Former US president Donald Trump got shot in the ear and the crypto reacted with a pump that is still ongoing by the time of writing this. ETH ETFs could see the green light this week and even though Mt.Gox's repaid Bitcoins possible sell-off still casts a shadow, the general feeling is optimistic.

Since we've just witnessed a choppy beginning of summer, I have been looking for a safe haven in the uncertain crypto space. Of course, there's always the stablecoin option but I still want that crypto exposure and something that will increase in value over time.

The Jupiter Liquidity Provider Pool

JLP is a liquidity pool on Jupiter Perps. It acts as a counterparty to traders who will borrow funds from the pool when leveraging.

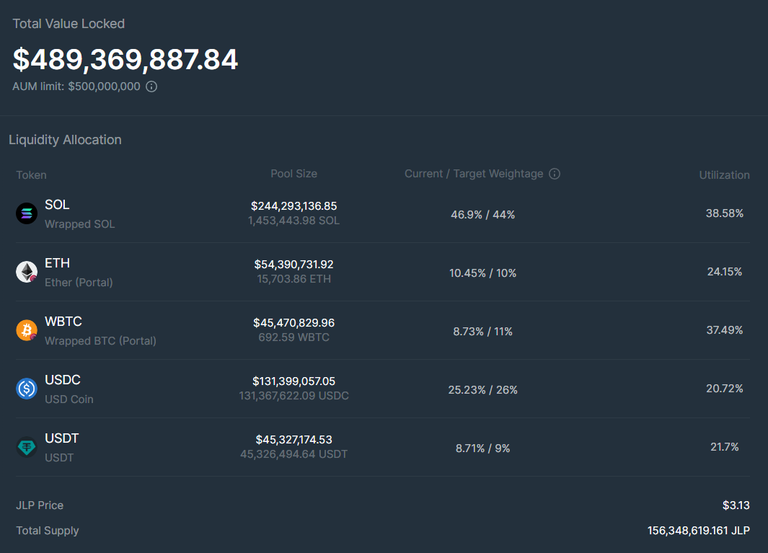

It is sort of a basket of 5 assets:

- Solana

- Ethereum

- WBTC

- USDC

- USDT

In addition to the current value of these tokens, the value of JLP is also derived from the trader's profit & loss and 75% of generated fees such as opening or closing position fees.

These fees are redistributed back to JLP holders creating a changing APY that was 78% last week and is currently at 38%.

The weightage and utilization will change depending on which assets the traders are favoring. By looking at the picture above, we can conclude that SOL/USDC is the most used trading pair.

Price Development

Obviously, the JLP price will dip if the three blue chips dip, and as we know, when the BTC price drops, the others follow. However, JLP will hold stronger since it also consists of stablecoins that will balance the price.

Also, because of that stablecoin exposure, the JLP price won't be making radical surges; instead, it draws a slow and steady graph of upward movement.

For example, here we can see BTC price on a 1-year scale and below that, JLP price on that same scale.

Strategy

The yield that hourly injected into JLP is making it appreciate in value over time creating this a somewhat safe savings option for both bull and bear markets.

I look at Jupiter Liquidity Provider as an option between volatile crypto assets and stablecoin positions.

At the moment I believe we are on the verge of a full-blown bull market so now is not probably the best time to invest in JLP. However, during the bull run, and especially when the market top is getting closer, I plan to start "slowing down" and move some of my profits into this.

Airdrop Exposure?

Some time ago Jupiter had a really generous airdrop of their JUP token for the early users of their platform. Unfortunately, I wasn't one of them but the next wave is already on the horizon and perhaps one criterion could be holding JLP tokens.

I know, this is very speculative but in addition to a solid savings strategy, that would be a great bonus.

Thank you for reading and let me know what you think of JLP in the comments.

Note that this is not financial advice.

Ongoing Airdrops To Farm:

🔸 Grass - perhaps the easiest way to gain exposure for a potentially very big airdrop! (time sensitive, last epoch!)

🔸 GRVT ZkSync Mystery Box - just log in and claim your first mystery box!

🔸 Hamster Kombat - addictive Telegram game hopefully leading to $HMSTR token allocation.

🔸 Mitosis - farm on multiple chains

🔸 Karak - restake multiple assets

🔸 Plume - free testnet

Disclaimers:

Thumbnail background image made with Canva

Other pictures are from Coingecko and Jupiter

This article contains referral links - remember to DYOR, and double-check URLs!

Posted Using InLeo Alpha