Bank runs are not exclusive to Crypto. In fact, crypto didn't even invent them. There's a reason that they're called bank runs afterall.

In a fractional reserve system, if enough people start withdrawing at the same time and some bad news cycle coincides, you can quickly see a bank go under. They may very well have the capital to cover deposits, but it might be tied up in investments.

Afterall, that's how a bank makes money, right? They take deposits and then utilize those deposits to buy assets, lend it out for interest, etc.

A basket of options often makes up what a bank owns in terms of assets. These various assets are earning interest and when people come to the bank to withdraw, things are ok. The problem is when everyone starts frantically withdrawing. That's when the bank is under pressure to liquidate positions - often at a loss.

Silicon Valley Bank | The 16th Largest Bank in the U.S. Goes Under

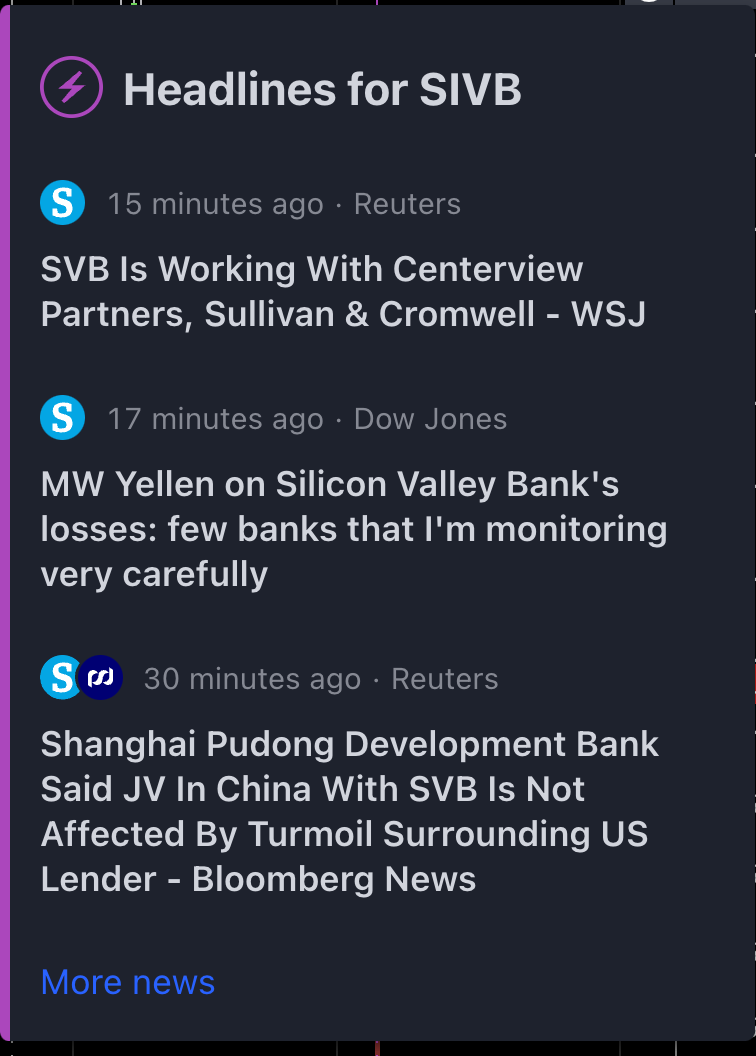

SVB opened down 70% today. That's a nasty candle. After Silvergate Bank (a different institution that serviced a lot of large crypto firms / exchanges. I wrote about them yesterday) went under, people are already on edge. Then they started hearing about some interesting pieces of news out of SVB:

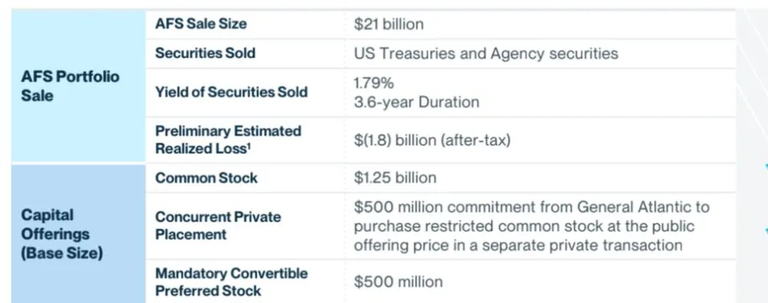

- SVB sold $21B in medium-duration securities, realizing a $1.8B loss

- The bank stated publicly that they were taking $500 Million from General Atlantic

- Simultaneously, they announced a 2.25 Billion equity and debt offering to raise capital

This was the equivalent of yelling FIRE! in a movie theatre. We saw a bank go under and at the same time saw another bank liquidating assets at a loss while simultaneously announcing that they were raising capital to help with deposits.

Samir - Former SVB Employee on Twitter

The Bank Run

What followed was a massive bank run. SVB primarily services venture capital firms and tech companies in Silicon Valley - as the name aptly suggests - and an enormous number of withdrawals happening all at once led to an inevitable failure in the fractional reserve banking structure at SVB.

They announced that they will be looking to get bought out.

The Broader Economic Thesis

There are a lot of ideas floating around about the economy right now. People are trying to figure out what the hell is going on.

We live in uncertain times. Whether you're in business or even just a middle-class family living in America and trying to buy your groceries.

Everyone is hurting right now. Even the billionaires are losing net worth like there is no tomorrow.

The FED's economic policies have undoubtedly weakened not only America but the entire world. We're seeing a lot of pain right now as we whipsawed from a 0 interest rate in environment and free money everywhere to high interest rates and everyone clenching their buttcheeks for a potential recession / depression.

In my opinion, we're in for more pain until the FED reverses course. Nobody knows when that is going to happen but the FED is undoubtedly driving the ship right now.

We were sitting on a massive asset bubble caused by FED economic policies both before and during COVID. Things accelerated during COVID, but they were already headed in that direction.

I'm sure this will come as no surprise to you, but this strengthens my belief in programatic monetary policy. Why the F*ck in 2023 are we reliant on a guy to decide what happens to monetary policy on the whims of whatever the hell he feels like doing?

The FED is looking at delayed data, they are biased and most importantly, they are human. They make mistakes. Why are we not relying on programmatic monetary policy? Why don't we have real-time economic data feeds?

Bitcoin solves this. I'm not saying that BTC will replace the USD or become the primary currency in the world. I think we'll always have government-backed money. BUT I am a firm believer that BTC will be a safe-haven for programmed store of value. Nobody can change the protocol. Everyone has a voice. It's owned by no governments that have biases.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha