When it comes to cryptocurrency, use case is something that is vital. Unfortunately, it appears that it is lacking in many ecosystems.

Hive is a bit different. We have a unique situation developing that could make things very interesting (and profitable) in the future. The value of HIVE could be pushed much higher simply due to the inherent characteristics of this token.

In this article we will review what they are and how this could really lead to a massive explosion in the value of the base token.

Before getting into the details, HIVE is an inflationary token by design. Each block is generating new tokens which are distributed to the community. This is vital for getting the token in the hands of new users while also enhancing distribution. However, as we will see, there are mechanisms in place that can flip this to deflationary.

HIVE At A Glance

We will use the data provided by Hiveblocks for our discussion.

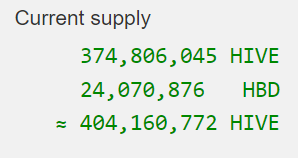

According to the data, this is the present token distribution:

There is just under 375 million HIVE in existence. It is a number that could be pushed over 400 million if all the HBD was converted to HIVE. The problem with this metric is the fact that about half the HBD is locked into the Decentralized Hive Fund.

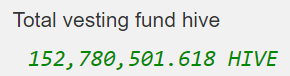

Next we have the HIVE that is powered up (staked):

Using some basic mathematics skills, we get roughly 222 million HIVE available in liquid form.

Utility

There are a number of ways that HIVE can be used on-chain. All of it focuses upon basic features of the ecosystem. We will see that as activity in any area increases, the need for HIVE does the same.

Interaction:

HIVE that is staked is what allows people to interact with the blockchain. This is done through a mechanism called Resources Credits (actually Mana but that is a different story). A certain amount of RC is required for each on-chain activity.

At present, this is directly tied to the amount one has powered up. RCs do recharge each day at the rate of 20% of the total. Here is where we can say that Hive has no direct transaction fees. It is built into the Resource Credit System.

This is going to change some in the next hard fork since RC delegation is going to be added. Yet, HP is still needed to generate the RC that is delegated.

Voting Power:

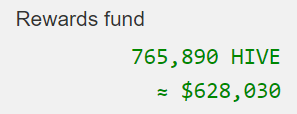

Anyone who wants to be involved in the Proof-of-Brain distribution needs to have Voting Power. This is tied to the amount of HP one has. Hence, as this grows, so does the value of one's upvote as long as the percentage to the whole that is voting remains the same.

This comes into play with curation. One is entitled to 50% of his or her upvote. Thus, if the vote is worth 2 HIVE, the curator gets half of that (1 HIVE) a week later. The other goes to the author of the post or comment.

Here is how the reward pool is distributed.

Governance

We will not delve too deeply here. Basically, we are looking at two main options: witness and proposal voting.

The first is what controls the chain. We have a system of 20 consensus witnesses along with another who rotate into the block validation. There are roughly 100 witness servers running. The amount of HP determines ones voting weight for governance (separate from post/comment voting).

There are funds that can be used for ecosystem advancement. Individuals can submit proposals that the community votes on to fund. Again, one's HP ties into this.

One point here is that another looking for influence (attack?) will have to buy HIVE and power it up. The witnesses are all in place based upon the amount of HP behind the votes they receive.

From Inflation To Deflation

As we can see, there are a number of use cases for the base token that give it utility. Buying HIVE means more than just speculating on the price. There are ways to use the token for on-chain activities.

However, there is two other points that can change the entire equation. This is what will flip the token from being inflationary-to-deflationary. Key to this idea is the fact that it can be done while providing enough money for the system to keep growing.

Account Creation:

Everyone needs a Hive Account to utilize most of the monetary aspects of Hive tied to the ecosystem. Here is where Hive's base level Account Management System is strong. We can theorize about the face that one Hive account gives one access to all that is built on Hive. Couple with the immutability as well as the fact that accounts cannot be closed, and we see how value is there.

At present, to buy a Hive account costs 3 HIVE. This is burned, hence reducing the supply. One account is not going to make a difference. However, if the ecosystem gets to the point where millions of accounts are being created and we could see millions of HIVE disappear from the float.

What is interesting is we are reducing the float while enhancing the value of the ecosystem. As the amount of accounts grow, the network effect kicks off. This results on the value of the entire ecosystem expanding exponentially. Hence, it is not just a token burn to manipulate price.

Hive Backed Dollar (HBD) Creation:

This is similar to the Hive account creation except this can take place on a much higher level. The numbers here can get crazy.

HBD is backed by $1 worth of HIVE. This means there is a correlation between these two tokens. We can increase the supply of one while reducing the supply of the other. This is done through the conversion feature that is now built into the blockchain.

As the use cases for HBD, Hive's stablecoin, grows, we will see demand follow suit. There is very little HBD available meaning we can presume a lot more is going to be needed. One way this is generated is through the interest paid on HBD in savings. This is a time-based feature. However, it does not expand the amount very rapidly.

Here is where the conversion enters the picture. By converting HIVE-to-HBD, one is able to reduce the amount of the former while increasing the latter. It is easy to see how this can really send the value of HIVE skyrocketing.

What if, hundreds of millions of HBD is required? Where is it all going to come from? Even if there was a billion HBD in savings paying 20%, only then would we get 200 million a year. Hence, we are back to the conversion mechanism especially since we do not have a billion HBD to start with.

Simply put, if the ecosystem needs a larger number of HBD, there is a use case for HIVE. The conversion is the quickest way to generate it. It is a fantastic utility for the base token.

In Conclusion

There is no doubt that the mechanisms are in place for the value of HIVE to head much higher. We see a number of built in use cases that will be leveraged as more people join the ecosystem.

Here is where the second layer is the feeder system. If games and applications start to see growth, this feeds into the base layer. All mentioned here is tied to those since interaction with the chain is required, at least in part.

The fact Hive has a base layer stablecoin that is tied to the main token means we see how a very powerful use case exists. In other words, for commerce to take place on Hive, more HBD is going to be generated. This is occurring at the same time as people need RC to interact as well as accounts.

When we consider the base utility of HIVE, we see how it stands out. Most tokens have minimal utility other than "gas fees" and transacting value. Here we covered 5 or 6 use cases for HIVE that are inherent to the ecosystem. This is before we get to second layer applications such as liquidity pools.

Just consider the possibilities if we see a couple million people using Hive in different ways.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

. Keep up the fantastic work

. Keep up the fantastic work