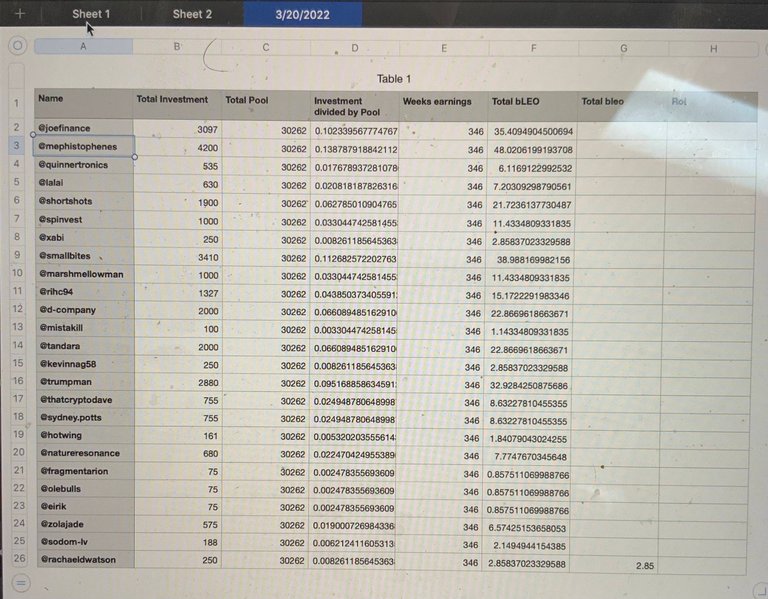

Group A Pool Investors Earnings this Week.

The pooled Leo is converted to BLEO, via the trusted Leofinance bridge, then one half is exchanged for Cub, and one half is exchanged in BUSD. These assets are deposited in the Cub-BUSD farm. The Cub-BUSD farm earnings for this past week were 307 Cub, so it traded for 384 bLeo and 38 went to @shortsegments as an Admin Fee. This left 346 BLEO for the stake based investors. The distribution is detailed in the spreadsheet below.

This weeks Stake based earnings

This weeks Stake based earnings using Excel Spreadsheet:

.

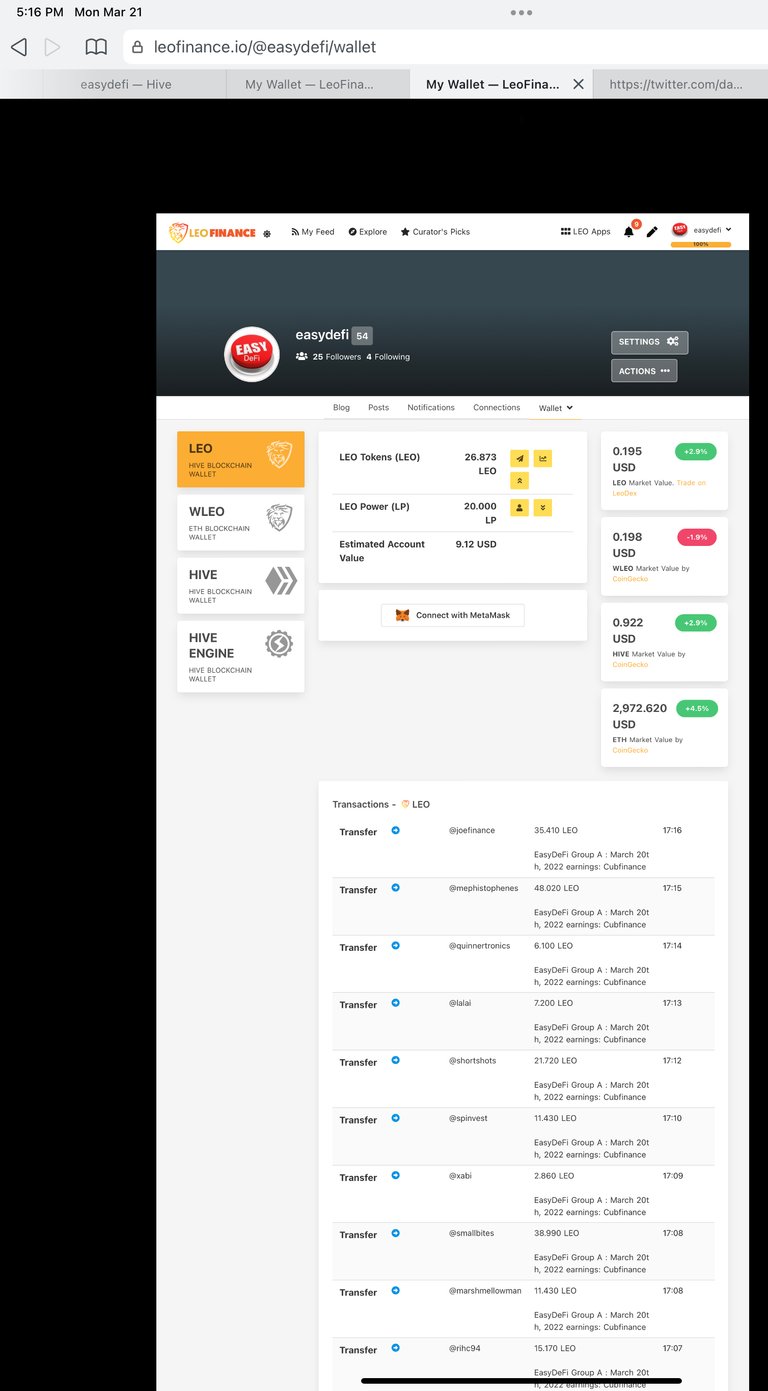

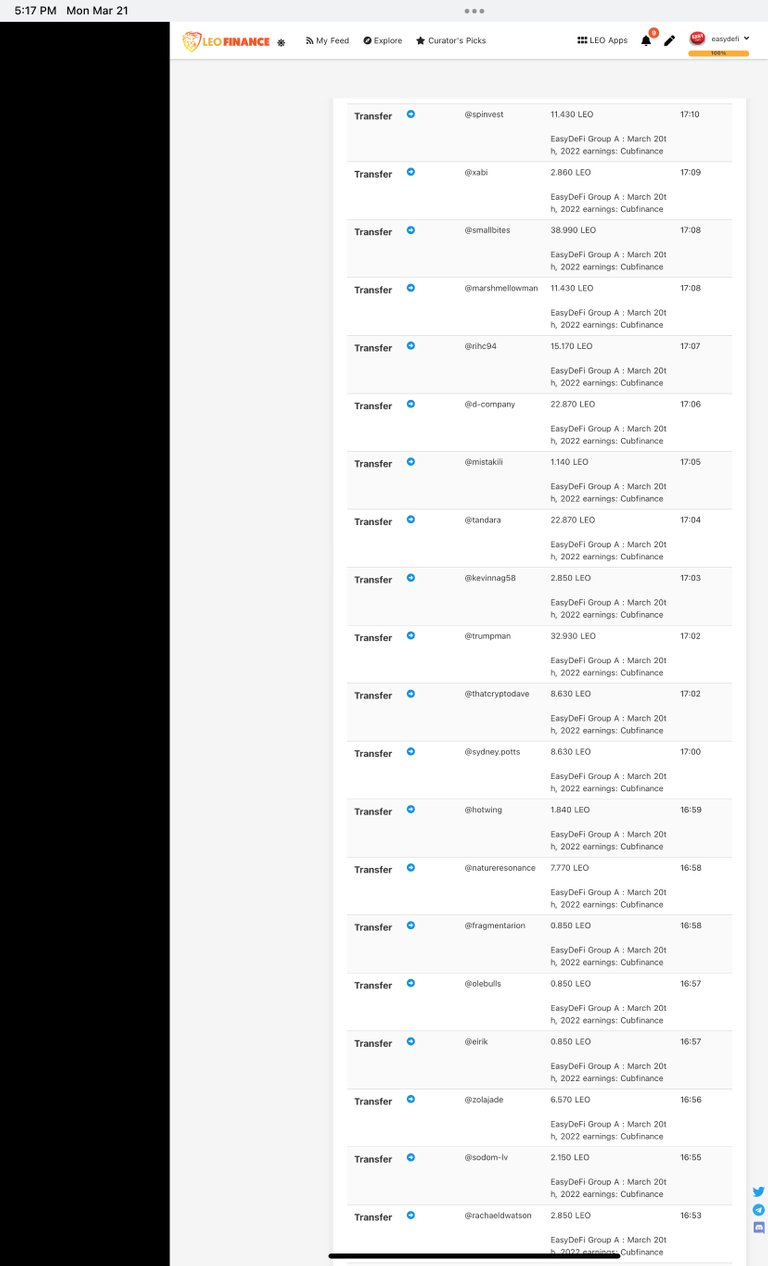

Distributions from today have been made via wallet transfers:

.

Summary of EasyDeFi

A brief summary of this project would be:

Easydefi changes a 10 step process to invest in DeFi from Hive into a two step process.

EasyDeFi makes this a two step process; you send your capitol (minimum 100 Hive or 250 Leo) to the @easydefi wallet, and the @easydefi wallet sends your earnings to your wallet on Leofinance every week.

You send me Leo or Cub via @easydefi wallet as a public ledger of your☺️ deposit. I invest it in decentralized finance staking and farming site Cubfinance. I send you your wallet rewards every Sunday.

EasyDeFi makes this a two step process; you send your capitol (minimum 100 Hive or 250 Leo) to the @easydefi wallet, and the @easydefi wallet sends your earnings to your wallet on Leofinance every week.

Monday Cutoff

- There is a Monday cutoff for investors to deposit funds in order to get earnings the following Sunday.

- The Monday cutoff protects the earnings of all investors, especially the smaller investors who would see their earnings reduced by deposits made after Monday and insufficient time to earn Cub because it is a shared earnings pool.

The End..for now.

Title: This is the weekly report to investors of EasyDeFi for Week 34 on Sunday 03/20/2022

Posted Using LeoFinance Beta