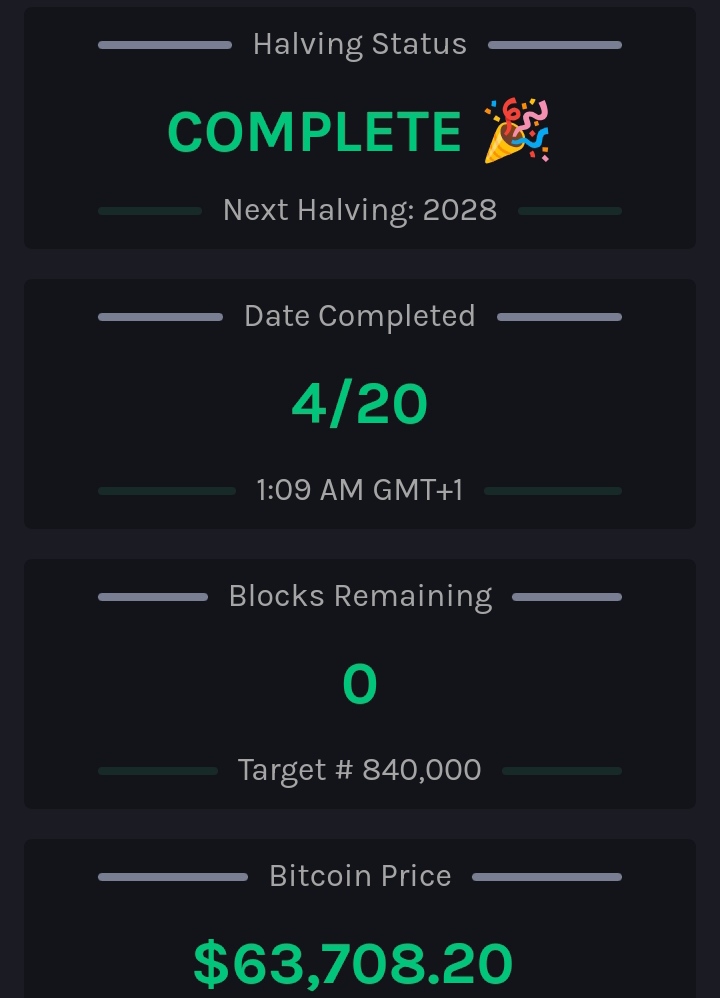

Long anticipated bitcoin block 840,000 has arrived triggering the unstoppable monetary policy - bitcoin halving. This is by far the most significant event in bitcoin and crypto world. Institutional adoption, government legal tenders, ETFs, corporate interests in bitcoin are great and important events as well. But nothing really comes close to what bitcoin halving means. Every 210,000 blocks bitcoin halving event happens reducing the block production rewards for miners by half. It happens every four years and this is the forth time. This is great milestone and show of a superior monetary policy compared to traditional monetary policies.

Unlike Federal Reserve or any other central banks, bitcoin doesn't need to have monthly meetings to evaluate the economic conditions, inflations, and other financial agenda to re-tweak monetary policy. Participants of economies do not need to wait for what Fed Chair Jerome Powell is planning to do regarding the interest rate cuts. There is no need to hope for fiscal responsibility from government and wondering and guessing how much money supply will be increased by. Monetary policy is simple, transparent, and predictable in bitcoin. Nobody can manipulate it, nobody can stop it.

It has been repeated that this time bitcoin's price appreciation is different many times by many people. I am not sure about everything else, but one thing truly has been different this time. Bitcoin managed to make another all-time high before halving event. Anything more after halving is now just a bonus. It wouldn't bother me if now bitcoin takes plunge and triggers another bear market. This year has already be awesome for bitcoin. Taking a break and getting to lower prices for a change may even be better to build up a momentum for another all time high attempt. $100k is so close, it seems this year it can easily be achieved. Other like Plan B have much higher price predictions and suggest bitcoin may reach half a million dollar before we get to 2025.

What really matters is the fundamentals. The importance of halving event is the demonstration of certainty and power of decentralized monetary policy where no individuals or groups can manipulate the system. Definitely a better example of how money should work, if not the best money ever imagined.

It looks like Satoshi was obsessed with number 21. I am not sure the significance of this number and why Satoshi chose 21,000,000 for cap of bitcoin supply and 210,000 for halving events. If you know let me know in the comments.

It is time for a new cycle, it is time new beginning for bitcoin and crypto. While the history doesn't necessarily needs to repeat, in the past we have seen positive price action after halving event. Not right away, but not too long after either. If we look at the last bitcoin halving which happened in May 2020, bitcoin's price was at $8,600 and many alt coins were had much lower prices as well. In fact, if we blindly picked few decent coins within a year would have made good returns on our investment. Bitcoin already had great price action this year, and I am sure we will see more. What we really want to see is an alt season. It is about time! Halving events are great for entire crypto world.

Numbers don't lie. Now that miners will be earning less for the same work and effort put in, the economics of mining business will see significant changes and they will need to adapt to the new reality. I am sure they have already been preparing for this event. No matter how much we prepare, we are not always ready until numbers starts impacting the balance sheet. As miners reevaluate their business strategies, this will have an affect to the supply of the bitcoin. Basic economics of supply and demand is in favor of bitcoin continuing becoming more valuable over time. Things may take some time but markets do rely on supply and demand. Things look even better if we consider the demand for bitcoin in ETFs, companies contemplating and planning in utilizing MicroStrategy's blueprint of treasury policy, sovereign funds realizing the potential of preserving the wealth, etc.

Posted Using InLeo Alpha