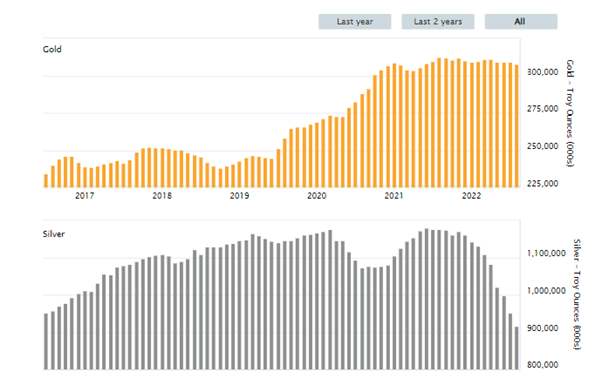

The amount of silver that is stored in the vaults of the LBMA in London has been steadily decreasing on a monthly basis over the course of the past 12 months, and it has now reached an all-time low. Earlier this year, BullionStar has already brought attention to the fact that there is a negative trend in development; the amount of silver stored in the vault is diminishing at an alarming rate. I have no idea what the London Bullion Market Association (LBMA) is scheming, but maybe the physical silver is actually running out.

[Source: https://www.lbma.org.uk/prices-and-data/london-vault-holdings-data]

There are always speculations that the banking institutions hold significant short position on silver. The silver market is notoriously highly manipulated; there have been several news stories in which big banks such as J.P. Morgan get caught pulling the string behind the scenes; at this point, it is not even a conspiracy theory; it is simply a fact. It's likely that the price of silver is kept artificially low by silver funds and big banks, with strategies like spoofing. I have written a post that outlines how J.P. Morgan manipulated the price of silver in the market. SLV's Silver Manipulation

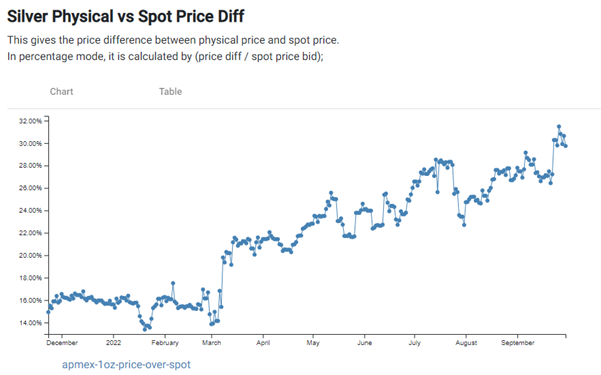

It's speculated that there are as many as 200 derivatives or contracts (paper silver) in circulation for every ounce of silver that is available. Buying actual physical silver is the only way to free silver from the manipulation of phony "paper silver." It is true that short sellers can bring down the price of silver by short selling the derivatives, but the premium over the spot of physical silver cannot be influenced by derivatives in any way.

[Image source: https://silverbacksnakes.io/finance/silver]

Perhaps this is why the premium over spot for silver is increasing like crazy.