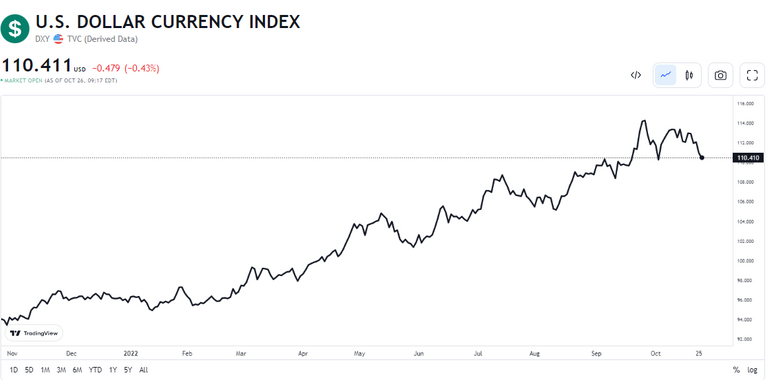

The dollar is getting stronger (DXY keeps pumping). Despite its strength and “stability”, the dollar poses risks. The dollar is vulnerable to pump-and-dump manipulation by the Fed. The only reason the dollar has survived to this day is that it is the world’s reserve currency. When it comes to foreign transactions, people have no choice but to use the dollar. The BRICS countries and others tried to escape the dollar because it is not hard money (not backed by metals). Think of the dollar in crypto terms. In theory, It has an unlimited total supply; the creator, the U.S. government, has the ability to create new dollars at any time. It has limited potential upside, and nobody likes it except it’s irreplaceable in international trading. Everyone knows it’s a worthless “stablecoin”, but people keep using it anyway.

All of this ranting reminds me of a blog post I came across a few months ago from Alhambra Investments. TLDR of the post: The inflation of the dollar is not real. As the Fed prints more money, they create more deflationary money; the value of the dollar (DXY) continues to rise as m2 grows. The post basically predicted the continuation of the DXY rally despite the rising USD liquidity in the market. Everyone was panicking about hyperinflation at the time, but, they were bracing for the dollar’s deflationary effects. Kudos to Alhambra Investments’s brilliant analysts!

I guess you could argue that the dollar is still deflationary despite the CPI inflation rate of 8.2%. Perhaps the CPI is not an accurate measure of inflation. Or, one may argue that the irrationally strong dollar (and the reasonably weak currencies such as GBP, JPY, and EUR) effectively neutralize the high CPI inflation and make the dollar deflationary on the international market.

Nonetheless, the dollar’s strength is not permanent. The dollar is susceptible to weakening if the Fed turn on the printer again and QE to infinity. I think I sound like a broken record at this point: The supply of precious metals is limited, unlike fiat currencies. The currencies with limited supply are real money. It’s true that the dollar is stronger now. But, If you’re a patient investor, I’m certain that the dollar will eventually weaken versus real currencies with limited supply, such as Bitcoin, gold, and silver.