And here we were thinking that we were in the middle of a bear market, saying that the Hive and Leo price are holding nicely despite the huge loss of market cap most projects are going through.

But it turns out that the Bitcoin whales have accumulating Bitcoin since last week on levels we hadn't seen in seven years. IThe firm also says the number of BTC addresses holding 0.1+ coins just reached an all-time high of 3,832,859 on Monday.signalsn 2015 and 2019 we saw this kind of accumulation behavior and in both cases, it signaled the bottom and gave way to two of the biggest bull markets in terms of volume and price hike for cryptocurrency projects. On top of that, the bitcoin bought over six months ago now represents 74% of the realized cap (realize cap means market cap in terms of Profit and Loss realization). During the 2019 bottom the realized cap was 70%, and in the 2015 bottom it was 77%.

Coincidence? I don't think so, but this is not financial advice and it doesn't substitute your own research.

Crypto whales added more than 45k BTC to their bags in less than a week.

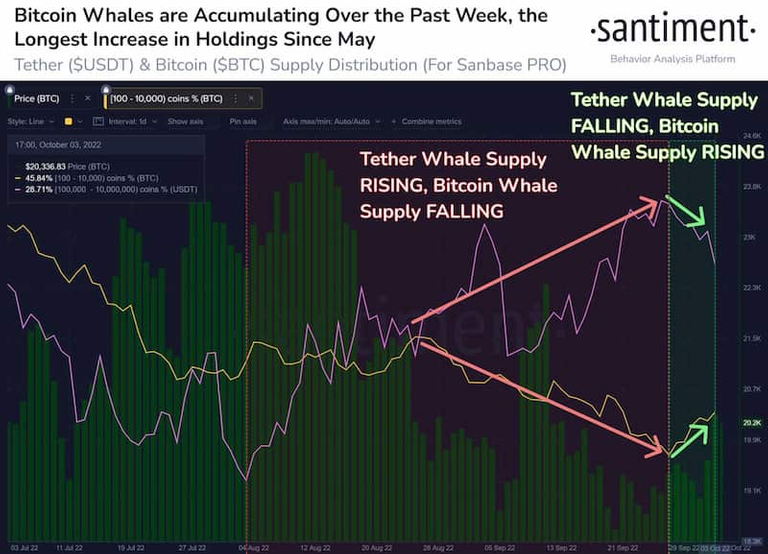

According to Santiment, wallet addresses with 100 to 10k BTC have added 46,173 BTC since September 27. Another thing they noted is that these BTC retail purchases are correlated to the Tether (USDT) supply, for the uninitiated this means that whales are buying BTC with USDT, moving from stable coins to bitcoin in what is the longest sustained Bitcoin accumulation period since May.

This is relevant because between the start of August this year to the end of September, whales’ supply of Tether had been on the rise, and their supply of BTC fell to a multi-month low. A reverse on this trend is what is drawing the attention of the market.

To put things into perspective, in the past week whales accumulated more than $931 million in Bitcoin.

Whenever there's increased BTC accumulation by whales, the market perceives this as a positive signal that indicates that investors are bullish on an asset and we have some bulls coming.

Now, this doesn't guarantee a bull market incoming, if you use Twitter you will notice whale alert made public that more than 300M USD worth of BTC were moved to the centralized exchange Huobi, signaling that retail sellers might not be done with BTC's bears.

This Bitcoin accumulation can be perceived from speculators as a move that builds bullish momentum from the whales hoping that the US Federal Reserve will pivot away from its aggressive liquidity withdrawal measures.

Finbold, a finance news outlet also reported in September that 47% of Bitcoin holders remain in profit despite BTC’s 60% price drop in 2022, suggesting that many Bitcoin investors are not fazed by the ongoing bear market.

More bullish signals?

Or at least signals that decentralized the biggest crypto asset in town: The number of BTC addresses holding 0.1+ coins just reached an all-time high of 3,832,859 on Monday.

Do what you must with this information, and by what you must I mean you should do your own research.

Posted Using LeoFinance Beta