Crypto is still a hot topic at the moment. As the democrats try to save face and buddy up with crypto after four long years of being the most oppressive towards it. We have now shaped into a time where countries are thinking about or already stock piling bitcoin and still the price hasn't really moved.

So what happens when countries end up owning the vast amount of the supply of bitcoin in the future? Does it put the entire system at risk or does the proof of stake.

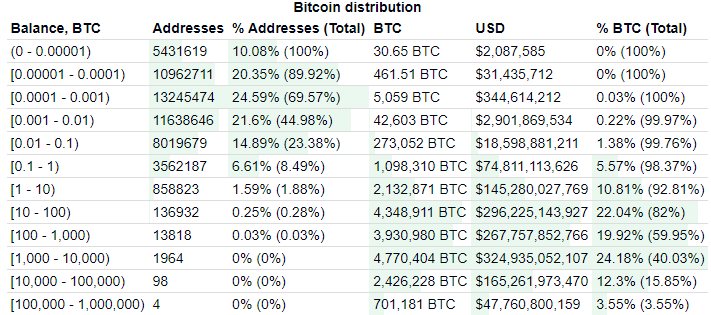

We are actully not too far away from such a scenario. Just take a look at current bitcoin wallets and distribution.

I think one of the biggest things to take note of here are the 1-10 accounts which is only at 859,000 (rounded up) with 21 million bitcoin in existence that means a huge amount of people don't own anywhere near 1 bitcoin. So when people say make sure you own at least one bitcoin you can start to see why that's the case. Even worse only 3.6 million wallets own less then 1 bitcoin or 0.1 bitcoin.

Now of course some wallets could have multiple people or a person could have multiple wallets. So we can clearly see that a vast majority of bitcoin is already in the hands of just a few accounts.

Does This Harm Decetralization?

In a way it does as large accounts could in fact manipulate the prices of bitcoin into their favor buying or selling by moving just a small amount of their assets around.

Before it was miners that were often the raise for concern with a 51% attack on the network as more and more large cap businesses started to show up mining bitcoin in droves compared to any single person could which is what was originally thought would be the case.

With nearly all of the bitcoin now mined and honestly trading on bitcoin doesn't happen that much because of the crazy high fees it's most likely that it will stagnate more and more over the next few years. So if your every day person doesn't start to pile in on bitcoin then the elite few will mainly hold control over the network.

Does It Matter?

As we can see today a vast majority of bitcoin is in fact in a few accounts. Of which some of those accounts could very well be lost to time and some bitcoin has also been "burned".

With a vast majority of it being tied up into these few accounts already we can see there really "so far" hasn't been much reason for concern. Bitcoins price has always kind of just done it's thing. But on hard sell offs or hard pumps either the low liquidity fuels this or the actions of these larger accounts which can swing the markets much faster compared to if it was more spread out.

On the other side of that there's also nothing that is currently stopping the whales from holding all of it. With that much current supply in a few accounts a few well placed trades will see them gobble up droves more of bitcoin.

This is a centralization issue that will most likely take a few years before we see the negative impact of. If governments get involved this will most likely only expand this even further as a few select governments would start owning vast amounts. This would leave core businesses and governments once again in control exactly what bitcoin aimed to try and stop. A full 180 in just 15 years.

Posted Using InLeo Alpha