Now I'm back in a stable work routine with a more predictable income than of late I thought it's a good time to think about retirement stacking again!

While my new job is entirely bearable I'd really rather not be doing it and so I think this kind of thing is a useful tool!

As always this is dependent on my own personal circumstance, key dates for which are:

2029 - the year my mortgage gets paid off!

2033 - the year my teacher's pension kicks in.

TLDR the current goal is to look at 2029 as the year to stack for because that's when my outgoings reduce by about 40% and there's only a few years left until I get enough income from my private pension to ALMOST (not quite!) cover my outgoings!

How much I need stashed depends on my projected annual outgoings times four, as a blunt amount.

Although slightly less than this because of interest on the stash and income from side hustles which I hope will still be going in a few years time!

Projected Outgoings During Retirement...

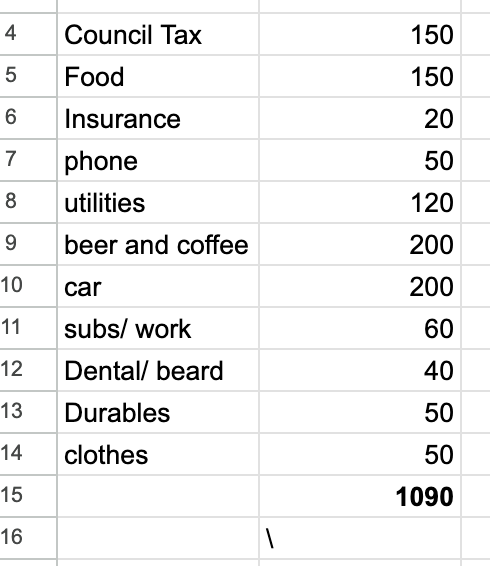

What I need going forwards depends on my outgoings, which are.....

£12K/ year (bare minimum!)

NB this would maybe be a pretty bleak existence for some, but honestly I think I can live pretty well off of this amount of money!

Amount stashed required to fully retire by 2029..

= £12K times 4 = £48K!

So let's call it £50K...

That's actually NOT that much money TBH, in fact I've already achieved that if I factor in some of my crypto stash, and IF I settle for 2029 as a full retirement date!!!

Happy working for now...

I mean this is just as well as i need to work given I've still got 5 years left on the mortgage, NB it makes no sense to pay this off early as it's not that much more than the interest I earn on my savings.

Also i quite like my job, or it's more like a side hustle than my side hustles, seeing as that I only really work 5 days a month, and it's easy.

This tells me I can relax and think about what I want to do, don't need too much monies!!!

Easy but not that inspiring, i'd rather be earning money doing something meaningful, but that's a difficult thing to achieve in this life, but I've got time to get there!

The thing is not to risk my current relatively easy life, as in I wouldn't want to go back to school full time and have to give in this nice part-time job i've got, rather look to re-school part-time which is something I can do!

Side hustles

Obvs these can be used to bring forwards one's retirement date, as they are pass-ive ish income coming in and are not really work.

I now think of my main blog and my Hive blog as side hustles, given the way my income has come down, although it is still my main hustle/ job.

I intend to expand my main blog into different areas, diversification being useful in maintaining said income.

I wouldn't mind some more hustles, I'm just not sure what.

Drains

Potential drains on my current retirement pot include £15K roughly for a new-ish car within the next 5-8 years and also i wouldn't mind going back to school, that could be up to £13K.

Ideally I'd like to save in advance for either or both of these, and if I'm gonna do both, I'd need to save an additional £5K a year over 5 years.

Crypto and retirement

I'm reluctant to factor this into my retirement plans, although by 56, certainly 60 I will be skimming off yields and maybe drawing down a little every now and then, but I'm not banking on this being worth more than £2.5K a year or £200 a month, but that's still a decent amount!

Retirement by 56 final thoughts...

I'm nearly there, I just don't wanna get complacent, so keeping working, keeping stacking and keeping diversifying those assets and skills is the way to go!

Posted Using InLeo Alpha