There have been two major moments in U.S. financial policy that completely reshaped the global economy. The first was when Nixon dumped the gold standard in 1971, severing the dollar’s ties to gold and turning it into the world’s reserve currency backed by nothing but trust. The second was when Reagan devalued the dollar in the 1980s, using monetary policy to reinvigorate U.S. exports and manufacturing. Now, a third move could be on the horizon, and it might be the most dangerous yet.

The $7 Trillion Time Bomb

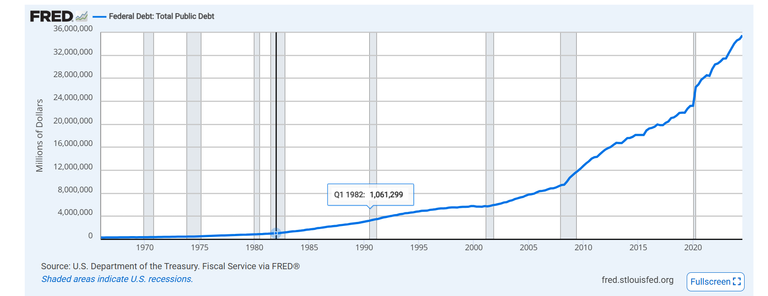

The U.S. has a serious problem: It needs to repay $7 trillion in debt soon—about one-fifth of the entire national debt. That’s an astronomical figure, and there are really only two ways out of it. Either they create enough inflation to make that debt cheaper in real terms , or they restructure it. And that second option is where things get terrifying.

Now, imagine this: Trump summons major U.S. debt holders to Mar-a-Lago—China, Japan, European banks, big institutional investors. He tells them: "You either swap your short-term bonds (2-year, 5-year, 10-year) for 30-year or 50-year bonds, or you get nothing. Take it or leave it."

This isn’t just a theoretical scenario; it’s something Trump would absolutely consider. He built his empire on renegotiating debt, often by pushing creditors to accept worse terms. If he applies the same playbook to the U.S. economy, he would essentially be forcing a debt restructuring on global bondholders. And let’s be clear—this isn’t just a minor shake-up. This is financial Armageddon.

The Nuclear Bomb of Global Finance

U.S. Treasury bonds—especially the 2-year and 10-year notes—are the backbone of every major financial portfolio. They are the reference point for global interest rates, the anchor for pension funds, the safety net for banks, the foundation of the financial system itself. If the U.S. forces creditors to accept longer-term bonds, it means one thing: the U.S. has technically defaulted.

A technical default of this scale wouldn’t just be a bad day for Wall Street—it would be 2008 multiplied by 1,000. Banks would collapse under the uncertainty, pension funds would implode, global trade would seize up, and every country that relies on U.S. debt as a benchmark (which is basically all of them) would be thrown into crisis. The dollar, the world’s reserve currency, would be fundamentally shaken. It wouldn’t be a financial crisis—it would be a financial apocalypse.

More Dangerous Than Leaving NATO or Ukraine

People love to talk about how Trump could wreck NATO or pull the U.S. out of Ukraine support. Sure, those would be major geopolitical shifts, but they are manageable. The world can survive without NATO. Europe can (eventually) defend itself. But a world where the U.S. has defaulted on its debt? That’s a world where financial systems no longer function.

If this happens, we’re talking about complete market realignment. China, which holds over a trillion dollars in U.S. debt, would panic. The European Central Bank, which relies on Treasuries as a stabilizing asset, would be in turmoil. The entire global economy would need to be rewritten because the one thing keeping it together—the trust in U.S. debt—would be gone.

Could Trump Actually Do This?

Yes, and that’s what makes this so terrifying. Trump doesn’t care about the status quo. He loves breaking things, and what could be a more satisfying demolition job than bringing down the world’s financial system? He’s done it in business, and he’s shown time and time again that he sees government as just another business deal to be negotiated. If he sees the debt as a problem, his instinct will be to restructure it—just like he did with his bankruptcies.

It would be the ultimate Trump move: force the world to play by his rules, no matter the cost. And in the process, he could trigger the biggest financial disaster in modern history.

We might be standing at the edge of the third shift in U.S. financial policy.

Posted Using INLEO