Welcome to my Not financial advice – June 2022 post!

Hi everyone!

I think I've been pretty bang on prediction-wise so far... so hopefully I can keep that all rolling...

In my previous post:

Not financial advice – May 2022

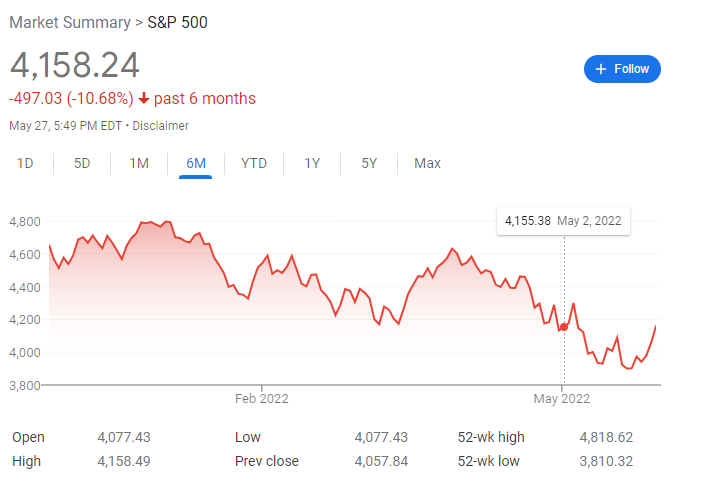

I mentioned that it was likely that the US Fed would announce a 50 basis point (0.5%) increase in interest rates which will cause the market to go sideways or decrease over the next 3 months... and OMG that was exactly what happened. There was a slight increase in markets the day of and next day... and then a pretty significant reduction until last Friday where month-end activities created a slight uptick ending in a whole lot of sidewaysing.

I wrote that post on May 2nd...

Source

Obviously I didn't predict $UST falling off a cliff, but the resulting BTC action just a little lower than my expectations... but it was in line with not hitting 90k-108k price for Bitcoin in May that others had predicted.

Source

So, what do I think will happen next?

Honestly, it's not good.

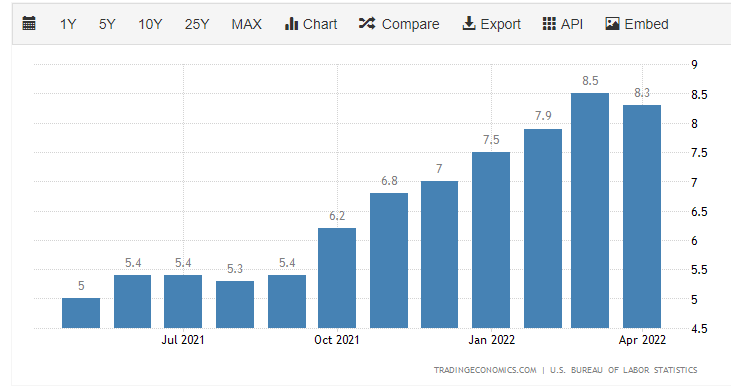

I think inflation will come down really, really, really quickly.

While that sounds like a good thing, I don't think it will be.

Usually people spend 70% of their disposable incomes on services and 30% on goods. During the pandemic services essentially disappeared and people were spending 100% on goods. Businesses were caught out, stock wasn't available and prices rose.

Now in the US, people are back to purchasing services, they don't have much savings anymore, they're worried about the economy and businesses caught up... but now they have way too many goods in stock and so prices will have to drop.

At the same time, the $USD has risen because Europe and China are essentially in recession. An increase in $USD and a decrease in prices is awesome for US consumers... they can buy more things!

During the pandemic more people chose not to work and/or retired early... and so companies had to offer higher salaries, which have increased their costs... and because of the $USD rising they can't export as much... so corporate profits have decreased... and companies will have to lower costs which means layoffs.

When there are layoffs, everyone starts to try and save, less spending, corporate profits decrease further which equals more layoffs.

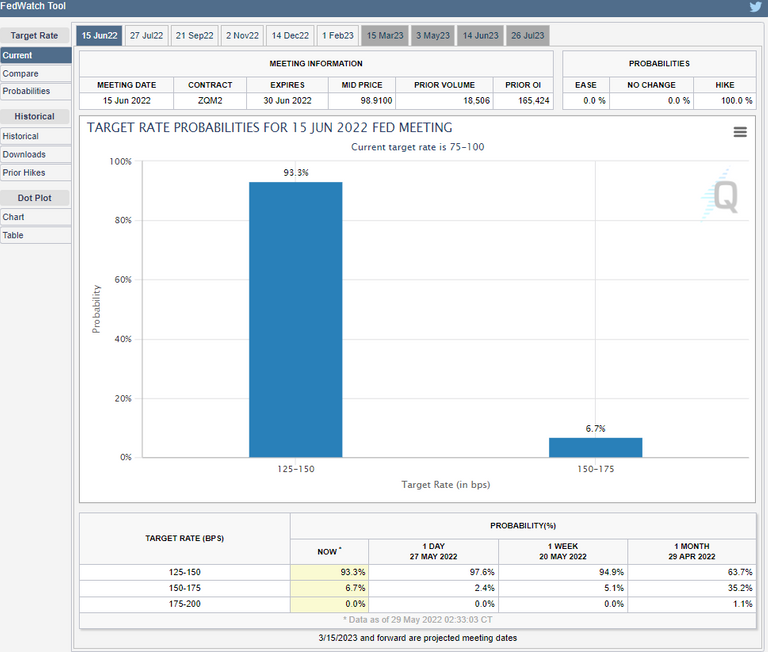

Add to all of this... the market still thinks it's very likely the US Fed will raise interest rates again on June 15th which will speed up all of the above even faster...

Source

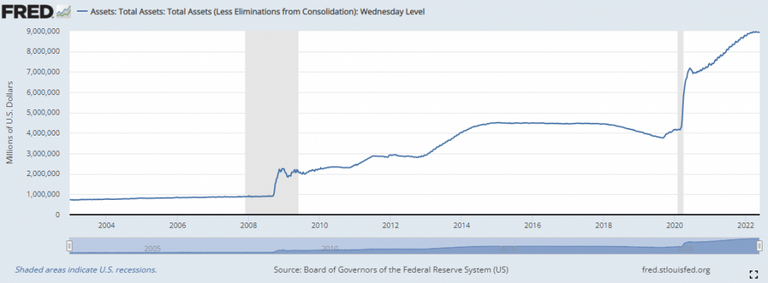

Not only is the US Fed going to be raising interest rates more... but they also said they will start shedding the assets on their 9 trillion dollar balance sheet in June. The stock market is absolutely going to hate that.

Source

Call me crazy... but I think we could be looking at really low inflation rates at the end of this year... maybe something like 3% or 4%.

Source

The other bad news is that while prices of goods will decrease... things like food and fuel are likely to remain high with the Russian invasion of Ukraine.... so, um, that's going to hurt everyone.

Short term pain... but for the US I predict some real long term gain.

Russia's invasion of Ukraine is horrible every way you look at it... but if I may point out a tiny sliver of a silver lining was that it highlighted many countries reliance on Russian gas and oil. This has sped up many countries and states move to green energy as it quickly became a security and resiliency risk. This month the state of California was 99% powered by renewables which will drive down costs to homes and businesses in the world's 7th largest economy.

The supply chain issues caused by the pandemic, plus Russia's invasion, plus Shanghai's zero covid policy (I have friends that have been locked down in Shanghai since April 1st) has highlighted the US's reliance on international trade, which again, is seen as a security risk. This means it's very likely that manufacturing will return to the US midwest... but built anew with the latest automation technology. I think the USD is going to be very strong for a long time to come.

So short term bad. Long term good. What about the medium term?

The current plan of the US Fed is to get to 2% interest rates. It's at 1% now.

Source

It might take a couple of months... and it's possible that the US Fed actually doesn't make it to 2% interest rates in 2022... but at some point in the next 6 months they are going to announce they are going into 'wait and see mode' as they watch inflation go real low and the unemployment rate start to rise.

At that point, the moment the US Fed announces that, I think growth stocks and crypto stocks are going to get flooded with investment capital. No one will care about value stocks, I think tech stocks will do extremely well at that point.

I personally see the next 6 months as a period of saving what you can, increasing your financial resilience and DCAing (dollar cost average - buying a set amount of an investment each pay period/month) on crypto and growth stocks while they are cheap. Obviously only invest once you've saved up a couple of months of an emergency fund. Companies will be laying people off in the next 6-12 months so be prepared.

Source

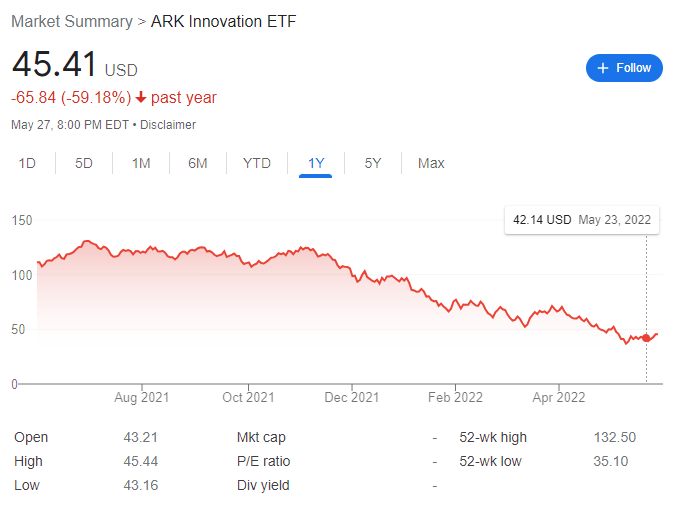

From a stock point of view, this is one I'll be looking into:

This one stock specializes in disruptive technologies like blockchain, automation, robotics, DNA technologies and electric vehicles - particularly where they all converge.

From a blockchain point of view I think the obvious play is Bitcoin. Until it's obviously not, I still think of Bitcoin as the gateway into the rest of crypto, and from a speculative point of view it should rise in price first and then capital will rotate into other cryptocurrencies. If you're lucky you could potentially ride that wave twice or multiple times.

Splinterlands

Splinterlands and the underlying Hive Blockchain are two spaces that I'll be investing my time over the next 6 months.

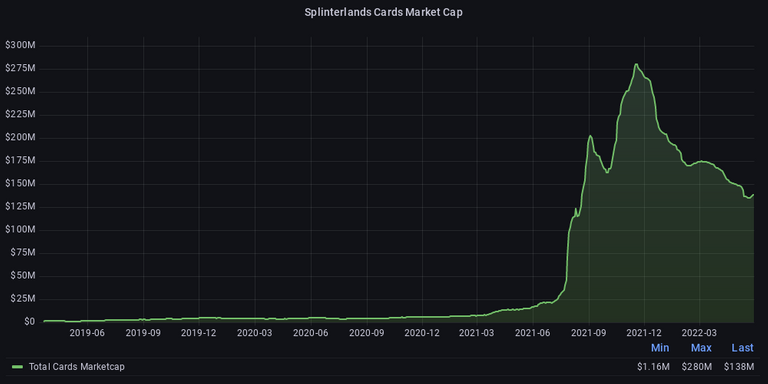

It's important to note that Splinterlands is a luxury. Asia and Europe are technically in recessions right now and so there just isn't going to be any new money coming into the game any time soon. Happily, as an established player of the game I don't need to spend any money to enjoy it.... and I'll be increasing my digital assets every time I win a game so that when the US Fed announces a pause on rate hikes and money starts pouring into assets, I'll have more assets that would enjoy price increases.

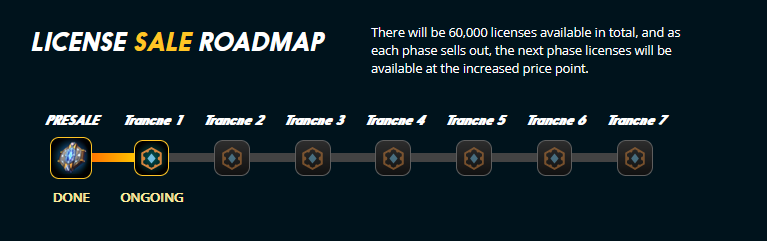

Splinterlands hit a really interesting milestone last week. They started selling the SPS Validator Node License NFTs that I wrote about last month.

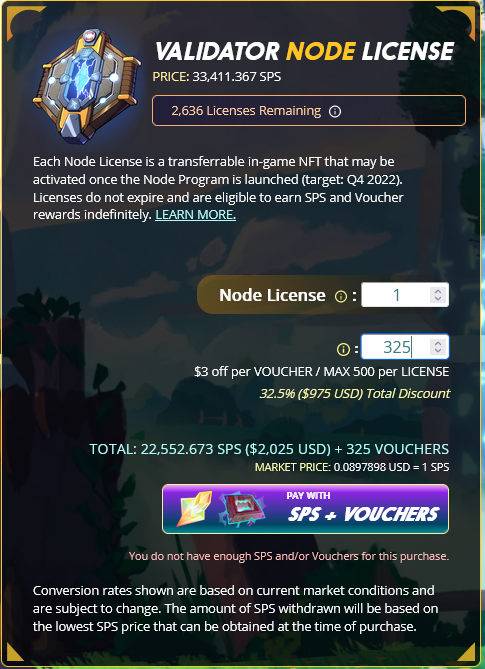

The licenses will allow users to earn SPS tokens if they run the SPS Validator Node software 24/7 when it comes out at the end of 2022.

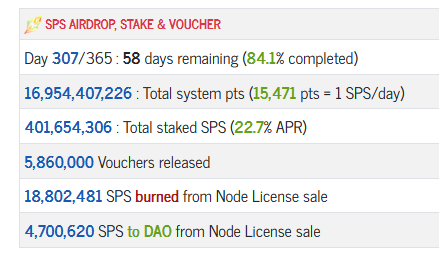

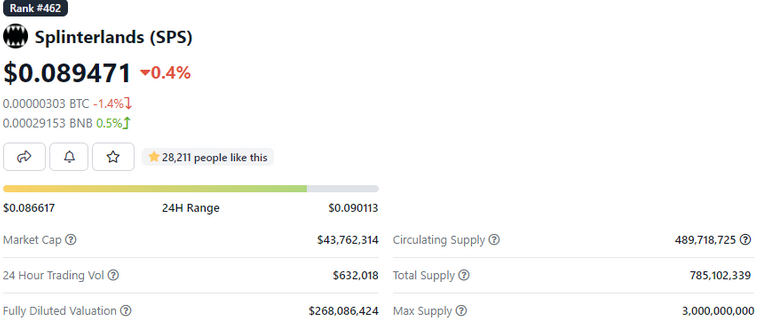

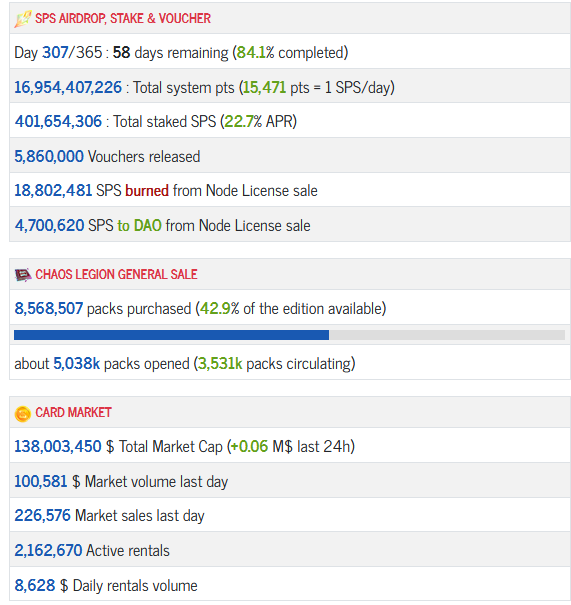

The SPS airdrop has 58 days remaining... and after that the only ways to earn SPS will be through tournaments.

Source

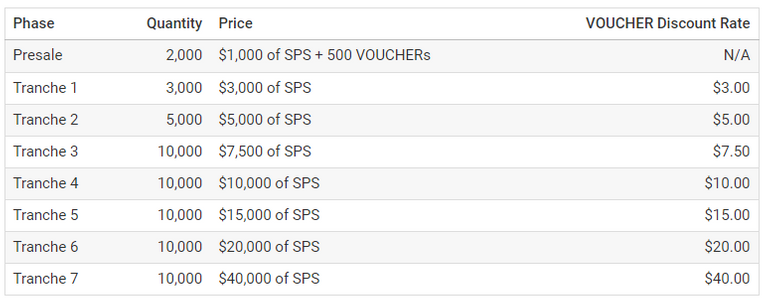

The SPS Validator Node NFTs could only be purchased using SPS and vouchers... and 80% of the SPS and 100% of the vouchers were burned. As you can see above, 18m SPS has been burned so far. I mentioned in my last post that the sale had manufactured scarcity and that you could only get partway through Tranche 3 before burning all current SPS:

Source

Source

The Presale sold out in 11 minutes... and they sold about 300ish licenses into Tranche 1 and it's pretty much stalled at that point... which is fine. Again, Splinterlands is a luxury and people generally don't buy luxuries heading into recession economies.

It doesn't really matter because there are 845 different accounts holding 2364 licenses. Let's say 70% of those run the SPS Validator Node software. That's 3,375,000 SPS / month getting sent to 1654 licenses will equals around 2,000 SPS per month. Great! The important thing is, though, that 70% of 845 accounts is 591 new servers running nodes and processing Splinterlands transactions.

That reduces costs to the Splinterlands company, improves the robustness of the game and most importantly makes it the only properly decentralized Play 2 Earn blockchain game around. I imagine this alone will provide it with a lot of attention and investment opportunities from the blockchain community around the world. I would be extremely surprised if massive companies (ie, Disney) aren't trying to buy it at that point to increase their investment opportunities in the Web3.0 and NFT space. The reason this will get so much attention is because the blockchain community will hold it up as an example of the power of decentralization, blockchain and Web3.0. The community will want it to succeed.

Obviously I could be wrong about all of that... we'll just have to wait and see.

I spent a lot of time trying to figure out if buying a SPS Validator Node License NFT during presale would be smart or not.

My hesitancy was from seeing what was going on to other node sellers.

Source

$STRONG is a node seller that was worth $710 per token at it's height 5 months ago... it's now worth $10.

I think a Gala Games node costs $93,000 to purchase... but they don't have a blockchain yet so running the node gives people $GALA tokens, but they're not actually processing transactions.

Source

Usually Node sales have increased the value of the underlying token so if you purchase a Gala Node with 10,000 $GALA when was $0.02... (cost $200) and then it's $0.71 four months later (cost $7,100) . Obviously the 25 $GALA tokens you make are nice... but you would have been better off just holding the tokens.

The SPS Node Validator Node NFT licenses cost just over 9000 SPS tokens and 500 vouchers during the Presale. I imagine it'll take about 5.5 months to earn back the SPS if you run the software. This means most license holders won't break even until June 2023. What are the chances SPS surges in that time? I think it's a good chance to do that... but the benefit that Splinterlands nodes have over Gala and Strong is that users can sell their NFT licenses at any time.

Source

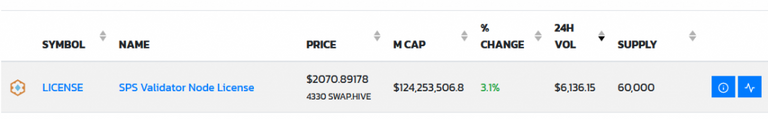

There are literally people buying and selling them on the secondary market right now. You can buy them on the Splinterlands website for $3000, or $1500 with 500 vouchers (currently $1.22 each so $2110 if you don't have any vouchers) or $2070 on the secondary market.

Source

The people selling likely picked up their licenses in the presale (9000 SPS + 500 vouchers = $1,450 worth of digital assets) so $2070 is a pretty decent profit.

The point is though, if SPS does start to surge, owners can sell their licenses for Hive and buy SPS if they're worried about missing out in that surge. Or maybe sell them directly for SPS once the Splinterlands internal market is built (58% complete according to the below):

Source

I was also worried that the SPS burned from the Presale and Tranche 1 would increase the price of the SPS token so much that Tranche 2 would literally be cheaper... but I didn't need to worry about that... SPS is cheaper now than during the presale despite the 18m burned.

In the roadmap you can see Riftwatchers due in about 3 months(ish). This is a smaller edition that the Splinterlands company won't make any money on... instead it will exist purely to excite players and burn more SPS (packs will only be available for purchase via SPS and vouchers).

Source

The work the Splinterlands company puts in to provide value to the digital assets owned by the community is incredible. It's extremely smart for the company, because that consistent creation of value for players is the product, that's what they're buying... not the digital assets... and ultimately the lack of that continual creation is the reason why games like Axie Infinity are unsustainable.

I'm also really excited about the Land Phase 2+ milestone, which is probably 9 months away, but that will introduce a new meta game within the game to create item and spell NFTs... which will add an extra economy to the game and extra strategy... and potentially increase the demand for older cards.

I'm still very much expecting that after the SPS airdrop finishes in 58 days....

Source

... there will be a ton of DEC that has been sitting in people's wallets that suddenly floods the market...

Source

.. which will lower the price of DEC and I think will increase the value of the cards as everyone goes on a buying spree and all the cheap cards get bought up...

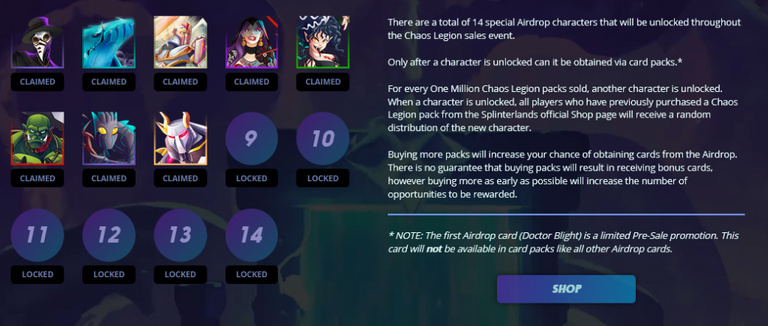

Personally though, I'm not going to touch my DEC at all, and instead will wait until all the Chaos Legion packs are sold, completing the remaining airdrop cards (the last 6 will be legendary summoners - easily the most important ones):

Source

People have been waiting until all the packs are sold to open them (only 58% of purchased packs have been opened to date) so that the airdropped cards will be included in the packs. I'm expecting a lot more packs to be purchased towards the end of the edition, and I'm expecting a lot of cards to be dumped on the secondary market at the same time... and that's when I'll be using my DEC to make card purchases.

My own collection has hardly any Chaos Legion cards in it... and I've been struggling to win... and there is essentially no point in playing tournaments at the moment.... so I'll be excited to purchase the cards that I need to be super competitive with the DEC I've been collecting and holding onto for the last 307 days and counting.

The rate the cards have been purchased at has slowed right down (again Splinterlands is a luxury) so I don't expect Chaos Legion packs to sell out until early-mid 2023.

From the Roadmap, Rebellion is the next card edition for sale, it won't be ready until early 2023 anyway and the Splinterlands company has promised they won't release it until Chaos Legion is sold out.... because, you know, no one would buy the old shiny thing at that point.

The other good thing about Splinterlands is that for every new card that's released, it increases the strategy potential exponentially and so we'll hopefully see a constantly changing meta. Even now it's not common to face the same strategy twice in a play session.

I also really like that Splinterlands constantly releases data via APIs so that developers can build additional tools for the Splinterlands community in tandem. That's a huge part of the recipe for growing the ecosystem.

So, for the next few months I'll be tightening my belt and saving money... then I'll be buying $ARKK and $BTC/$ETH when I feel safe while I'm building up my digital assets in Splinterlands.

What are you thinking? I'd love to know if you think I've got something wrong... it's such a great way to learn.

Thanks for reading my Not financial advice – June 2022 post!

Posted from my blog with Exxp : https://lifebe.com.au/opinion/not-financial-advice-june-2022/