The Splinterlands ecosystem is one that transcends the "Blockchain game" tag because it is a lot more than that. There are opportunities for everyone with a computer that's willing to do a few clicks.

For a long time, people have looked at Splinterlands as just a game and because of their lack of ranked battle brawling skills, they've not really participated in the game's activities.

If you take a closer look, you'll find that Splinterlands is more than just a game. It is a game with a variety of investment opportunities that don't require skill in ranked battles.

To put it slightly differently, Splinterlands offers traditional crypto investors an opportunity to get involved in the action through a variety of assets that are constantly generating value.

You can buy assets like packs, monsters, land and a variety of tradable in-game assets that you don't necessarily have to even use for the game. These assets can then be flipped in the way day traders do or just hold long-term and flip in the future when their prices rise.

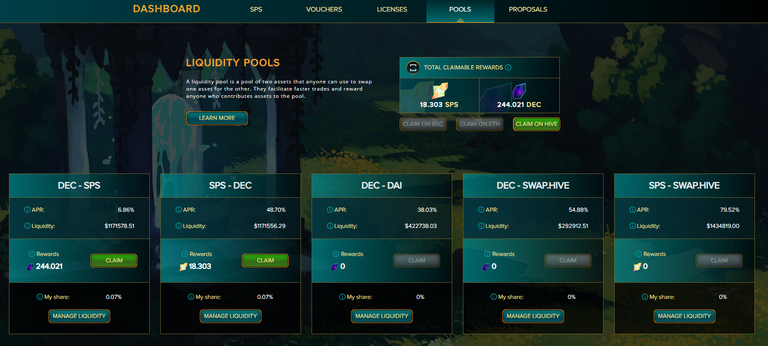

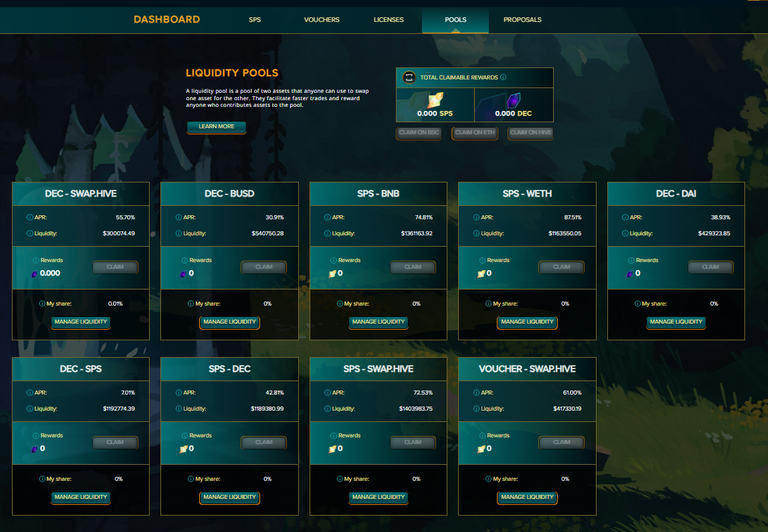

As the title depicts, there are also a number of liquidity pools that we'll be getting into in a bit. These liquidity pools offer different APRs and are all based on Splinterlands tokens.

Yesterday I announced the end of my ranked battle playing partnership with SEED project. This was not an easy decision but it also effectively halted my participation in ranked battle.

For what it's worth, I have a personal deck of approximately 90K collection power that I currently delegate to my friend. However, I've decided that I'd like to take a long break from battling and look at the other aspects of Splinterlands.

This is why I decided to explore the available liquidity pools in Splinterlands. My funds are very limited but I reckon I should still be able to participate in a couple of the pools.

Dive into the pool

At the time of writing, there are a total of 9 pools affiliated with Splinterlands. To find the pools, you simply;

- Visit Splinterlands

- Go to SPS management portal

- Click on Pools at the top right of your screen.

You'll notice that the assets you pool are broadly divided into two categories: Assets on Hive and Assets outside Hive.

For me, pooling assets on Hive will always be easier than pooling outside Hive. In any case, I'll break down the process of investing in all the Splinterlands liquidity pools.

DEC-Swap.Hive

The DEC-Swap.Hive pool is exclusively on Hive and you earn DEC rewards at 55.7% APR. To invest in this pool you;

- Transfer DEC and Hive into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

DEC-BUSD

This pool is staked outside of Hive and it offers 30.9% APR that is paid in DEC token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Pancakeswap to stake equivalent amount of the two tokens

SPS-BNB

This is also another pool that you find outside of Hive and it offers an astonishing 74.8% APR that is paid in SPS token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Pancakeswap to stake equivalent amount of the two tokens

SPS-WETH

This is also another pool that you find outside of Hive and it offers an astonishing 87.5% APR that is paid in SPS token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Sushiswap to stake equivalent amount of the two tokens

DEC-DAI

This is also another pool that you find outside of Hive and it offers 38.95% APR that is paid in DEC token. To invest in this pool;

- Connect your Ethereum wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Uniswap to stake equivalent amount of the two tokens

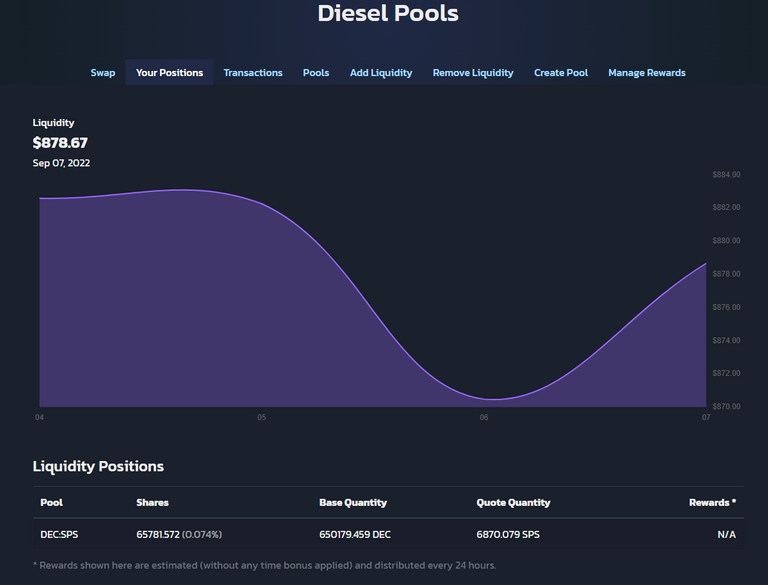

DEC-SPS

The DEC-SPS pool is exclusively on Hive and you earn DEC rewards at 7.01% APR. To invest in this pool you;

- Transfer DEC and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

SPS-DEC

The SPS-DEC pool is exclusively on Hive and you earn SPS rewards at 42% APR. To invest in this pool you;

- Transfer DEC and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

SPS-Swap.Hive

The SPS-Swap.hive pool is exclusively on Hive and you earn SPS rewards at 72.53% APR. To invest in this pool you;

- Transfer Hive and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

Voucher-Swap.Hive

The Voucher-Swap.hive pool is exclusively on Hive and you earn SPS rewards at 61% APR. To invest in this pool you;

- Transfer Voucher and Hive into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

In Summary

I generally feel more comfortable with using Hive applications so I'll be investing in only the Hive-based pools. Others might see things differently though. I also like the fact that there are minimal transaction fees on hive as compared to Binance Smart Chain and Ethereum.

So, what about you frens? WIll you be investing in any of these pools?

Posted Using LeoFinance Beta