So I've just finished jiggling about some monies and finally I am in a position to re-evaluate my retirement stack....

I break this down into two different phases:

- Pre 60 years of age, or pre TPS

- Post 60 years of age, or post TPS.

Where TPS stands for 'Teachers Pension Scheme' which kicks in when I am 60, in about 9 years time.

I also make the assumption below that I've paid the mortgage off before retiring, that'll take me another 5 years so I won't be retiring anytime before 56 probably, still, not too far away!

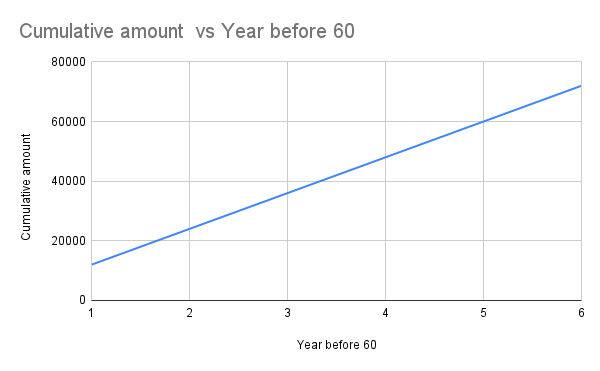

Pre-60 stacking requirements...

I'm working on needing £12K a year to survive.... my models are all with just bear necessities, I honestly don't need that much money to have a decent quality of life!

So that means, post mortgage, I need £12K a year per year to draw down on before I can quit earning an income.....

- So if I want to retire at 59 I need £12K in the bank that I am happy to just, well, spend on daily living costs!

- If I want to retire at 56 I would need £48K in the bank, again being happy to spend ALL of that!

ATW it's looking like 56 is currently the most likely target, at that point I should have that much money just to spend on top of a wedge more Vested for the post-60 years...

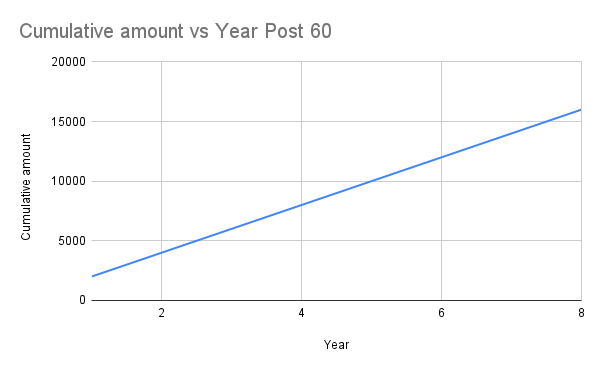

Post 60 I am already there...

The TPS is gonna pay me > £10K a year, so I only need another £2K per year, and NB that's all covered by the lumps sum, after I've bought a brand new car.

Probably easiest to focus on earning money from stuff I enjoy doing~!

Basically I just need to focus on income generation for a further 5 years and then I'm pretty much clear to do what I want.

Basically I need to earn around the £20K a year mark to live, pay the mortgage off and save just a little more and I'm clear at 56.

I am feeling this should JUST ABOUT be possible to do by doing things I MORE OR LESS ENJOY (One has to make some compromises, after all!).

The other alternative would be to go back into full time work and work like a dog for a couple of years, and I just don't think I can face that.

Also, I will probably carry on doing work well into my 60s, especially if it's stuff I enjoy!

Posted Using InLeo Alpha