Hive has one of the best ever play2earn games on the web3 blockchain of Hive. It's also challenge Axie Infinity and other large block buster web3 games in the past. However it has falling on some hard times like any application did during the bear market but also some mistakes were made which are still being paid for to this day.

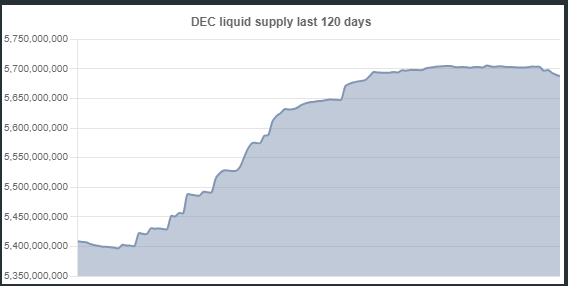

However, with that said I believe we are closing in on the end of that and I personally feel assets are about as low as they are going to get. This goes for Cards(NFTs), governance tokens SPS and even the so called DEC stablecoin which is greatly depegged once again at 0.00076 when it should be holding at around 0.001 in fact we are already starting to see it climb a bit for no reason other then normal supply. We can see this more clearly when we look at the DEC liquidity of the last 120 days of which I believe a lot of that was the result of burning old reward cards and other Chaos cards from the hyper inflation days.

The other reason why this price increase looks promising to me is that the price of Hive which it's often pegged closely to has been falling in price while Splinterlands tokens have been slowly increasing in price. Normally we would see a increase in Hive and that would corollate to a increase in DEC and or SPS prices increase as well.

New Additions

Splinterlands also has had a number of new additions which have a slow burn amount on the token including fees that can be generated.

One of these recent additions has been the Grain : DEC pool which I'm going to be honest with you I'm very surprised at how active it is already. Why? Because later on with land 2.0 grain is only going to be able to be produced on certain plots of land and you're going to have over 40 new assets to be mined on these lands of which ALL of them are going to need grain supplies to work.

In just the few days it's been live over $6,000 has been swapped in this internal market and a total of $325 has been generated in fees. This is actully huge because from what I know 5% of this is given to liqudity providers but also 5% is burned. That means 12 million grain was burned and over 200,000 DEC was burned from a single market swap that's internal to the game.

Let that sink in because land is bear bones basic at the moment with only one asset being swapped and grain being able to be produced on ALL plots and not currently limited.

The other resource I see that will trade nearly just as much will be wood. But there will also be many others that people will be after such as infused grain with magic to help workers work even harder and tons of other trading within the game. All of this is going to generate revenue and also burn fees which I believe will quickly suck up all of the hyper inflation we have seen.

We can also see there are only 2.2 million Chaos legion packs in circulation right now (with a stupid cheap price of just over $0.50 each so any new player could buy up a ton of packs and start playing) There are also about 1 million of each card in circulation at least for common so there's still a bit of hyper inflation on those which honestly I don't think will ever go away. Instead the Rebellion set should do well in holding some decent values including when the next pack set is released in a little under a year.

You can also grab up SPS governance tokens for just a bit over a penny so the upside there is potentially massive as well as I could see it hitting $0.10 when land 2.0 goes live.

There's a lot of promising in the game right now while it feels like some people are thinking the other way. To be it's that low again before the main break down. Now I don't think it will be anything like 2020 with the massive spike there however I do believe we could see 10x - 20x on SPS and card values again.

I can also understand that some people feel like they lost values I mean card values are stupid low again honestly and the demand has been drying up for the most part.

Posted Using InLeo Alpha