Why did SVB Collapse?

I have been asking myself the question of why Silicon Valley Bank collapsed and I found part of the answer in this article by Simon Black of Sovereign Man on Zero Hedge:

https://www.zerohedge.com/markets/simon-black-unraveling-can-happen-instant

The basic premise of this article is that while in 2008, the toxic assets that led to the collapses of financial institutions were Collateralised Debt Instruments (CDIs) based on mortgage loans to people who were NINJAs (No Income, No Job and no Assets) TODAY the toxic asset are US Government Bonds themselves.

This is because bonds purchased when interest rates were very, very low have lost substantial value now that interest rates have risen a lot. Thus organisations that hold US Government Bonds (supposedly the safest of safe haven assets) are sitting on extremely large unrealised losses.

This has led to the technical insolvency of many banks and financial institutions including the FDIC and the US Federal Reserve itself.

The entire traditional financial system is technically insolvent.

But while clearer now than ever, this is not new.

Indeed, many crypto people (including Satoshi himself) have been saying this for almost 15 years.

Why did SVB collapse FIRST?

This doesn't answer the question of why Silvergate Bank, Silicon Valley Bank and Signature Bank collapsed and other's haven't, YET!.

Is it because they all start with the letter 'S'?

Is it because they had many clients from the (centralised) cryptocurrency industry?

Neither of these is correct, but nor are they completely off the mark.

The answer is because of two things starting with 'S' which relate to the nature of these banks' clients:

- Speed

- Sophistication

and one thing starting with 'I'

- Interconnectedness

You see, the entire traditional financial system is an Emperor with No Clothes. It is technically insolvent and even openly admits to massive losses on US Government Bonds in their financial statements (see Simon Black article linked above).

The whole system is a giant bonfire of high explosives ready to blow ... but you can't start a fire without a spark.

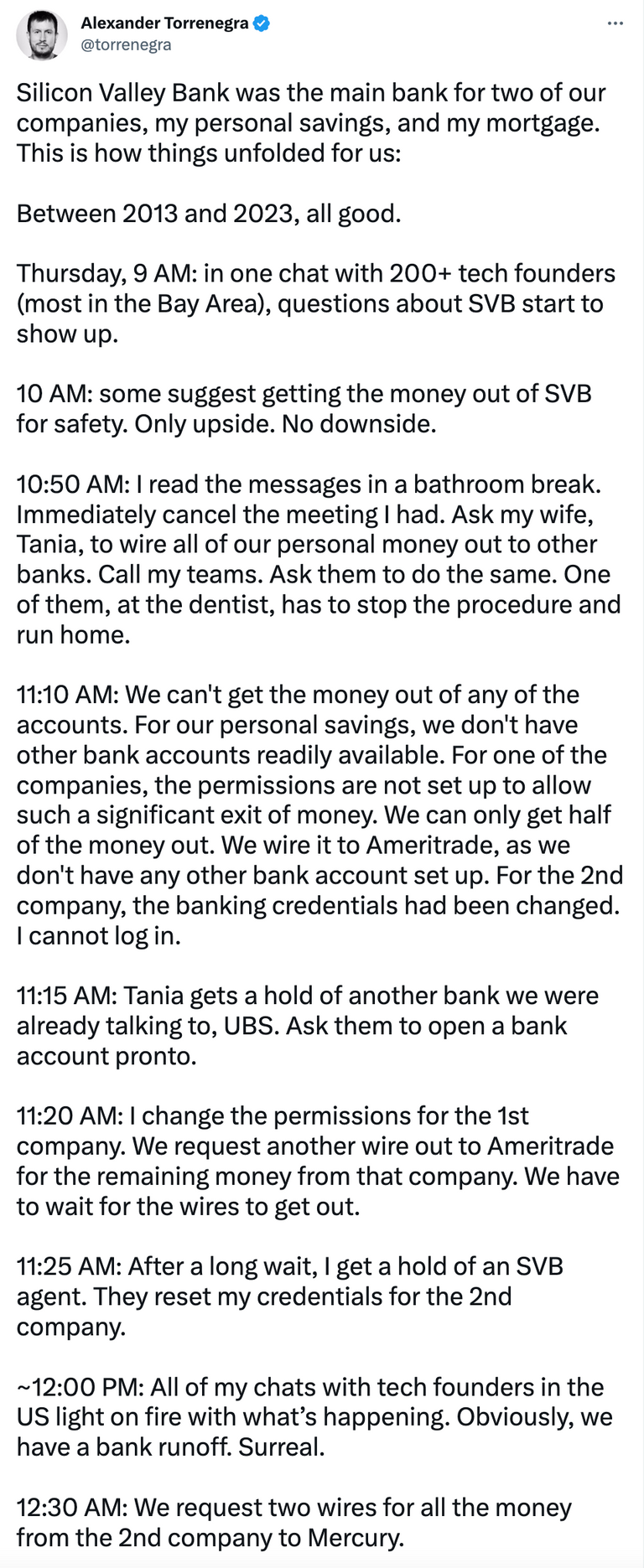

The reason why these 'S' banks with client bases including many (centralised) crypto companies were the first to collapse is because their clients are almost exclusively sophisticated technology investors (including fin-tech and crypto) who live life at high speed, are interconnected with each other via high speed online channels and are sophisticated enough to have some understanding of how fragile the system is.

It just took some people raising questions about SVB's solvency on an online channel at 9am (US West coast time) on Thursday, 9 March 2023 to trigger a bank run with $42 Billion in deposits withdrawn by the end of the day.

https://www.zerohedge.com/markets/never-seen-over-40-years-svb-collapse-sparks-bank-runs-people-wait-lines

This Twitter thread gives a personal insight into the experience of one SVB client:

In Tel Aviv (where I live) VCs were advising their clients to withdraw their money from SVB.

We denizens of the cryptocosm are well aware of how extraordinarily quickly things can happen in a 24/7 online interconnected financial environment.

Now the fire has spread from S class to R class, the US regional banks, which are experiencing classic bank run type scenes of depositors lining up outside banks to get out their funds.

Will the guberment be able to extinguish the flames before they reach the hyper-explosive core - the insolvent FDIC and Federal Reserve?

Time will tell...

Maybe this time, but sooner or later the whole system will blow - and the cryptocosm provides a ready made and far better replacement.

No traditional safe haven assets

But what is clear is that there are no safe haven assets inside the traditional financial system.

If you move your money from SVB to another bank, that bank could be next in line to collapse, suddenly with no warning other than the one I and many other are giving now.

Many are moving their money to very large 'Systemically Significant" banks like JP Morgan, on the expectation that the guberment and Fed will always bail these banks out.

But their are two problems with this:

- the guberment and the Fed are themselves insolvent;

- it has been US policy for 10 years to utilise bail-ins (haircut on deposits like Cyprus 2013 - exactly 10 years ago) rather than bail-outs.

Thus even these biggest banks are not safe.

BTC, Gold and HBD as safe haven assets

The only (liquid) safe haven assets are BTC, Gold and HBD.

BTC

The BTC price is currently being pulled by two powerful opposing forces:

- traditional financial types which consider it a 'risk asset' to be sold at any sign of trouble;

- 'red pilled' people who know that it is the ONLY large capitalisation liquid asset without counter-party risk.

As more and more people realise that there are no safe haven assets inside the traditional financial system, the later forces will win. The price of traditional financial assets will collapse when priced in BTC.

Many will call this a crypto bull market but it is not - it is the collapse and disappearance of the non-crypto financial system.

Gold

Physical gold, held under the personal control of its owner, will continue to be the classic, historic, safe haven asset.

But if there is any counter-party or holding party risk - ie all other forms of gold - forget about it!

The other party will just steal your gold when they face collapse or just because they don't like you.

They did it to Russia and Venezuela and they will do it to you.

Of course physical gold is very inconvenient and impractical, so is of limited utility for large holdings , but it is still a useful SHTF asset, in case we revert to pre-modern times.

HBD

The situation of HBD is a bit more complicated.

In the short-medium term it is an excellent safe haven, providing safe 20% returns on a US Dollar equivalent.

However, ultimately the US Dollar itself will collapse in value as the financial system which was based on it collapses and it loses its reserve currency status (already well underway from geo-political events), triggering the insolvency of the US guberment, which will be unable to pay its massive debt load and will default.

The Hive Witnesses will, I'm sure, as I am one of them, keep a close eye on this situation and will be prepared to move HBD onto some other stable peg when the time comes.

Please vote for my Hive witness. (KeyChain or HiveSigner)

Witness Vote using direct Hivesigner

Posted Using LeoFinance Beta