FX and Bonds Week

United States - Federal Reserve

Interest Rate Decision (Wednesday): Expected to remain steady due to a strong economy.

Key Data:

Q4 GDP (Thursday): Expected steady growth around 2.5%-3%.

PCE Inflation Data (Friday): Indicators for potential future rate cuts.

Market Focus: Updates from Trump on tariffs and economic plans.

Canada

BoC Interest Rate Decision (Wednesday): A potential 25-basis-point cut due to weak growth.

Main Risk: Possible 25% tariffs on Canadian products by the US (starting February 1).

Eurozone

ECB Meeting (Thursday): Expected rate cut by 25 basis points to support recovery.

Key Data:

GDP & CPI (Thursday & Friday).

Confidence surveys from major economies.

United Kingdom

Key Reports (Thursday):

Mortgage and credit data for December.

Nationwide House Price Index for January.

Japan

Inflation Data (Friday): Tokyo CPI will indicate national trends.

Other Important Data:

Industrial production, retail sales, and employment (Friday).

The past week there was some really interesting earnings releases from two major companies that i want to share with you.

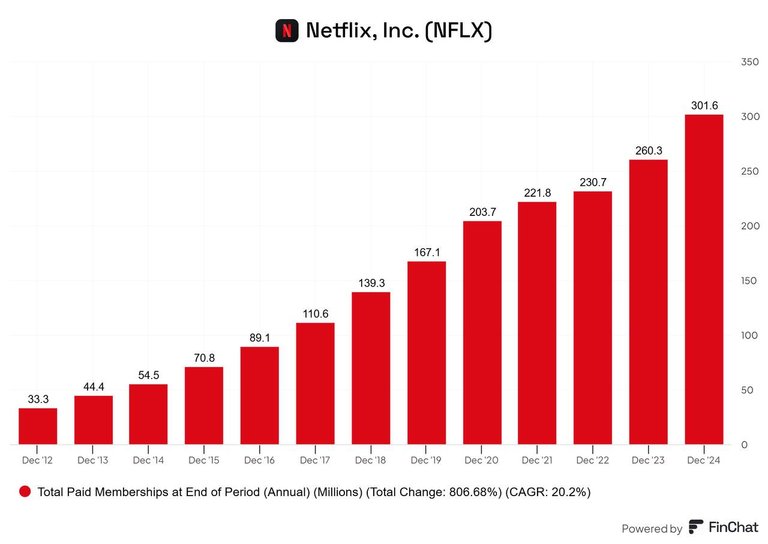

NETFLIX

On Tuesday, Netflix released its quarterly results

The company delivered a double beat, surpassing analysts' expectations on both revenue and earnings per share

But what shocked everyone the most was the surge in new subscribers to the platform

Last quarter, Netflix added 19 million new subscribers, more than ever before in its history—even during the COVID era

Now, Netflix boasts a whopping 300+ million total subscribers

With this news, the stock skyrocketed by +15%, hitting $1,000 🚀

And there’s more

Profit margins soared, and the company announced plans to raise prices further, flexing its pricing power like a boss.

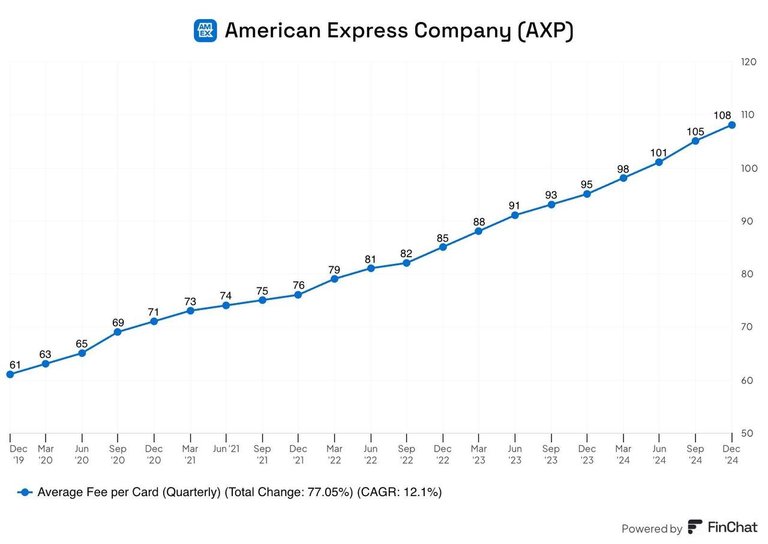

AMERICAN EXPRESS

American Express released its quarterly results

The company beat earnings per share estimates and was in line with revenue projections.

What’s truly impressive is the chart showing the average interest earned per card. As you can see, it keeps climbing every quarter, with an average annual increase of 12.1%

AmEx is a highly profitable company, returning a significant portion of its earnings to shareholders through dividends and share buybacks

Over the last 10 years, it has reduced its total share count by 27.5% and increased its dividend by a whopping 148%. It announced another +17% dividend hike

American Express shows us that people are eager to keep spending more, which signals a strong economy.

Posted Using INLEO