Phew... I'm starting to have some of my crypto accounting be fully automated with API reporting and others not due to missing bits in the API imports and also some pretty funky reporting with on-chain imports. I use Cointracking for my crypto accounting, and I've been pretty damn happy with it! However, there is ample opportunity to make mistakes when you are doing manual imports... and if you are doing CSV/Excel imports from Etherscan or exchanges, then you are going to need to do some tweaking to make sure that the right numbers and assets are being imported.

Honestly, after a month of tweaking and tinkering around with all of this, I'm pretty happy that I'm not a regular trader... that would be incredibly nightmarish... even as it is, I'm feeling pretty deluged by the combination of volume of imports and the lack of interoperability/standards for reporting. I really really miss the Dutch single snapshot... even though it means that I pay more tax due to not trading and only generally holding, I would happily pay that difference to avoid the headache of constant and endless cap-gains reporting for every bloody transaction that leaves a footprint! I swear that if I ever get audited, I will print the whole bloody lot on paper out for the auditor to wade through... these laws NEED to be updated!

Anyway, when importing manually... you are always going to be doing it in batches a LONG LONG way behind the API imports (even a week behind will see you being several hundred to thousands of entries behind...). This means that if you are importing into your "main" tracking account, then you will have you new entries disappear into the endless mess of transactions that already exist on your personal book-keeping ledger. That is a recipe for disaster....

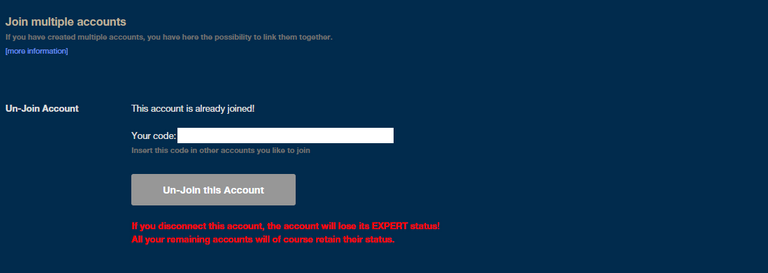

If you have a paid account, you can quite easily share your transaction limits between accounts that are linked to your paid account. So, the trick is to create a second account (a "test" or "staging" account and link it to your "main" tracking account. This means that it will be easy to import and export trades between accounts.

So, when you do a manual (or even a direct blockchain import) import, then you can do the import into the "test/staging" account without worrying about losing all the transactions in the flood of the "main" account. From the sparsely populated "test/staging" account you can quite easily find and track errors and tweak your import parameters to make sure that all the information is imported correctly.

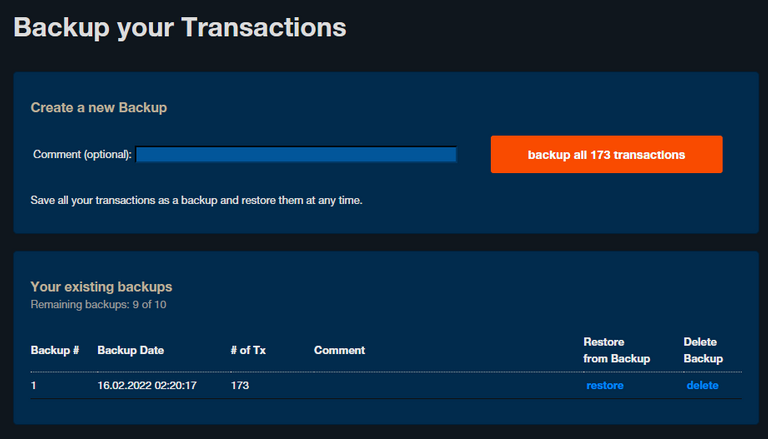

... after you have everything done to your satisfaction, you then create a backup of the "test/staging" account.

... then select "restore". This allows you to "restore" or export the backed up transactions to the same account or to your "main" account. Of course, if you are exporting to the "main" account, then you will want to keep all the existing transactions and not NUKE the whole thing (oh man... I can't imagine how painful that would be...).

After you have restored/exported the "test/staging" account to your "main" account, you should clear and delete all the transactions on the "test/staging" account so that it is completely cleared and clean for the next manual import.

Trust me, this has been a real lifesaver to discover this little trick. Chasing up errors in imports is a pain in the arse when it is within 200 transactions... but imagine doing the same when the imports are already imported INTO your precious "main" database AND scattered throughout tens of thousands of transactions. Definitely a good deal less fun...

... catch the errors and tidy up your imports BEFORE you lose them in the "main" database by using a "test/staging" account in Cointracking. Preparation like that means that you will have less headaches later... plus, it doesn't cost anything to set up a second account and to link it to your main!

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

FTX: Regulated US-based exchange with some pretty interesting and useful discounts on trading and withdrawal fees for FTT holders. Decent fiat on-ramp as well!

MXC: Listings of lots of interesting tokens that are usually only available on DEXs. Avoid high gas prices!

Huobi: One of the largest exchanges in the world, some very interesting listings and early access sales through Primelist.

Gate.io: If you are after some of the weirdest and strangest tokens, this is one of the easiest off-chain places to get them!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Stoic: A USD maximisation bot trading on Binance using long-term long strategies, powered by the AI/human system of Cindicator.

StakeDAO: Decentralised pooled staking of PoS assets.

Poloniex: One of the older regulated exchanges that has come into new ownership. I used to use it quite a lot, but have since stopped.

Bitfinex: Ahhh... another oldie, but a goodie exchange. Most noted for the close affiliation with USDT and the Basic "no-KYC" tier!

Account banner by jimramones

Posted Using LeoFinance Beta