Ever since Robinhood ruined its reputation during WallStreetBets fiasco, they have been trying to reinvent themselves, giving a try for innovation once more, and coming up with different ideas to attract more users to their platform. One of their latest ideas is to offer 3% APR on uninvested cash. However, to qualify for this users need to sign up for Robinhood Gold, which would cost about $5 a month. Users can early 1.5% interest even without trying Robinhood Gold.

My first reaction was - 3%? That's it? lol. Here on Hive we are spoiled with low risk 20% APR on our Hive Dollars, and 3% does not sound interesting at all. Perhaps there are investors who would be interested in earning 3% on uninvested cash. I don't know. But given the inflation rate has been 8+% as of late, not sure who would be interested in keeping cash for 3%. To be fair, their primary business is not taking/giving loans. They would much rather prefer users trading and investing on their platform. It wouldn't hurt to earn 3% bonus just in case an investors decides to stay in cash and watch the market at the sidelines and wait for the next investment opportunity.

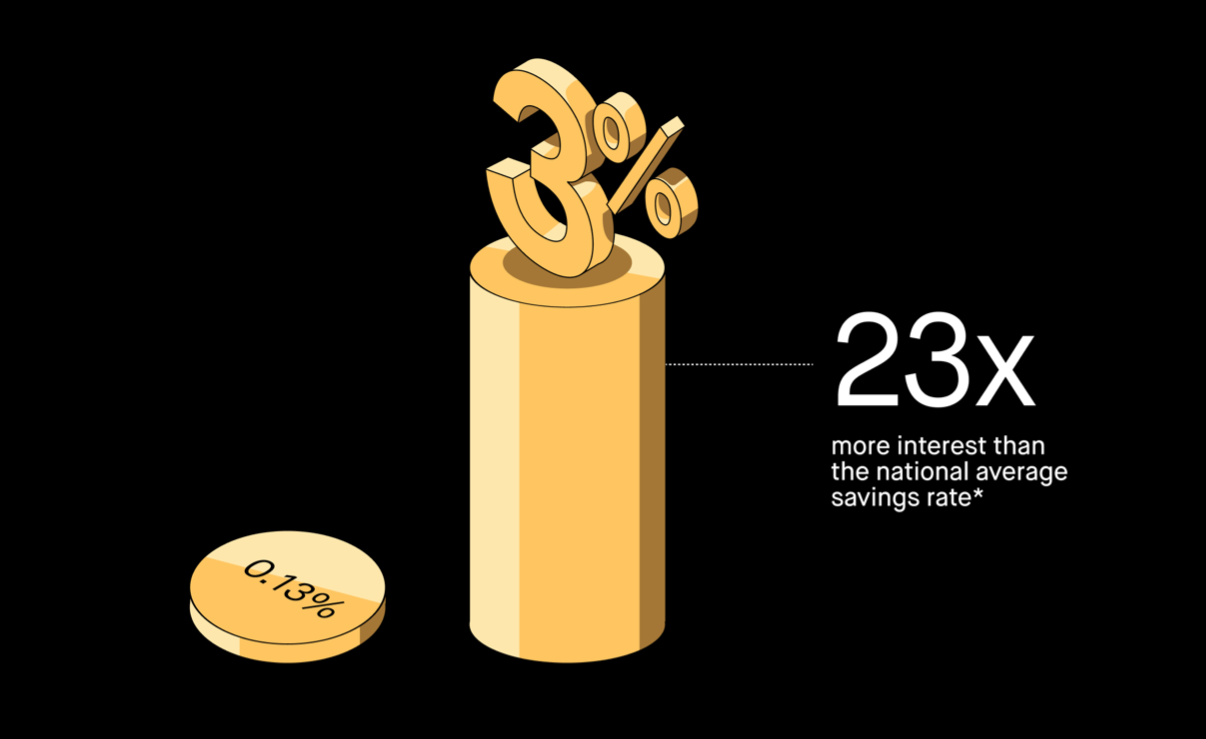

However, when I saw above image taken from their website, where they try to compare their 3% interest to national average saving rate and advertise it as something 23 times better, it got me confused. I didn't know Robinhood was in cash savings business. Even if they were, 3% is not a competitive rate to offer. Moreover, why would people want to keep their cash in Robinhood? If it was me I would only keep my stocks there. I don't see a need for them to hold my cash, especially for long period of time.

Now I have a better idea for Robinhood. A billion dollar idea. I am willing to give it to them for free. We don't charge fees for ideas on Hive. lol. One of the ways trading/investment platforms like Robinhood make money is by offering margin, like their Robinhood Gold accounts. Providing credit for margin trading/investing is a risky business. If the traders or investors start losing on their trading or investing ideas, without a collateral it can become possible that the users won't be able to return the borrowed money or stocks. For this reason they have margin calls. As soon as it becomes evident that money loaned is at risk, they activate margin calls and maybe even liquidate the stocks to return the funds. What if there was a better collateral for margin accounts? I Hive Dollars can be a solution for such model.

Robinhood is already heavily involved in crypto and crypto wallets. For them integrating Hive and/or HBD into their platform wouldn't be an issue. By offering HBD wallets or HBD representation on their platform, they can easily let users earn 20% APR on their HBD with a disclaimer that it would take 3 days to cash out HBD funds if users so choose. Let's say I buy or transfer 100k HBD to my Robinhood Account. Robinhood can keep them in the Savings on my behalf and pay me 20% APR in HBD and it wouldn't cost them anything extra, because Hive is the one who is paying the interest.

Now that Robinhood is holding my cash in HBD, they know I have collateral for a margin account. They should be able to lend me same 100k USD to trade or invest with zero risks. In the meantime, I am still earning 20% on my HBD and able to trade with the same amount of money. It is a big win for a trader or investor on Robinhood. But it is also a big win for Robinhood, because they would be earning interest on margin loan, and they would have more active users on their platform.

Are there risks for such a model? There are always risks. But these risks seem to be very low. If a user decides to invest in HBD, they are making their own trading/investment decisions just like buying anything else. Robinhood is not risking any of their money, because their is always user's HBD they can liquidate to return their margin loan if the user starts losing in their trades/investments. But since there is 100% backing of the margin loan, they don't have to activate margin call until users trade goes to zero or close to it.

The risk can be that the price of HBD would drop below $1, let's say to $0.9 or $0.8. Now the collateral is worth less than the margin loan. This may be of temporary concern for Robinhood. But this can also be mitigated by either charging higher interests or asking the user to add to their collateral, as they would do with the margin call. Since it doesn't take HBD to recover too long, I doubt this would be needed either.

Another risk is, Hive witnesses may come to consensus to decrease the APR paid on HBD or even completely stop paying interests. This shouldn't bother Robinhood, as Robinhood is not necessarily earning these interest payments but the users are. Users can reevaluate their investment and trading strategies as such changes happen.

It unlikely Robinhood will be wise enough to take this brilliant idea and create an interesting trading instrument bundle. But if they did, it would create demand for HBD. Demand for HBD would create demand for Hive. As a result Hive would appreciate in price and HBD become more stable and the HBD market would become more efficient. Win for Robinhood, win for traders, win for Hive & HBD.

Let me know your thoughts in the comments.

Posted Using LeoFinance Beta