Microstrategy got into the Bitcoin space back in August 2020. They weren't the earliest to the game but they were one of the heaviest hitters that got in rather quickly.

Ironically, it started with the sale of Voice.com to Eos. Saylor sold a domain name to EOS for a whopping $30M. I believe that is one of the most expensive domain names ever sold.

After that, crypto and more specifically, BTC, caught the eye of Michael Saylor. He found an opportunity to essentially turn Microstrategy (his public company) into a proxy ETF for Bitcoin.

I'm not sure exactly when he realized he could do this but he is a super intelligent guy. Maybe his original intention was simply to buy BTC for their balance sheet? Who knows.

What happened since is $4.2B invested into Bitcoin which outweighs the market cap of the entire Microstrategy company. MSTR now mimicks the Bitcoin price and is without a doubt one of the best ways for institutions and other investors to get price exposure to BTC without having to jump through the hurdles of investing in Bitcoin.

There are a lot of hurdles still for people who want to buy Bitcoin in the TradFi space. They have to do all sorts of filings, plead their investors, etc. Instead, they can just buy some MSTR stock and essentially get the same exposure...

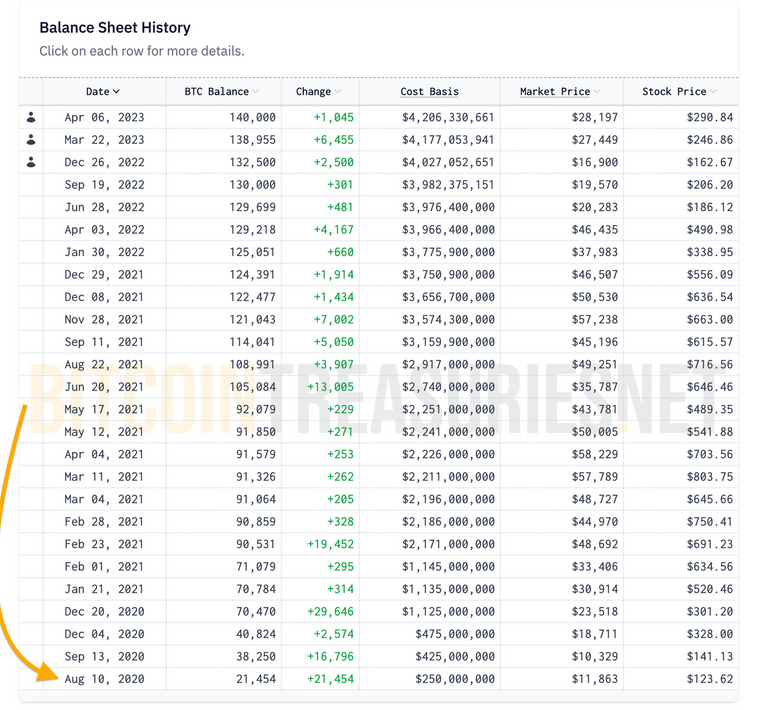

Here you can see the historical adds that Microstrategy made for Bitcoin to their Balance Sheet.

They bought $250M worth of BTC at $12k to start. Then they went on an absolute rampage and continued to buy. They even had some buys when Bitcoin was over $50k!!

Dollar Cost Averaging

Microstrategy is the king of dollar cost averaging. When they bought at over $50k per BTC, some people said that they were absolutely nuts.

Then BTC started to reverse the trend from the ATH, and people thought Microstrategy made a huge mistake and that they would one day go insolvent because of all of this buying... What ended up happening? They kept buying.

Things kept going down... What'd they do? They kept buying.

That's how DCA works. You keep buying. You find an asset that you believe is undervalued in the long-term and you simply keep stacking it.

Over time, MSTR brought their average buy for BTC to just under $30k per Bitcoin.

Finally Posting a Profit...

All of that DCA worked out for Microstrategy. Today, we see them finally post a profit on all of those Bitcoin holdings. It's been a really long time since that's happened for the company:

Inspiration...

Microstrategy is inspiration for anyone who wants to buy Bitcoin. You may think the price is too high. You may feel like you're getting in too late.

You are wrong.

Microstrategy came into this game quite late. They even bought Bitcoin when it was over $50k.

But what did they do? They kept Dollar-Cost Averaging.

It is literally the strategy that I tell everyone who asks me about Bitcoin to do. You can even automate all of your buys. Set it and forget it.

Over the past 7 years since I got into BTC, I've helped dozens of people do it. Just setup an automated buy - $10 a day... $100 a week. Whatever the amount.

Setup an automated buy that you can sustain for years without hurting your lifestyle. $10 a day is lunch money for most of the people I've talked to. It has no material impact on their life whatsoever.

Yet most people don't take this simple step.

Like Microstrategy, all of the people that I've helped set this up for are all in the green now. They're all profitable. Dollar Cost Averaging is that powerful.

I just took a look at one of such people's buy history last week. She's been DCA'ing $20 a day for years on end. Her total Bitcoin holdings are now over $15k and she can't believe that it's performed so well.

There has been no impact on her lifestyle, yet she's now got $15k in savings which is likely more than she's had in the past.

I will continue to preach DCA. Using MSTR as an example of how it can work at scale.