After reading Brookings' take on why a U.S. debt crisis is unlikely, one thing stood out— Trump plans to deal with the debt seems to be hiding in plain sight. The way I see it, he's setting up for a massive inflation play: slash interest rates to zero, fire up quantitative easing (QE), and let the dollar tank hard enough that the existing debt shrinks in real terms.

The Four Ways a Crisis Could Happen

The Brookings paper laid out four ways a crisis could unfold, but dismissed them all:

China Dumps Treasuries: China only holds about 3% of U.S. debt, so even if they sold it all, it wouldn’t really move the needle.

Debt Ceiling Standoff: If Congress refuses to raise it, market panic would probably force them to reverse course quickly.

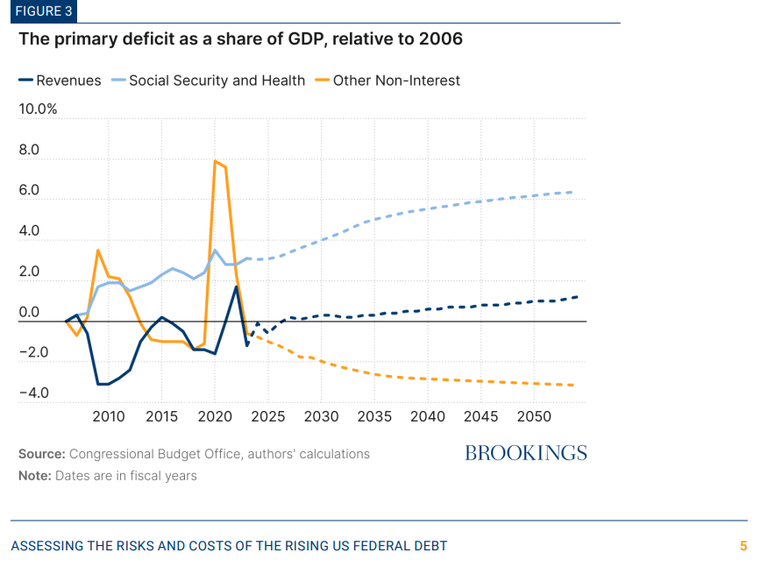

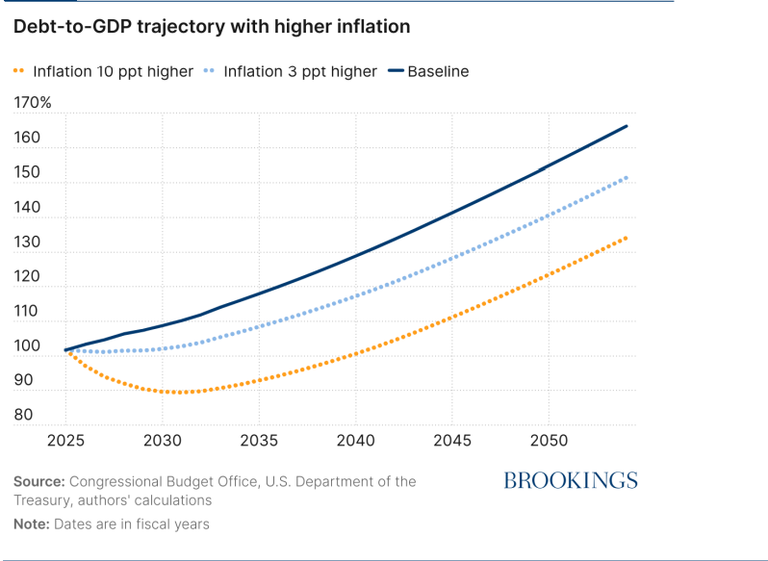

Fed Tolerates High Inflation to Devalue Debt: Brookings says this wouldn’t work because most U.S. debt is short-term and would just roll over at higher rates. (More on why they might be wrong about this later.)

Strategic Default: A U.S. default would be catastrophic for investors and make borrowing nearly impossible, so it’s not happening.

Their big takeaway? A debt crisis isn’t about the total debt—it’s about trust in U.S. institutions. As long as the government functions and the debt doesn’t spiral out of control, investors will keep buying Treasuries.

True but for me option number 3 seems to be the more plausible especially when Jerome leaves the Fed

Trump’s Real Play: Inflate It Away

Now that Trump is back in office, we’re seeing his strategy unfold in real-time. Here’s what’s signaling that he’s going for an inflation-driven debt wipeout:

Push for Near-Zero Interest Rates: Trump continues to pressure the Fed to lower rates, arguing they’re too restrictive.

More QE: The Fed is injecting liquidity into markets through bond purchases, keeping borrowing costs low.

Spending Cuts + Tariffs: Treasury Secretary Scott Bessent’s "3-3-3" plan aims to cut the deficit to 3% of GDP while boosting domestic production.

More Oil Production: The administration’s plan to increase oil output by 3 million barrels per day is aimed at lowering inflationary pressures.

Low Taxes: Trump is pushing for further tax cuts, even as the deficit remains high.

The Endgame: Dollar Devaluation

Put all of this together, and the result is a weaker dollar. If inflation spikes and the dollar loses 50% of its value, the U.S. effectively cuts its debt in half in real terms. The economy grows fast, wages rise, but the purchasing power of each dollar shrinks—making past debt way cheaper to repay.

Brookings argues this can’t work because of short-term debt rollover, but that assumes rates stay high. If the Fed is all-in on near-zero rates and QE, the government can keep borrowing cheaply while the old debt melts away under inflation.

Risks and Reality

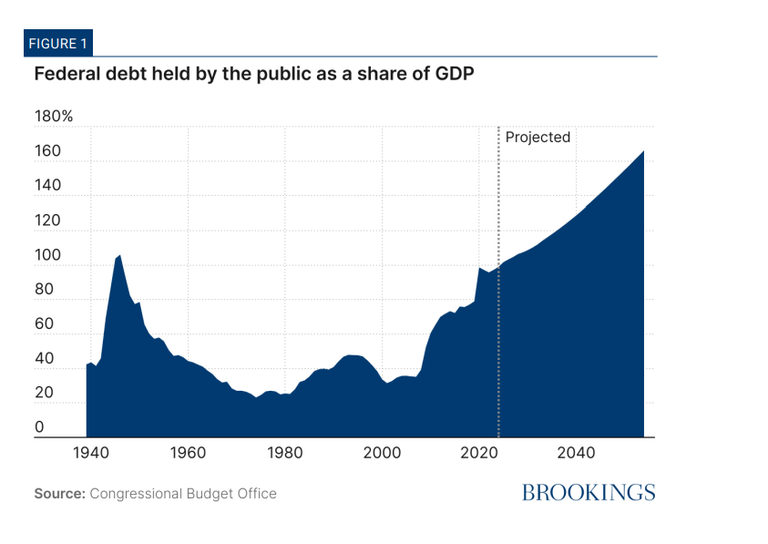

Obviously, this is a risky move. If inflation runs out of control (like in the 1970s), it could wreck confidence in the dollar and force the Fed to slam on the brakes with sky-high interest rates. Meanwhile, the Congressional Budget Office projects a 2025 deficit of $1.9 trillion—about 6.4% of GDP—with debt on track to surpass World War II records by 2029.

So, will Trump’s strategy work? We’ll see. But based on everything his administration is doing, it sure looks like they want the Fed to fire up the money printer and let inflation do the dirty work.

Posted Using INLEO