The average-consumer spends an astronomical £3126.63 a year on what I call consumer frivolities per year. This completely unnecessary expenditure includes spending on:

- restaurants and hotels (£791.32), which consists of weekly or monthly treats out and holidays. Actually a bit less than I expected, probably due to the cost of living crisis nerfing this expenditure area!

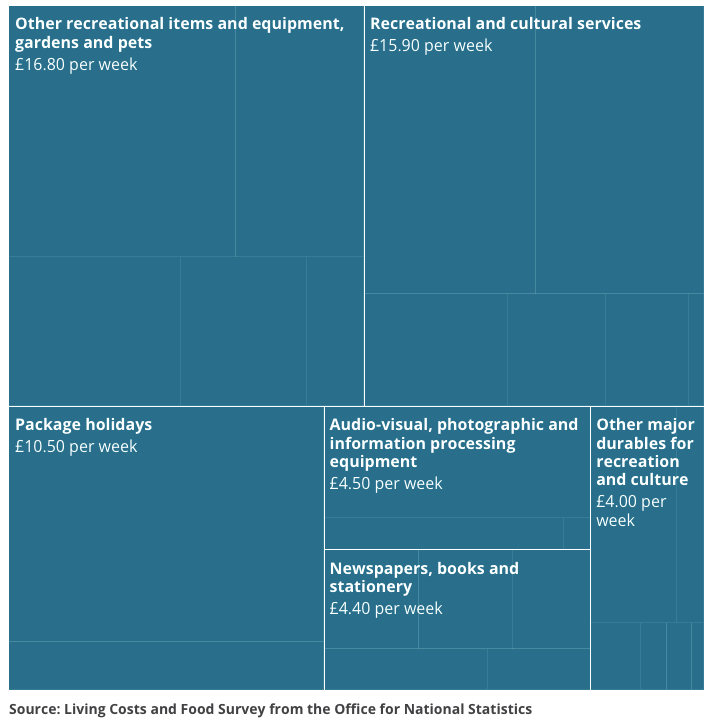

- recreation and culture (£1275.67), which for most people means the cost of purchasing audio-visual equipment and subscriptions to various services, and also includes the cost of entrance to things such as cinemas, concerts and festivals.

- And 'miscellaneous goods' (£1059.64), which in the ONS family spending survey mainly consists of beauty products and jewellery, and finally recreation and culture (£111.06).

Maintaining this for 10 years would result in expenditure of £31 263.30.

So what does the average person get for this £31, 263.10 over ten years. ?

Well, the consumer gets whatever frivolities they want for the money they've got, assuming the market can provide it. Some people will choose a house full of antiques, others a house full of gadgets, and still others closets full of clothes and boxes full of jewellery.

Increasingly likely, though, is that money will be spent not on stuff, but on experiences, such as playing the dating game, or weekends away and longer holidays, supplemented by such products as fake tan and sun cream to prevent an actual tan.

To many people, such consumerist experiences are the very purpose of life: the products we buy define us, mark us out, and the events we purchase play a crucial part in our weekly, monthly and yearly life-course – they are things we look forward to, and back on, the events which help to maintain and define our relationships with our friends and family and give us something to talk about with all of those other people who we aren't so keen on interacting with.

I've managed to resist the urge to be utterly cynical about the role which consumption plays in most people's lives, because just recently I've come to perceive most ordinary consumption as tragic, and in this context cynicism seems inappropriate. Those people who define themselves through their stuff become tied to it (and possibly require a bigger house in which to stuff their stuff), and for those who define themselves through their experiences, it seems to me that the way in which many people consume such events involves them not really being present because they're too concerned with acting for the sake of sharing the experience via social media, and for me if you're not actually present, then you're not really even alive.

Being frugal could knock a year and a half of yer retirement age!

In contrast, the frugal-consumer rejects the trivial, shallow and short-lived fake-joys of consumerism and instead engages in meaningful, productive and either free or very cheap activities when not working. The frugal-consumer is not, however, a total anti-consumer, and maintains an expenditure level on 'consumer frivolities' which allow them to avoid being completely cut off from ordinary society. This is mainly because I could not, hand on heart, say that I am ever likely to cut out consuming frivolities all together myself, cut down radically yes, cutting out altogether, highly unlikely.

So let’s say the frugal-consumer spends just £60 a month on such frivolities, allowing for £20 a month on restaurants and hotels (so basically no hotel stays and one trip to a restaurant a month), £20 a month on furniture and furnishings, given that this category includes spending on basic household items such as Hoovers, a further £20 for 'miscellaneous goods' because everyone needs a little something extra, and a whopping £30 a month for recreation and culture. This amounts to an annual expenditure of £1080 a year, a total of £10 800 over 10 years, representing a saving of £20, 463.10 over 10 years.

If we compound that amount monthly for 10 years then we end up with £29 244. That is equivalent to around 18 months of living on the frugal consumer’s low annual income needs of £18K a year.

NB If this looks unrealistic, or even unbearable, approximately the bottom fifth of the population of the UK in terms of income live such a life out of necessity, rather than as part of an early retirement strategy, so it is possible...

Sources

ONS family spending survey 2022

Posted Using InLeo Alpha