster their long term shock absorbers.

Conclusion

Am currently hooked on the tokens offered by the Hive chain and it makes me wonder how much we'd have in store if we had blockchain technology helping us along our savings journeys. Let's keep chirping away, and hopefully have enough gathered so we won't be fazed by the storm.