THE US

JOB MARKET

So, the latest data shows that the U.S. economy isn’t slowing down, and you’ll see exactly why.

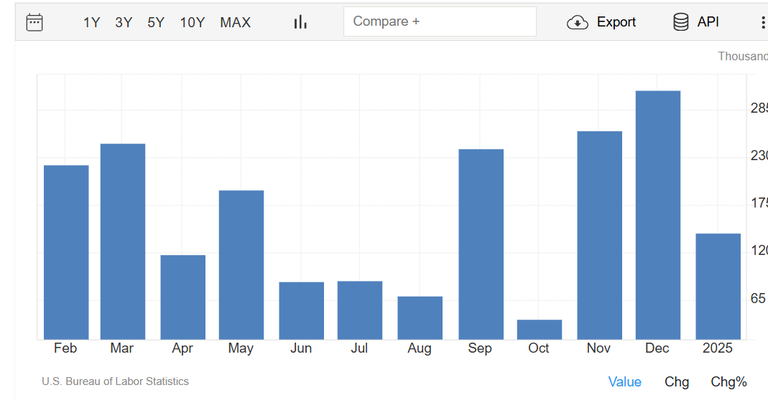

Starting with nonfarm payrolls, which increased by 143,000 in January. Is that a lot? Well, it's a bit below the 168,000 expected, but that’s not the whole picture!

That’s because December’s numbers were revised upwards, from 256,000 to 307,000 new jobs!

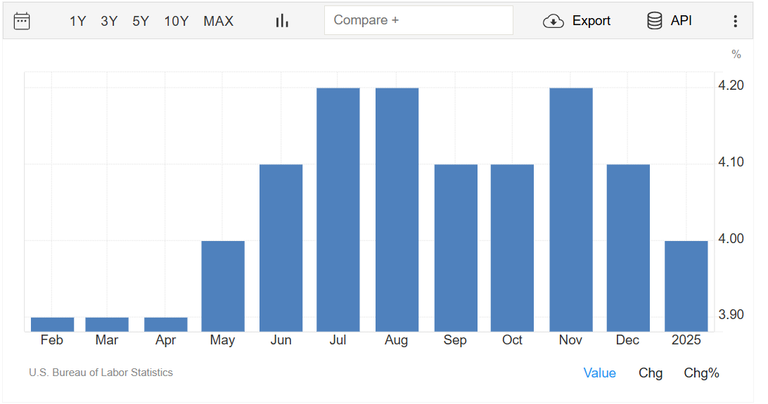

At the same time, unemployment fell to 4% from 4.1%, something almost no one expected.

Now, combine that with wages, which rose 0.5% month-over-month and 4.1% year-over-year, and it’s clear that the job market is holding strong!

So, is this good or bad? Well, it depends! It’s great for workers, but for the FED, things get a bit trickier. Here’s why: when more people find jobs and earn higher wages, they tend to spend more, which can keep inflation high.

FED

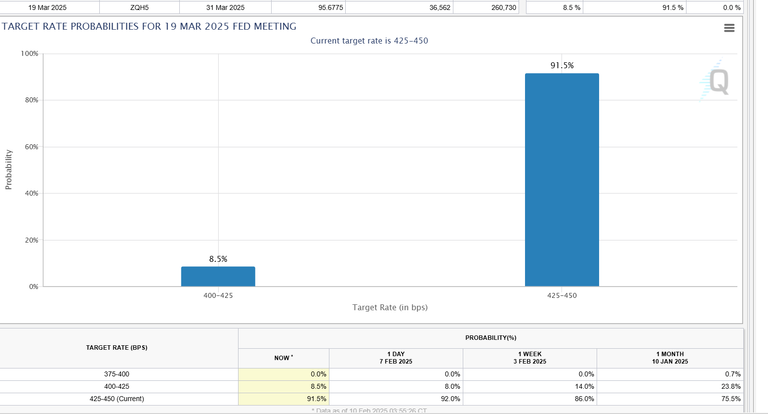

And what does the FED say about all this? The FED has made it clear that it wants to see a weaker job market before cutting interest rates.

So, what happens now that there’s no weakness? Nothing! As Adriana Kugler, a FED member, put it, the labor market is “healthy, neither weak nor overly strong.” In other words, the FED is just... waiting.

In fact, according to the FEDWatch tool from CME, there is a 91.5% chance that interest rates will remain unchanged in the March meeting! That would mark the second consecutive meeting with no rate cuts.

And if the data keeps showing a strong job market, the FED might keep rates steady for even longer than we thought!

British Pound

The Monetary Policy Committee cut the base interest rate by 0.25 percentage points to 4.5%, with a 7-2 majority last week. Two members preferred a larger cut to 4.25%.

Inflation stood at 2.5% in Q4 2024 but is expected to temporarily rise to 3.7% in Q3 2025, driven by higher global energy prices and regulated price increases. Despite this spike, the MPC anticipates that inflation will fall closer to 2% thereafter.

GDP growth was weaker than expected, but an improvement is projected from mid-2025. The labor market is balancing, although productivity remains low.

The MPC will continue to cut rates cautiously, as long as there are no signs of persistent inflation.

Conclusion for the British Pound (GBP)

The rate cut puts downward pressure on the pound (GBP) since lower interest rates make the currency less attractive to investors.

- Short-term: Slight decline in the pound.

- Mid-term: Volatility due to inflation.

- Long-term: If inflation drops, the pound will stabilize.

What To Watch This Week

USA

- Inflation Data (Wednesday): If inflation remains high, the Fed may delay rate cuts.

- Powell’s Speech (Tuesday & Wednesday): Investors will look for clues on monetary policy direction.

- Retail Sales & Industrial Production (Thursday): Key indicators of economic resilience.

- Tariffs: Trump shifts focus to Europe and possibly other countries.

Eurozone

- Industrial Production (Thursday) & GDP (Friday): Signs of slowdown expected.

- French Unemployment (Tuesday), German Inflation (Thursday).

- Bond Auctions: Germany, Netherlands, Portugal, Greece, Italy.

United Kingdom

- December & Q4 GDP (Thursday): If weakness persists, the BoE may cut rates again.

- Rate cut expectations for March are increasing.

Switzerland

- If inflation remains low, the SNB may cut rates in March.

China – Inflation & Tariffs

- Possible inflation rise to 0.4% due to Chinese New Year.

- Trade tensions with the U.S. persist, but signs of potential negotiations emerge.

Corporate Earnings

Monday: McDonald's

Tuesday: Shopify , Coca-Cola , S&P Global

Wednesday: CVS Health

Thursday: John Deere

Posted Using INLEO