Let's make one thing clear before I sing the praises of one of my banking apps - there isn't much better than 20 percent APR interest on Hive savings. But as diversifying has value, I like to spread my savings across various games - and a new, mainstream fintech attached to my primary bank in Australia is worth looking into just for the gamification of banking that appeals to a younger audience. They've thought hard about the social aspect that can be integrated into banking and the dream features that we didn't even think were possible in a banking experience. To say I love this app is an understatement!

Fintech 'is a catch-all term referring to software, mobile applications, and other technologies created to improve and automate traditional forms of finance for businesses and consumers alike.'.. Whilst in the past we may have used savings incentives like passbooks, little booklets where you'd go to the bank, make a deposit and get a stamp to watch your savings grow, apps like 'Up' makes the experience more streamlined, colourful and fun.

Most of my fiat investments are actually with 'U Bank', another fintech app, which offers 2.8% on savings if you deposit three times in a month, any amount. If you don't deposit, it drops down to 1.8%. A great little app to use . However, for the purposes of this review, I'm going to talk about 'UP'. Backed by Bendigo and Adelaide Bank for banking, Mastercard® for payments, and Google Cloud Platform for hosting, it claims to have no fees for use at all, which is a bonus from the get go.

Thumbnail images source here and here.

Why I Signed Up for Up

Originally, I signed up for UP because it was a no charge way of travelling with a card that was low risk to use. I could simply use online banking to transfer small accounts to my UP card and keep my other cards safe. That means if I lost the UP card or it was stolen or hacked, they'd only have whatever I put in there - say $150 for the day - over the more substantial accounts in my primary account.

They have no fees for international purchases which is HUGE, AND it doesn't charge markup onto the Mastercard® exchange rate, so you get foreign currencies at a really low rate. You also aren't charged if you withdraw from an ATM, like you would be with your ordinary card.

Furthermore, there's in app safety measures to cancel the card straight away if you want, and a live operator chat bot to chat to if you have issues.

After a lot of research, UP came up trumps for a card perfect for travelling, and I got one for me and one for my husband in case we lost one.

Beyond a Good Travel Card - More Fun Stuff

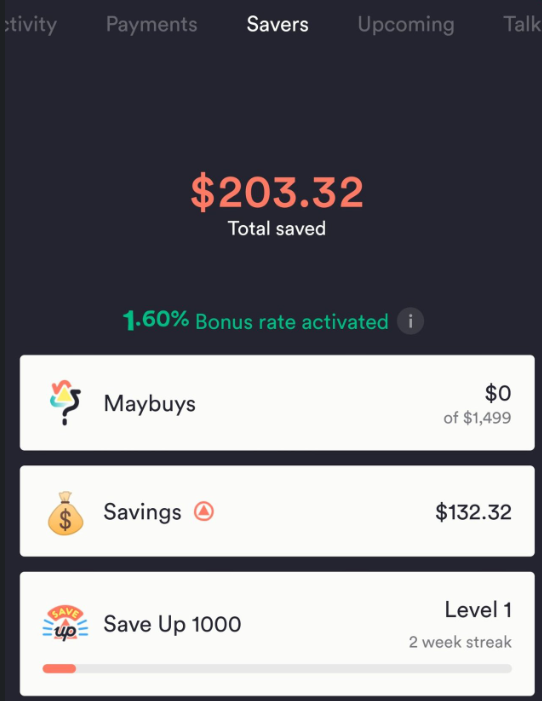

I've had this app for a while, but stopped using it. The other day I got back on and found it had these extra features which made it worth going back to - Maybuys and Savings.

First of all, the 'round up' function is great. Whenever you use your card, they will round up the cents and pop it in a savings account. Say you bought $25.75 at the shops. It'll add the .25 cents into your savings account. Believe me it does add up. These days I transfer money from my primary bank account onto this card because of this feature.

May Buys

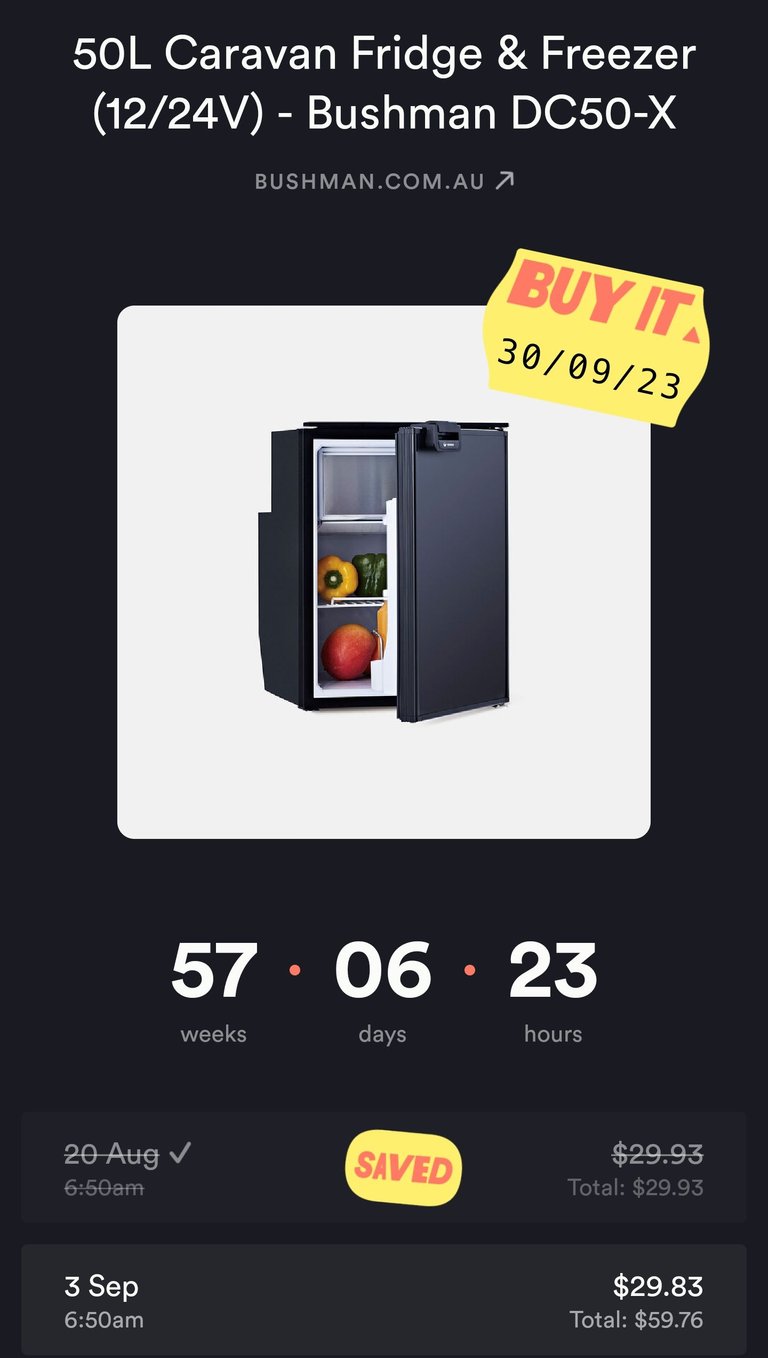

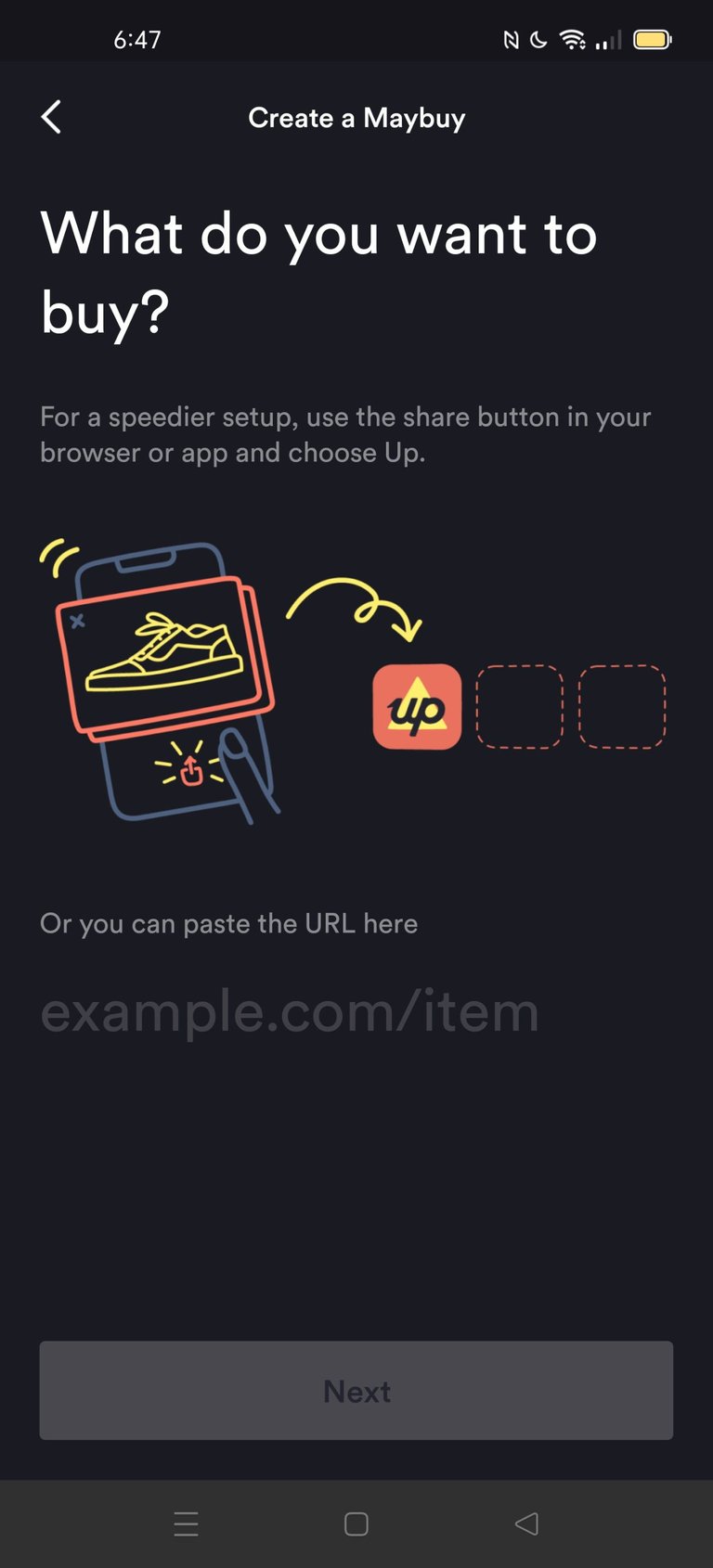

A play on the old 'layby' system that's been replaced by Afterpay and other payment schemes (@tarazkp voiced concerns in a post last week about this as it creates debt stress for purchasers who get the item before they pay for it), Maybuys creates a system where you can save for the item before you purchase.

Take, for example, this 50L Bushman fridge. To be honest I just bought this outright, but I'm using it to demonstrate how it works to 'maybuy'.

You paste in the URL of the item that you want to buy, select how much you can afford either monthly, fortnightly or weekly, and it will calculate how long it will take to save up for it. It will then set alerts to remind you to put that money aside in your 'mayby' ready for that purpose. If you don't end up wanting it, you can simply delete it and put the money elsewhere. You can have as many maybys as you like, funneling your savings into particular items you might want, such as Christmas presents or flights to Bali.

| MayBuy Item List | Saving Calender | Add a New Item |

|---|---|---|

|  |  |

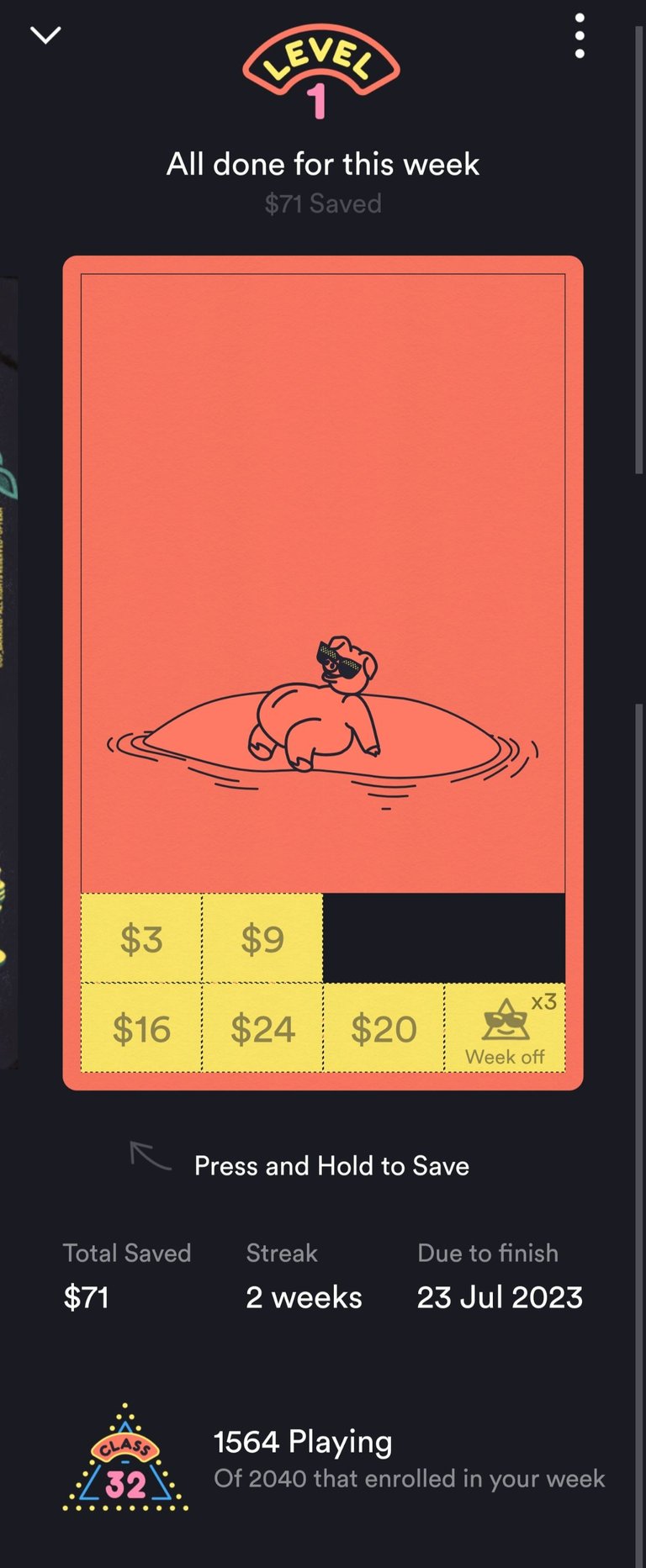

Incentive Saver

The other one is a fun saver where you aim to save $1000 in a year, receiving 1.8 percent interest. This of course isn't as much as U Bank, but I'm still using it as you put such little amounts away it's hardly worth me thinking about. When you have a savings account you don't think about, the bonus grand in a year's time is almost a suprise!

What it does is set you an alert each money to put a nominal amount a way, as listed on the virtual card. There's increments of tiny amounts to larger ones, but no more than about $40, with an option for weeks off. It's all worked out to ensure that if you stick to it, you'll have that much saved in a year.

There's also a PAYDAY function where you key in your payday to figure out what you can safely spend.

But wait, there's more....

Check out Slices - a way to divvy up bills between friends. There's also pay trackers and insights, so you can see where your money is going. Honestly what doesn't this app have?

The Cons

Now of course all big banking is a con of course. Any bank is going to try to get you to invest in their bank and hold your savings there. But unless you're hiding your money under a mattress, or willing to risk crypto for all your savings, or run a pen and pencil notepad of your accounts, I don't really see this as an issue. Bendigo Bank has always been a reasonably ethical bank to me, primarily for it's support of rural Australian communities.

Would I Recommend This App?

Absolutely. If you're in Australia I'd definitely sign up - it's super easy to do so. It's also fantastic for young people who might not have a lot of money to invest or are trying to save their pennies, or for people travelling overseas.

You can read all about it here, but if you want to sign up, do use my referral as it means we both get $10!

A Chance to Win $100

UP have a referral scheme where both of us win $100 if you sign up using my link, which is hook.up.me/riverflows (did I mention you can choose your own fun user name?). The prizes are awarded weekly.

It can't hurt to sign up, right? It doesn't mean you have to use it! But I guarantee you'll find it fun.

Do you use UP?

Do you have a similar banking app in your country?

Would you consider signing up for UP?

With Love,

Are you on HIVE yet? Earn for writing! Referral link for FREE account here