Hereford Council is set to charge double council tax on second homes from April this year, following a change of government policy that allows local councils to do just that.....

Councils all over the country routinely do this for empty properties, but this is a new thing for properties which are used on a regular basis but aren't first homes.

Couples in Britain, at least married couples, have to specify ONE property as their primary residence, so if they have a second property that's now likely to be charged double.

And if those second properties are large, this could be significant....

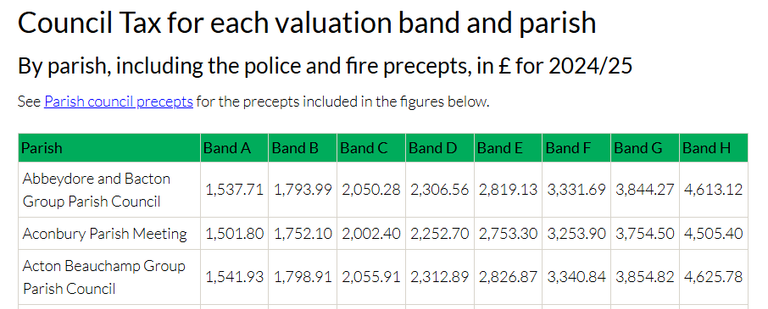

If we take band C then we're now looking at £4K CT a year rather than £2K for a second home, which really is quite the leap! And there aren't going to be many homes which are going to come in cheaper than that for CT!

The Argument for Doubling Council Tax on Second Homes...

Councils across the UK are facing record levels of financial pressure, and Herefordshire is no exception. A doubling of council tax on second homes should bring in additional tax revenue as well as assist in evening out housing inequalities.

Herefordshire Council, like other rural councils, faces growing budget pressure from the expense of social care and other public services. An increased tax on second homes would be an additional source of income, which would assist in keeping essential services running.

Alleviating Housing Shortages

Another significant benefit is the capacity to alleviate the local housing shortage. Herefordshire has a high proportion of second homes, particularly in rural villages and market towns. These houses are often left unoccupied for much of the year, limiting the supply of housing for local families and young professionals. Through raising the price tag of second-home ownership, the policy can encourage their owners to sell or rent them out, putting housing supply in local communities and easing pressure on already tight housing market.

Boost to the local economy...

Where houses are used primarily as second homes, they contribute less to the local economy than full-time residences. Year-round people have more stable expenditure at local shops, cafes, and services compared to owners away most of the year. By discouraging second-home ownership or promoting long-term letting, an increased council tax fee could bring a healthier and sustainable local economy with more year-round expenditure in shops, cafes, and other businesses.

Cons and Considerations

An increase in council tax could deter investment in the local property market or be loophole-prone, i.e., homeowners recording their houses as holiday lets to avoid higher charges.

Also, second-home owners are already actively putting money into the local economy by using local services and tradespeople.

Final Thoughts...

For Herefordshire, with its limited housing stock, doubling the council tax on second homes may well be a workable and effective policy.

Personally I don't have a problem making those who can afford to keep second homes empty for most of the year pay more for the privilege!