Hello dear Cent Community. As you know, we have 5 liquidity pools. Especially the transaction volume in Hive and HBD liquidity pools has reached very good levels. We still have not reached the desired values in terms of transaction volume and liquidity in the Hive/Cent market. However, as you know, transaction volume and liquidity are very important for a healthy price formation.

https://images.ecency.com/p/4i88GgaV8qiFkxbnGCXnHNbt8wcgAMNP6xb3BathLUp7dyDXtepjXNwPtxkJuKrNztsKGvwDuFg7FMVYrjhTCxehzKj2NEeXgXnykujwFZfCMyX5RJ65tWD82a.webp

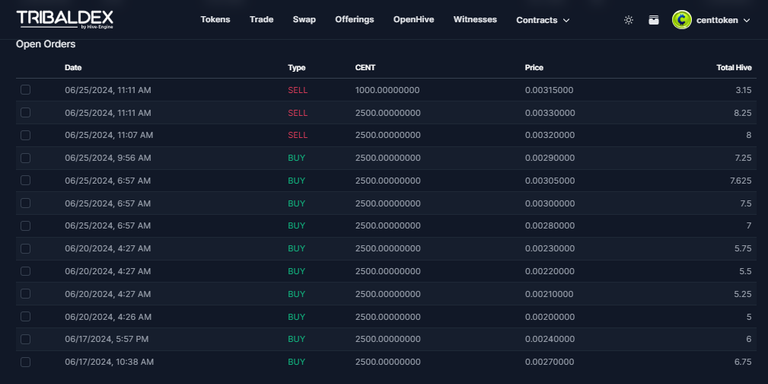

We enter buy and sell orders into the Hive/Cent market using the @centtoken account. Additionally, a few arbitrage bots ensure price balance between liquidity pools and the market. Several scalping bots operate in the market. But these are not enough. We decided to launch an event to reach sufficient transaction volume and liquidity in the Hive/Cent market. We have not set an expiration time for this event.

What you need to do is very simple;

Enter buy and sell orders on the Hive/Cent market. You can enter interval orders at certain price levels or by setting a percentage rate. If you want your transaction to be completed in a short time, reduce the price difference and order amount. If you aim to make a higher profit every time an order is executed, increase the price difference between orders.

Awards;

It is not currently possible for us to follow the transactions carried out technologically. Therefore, we will keep an eye on the Hive/Cent market. We will follow the market making transactions that take place. We will periodically send BEE tokens, Hive-Engine's native token, to users who make market maker transactions.

Things you should pay attention to:

- When trading, your priority should be to avoid loss. In cases where the price increases excessively, do not get excited and sell all your tokens. Do not buy tokens with all the capital you have in cases where the price drops excessively.

- Always keep Hive and Cent in your wallet. This way you are constantly on the lookout for possible buying and selling opportunities.

- When you need to enter a market order, divide your orders into parts. Don't act hastily. Allow time for arbitrage bots to achieve price stability.

- Track the price in the Hive/Cent liquidity pool. As we mentioned above, the Cent price is determined mainly in liquidity pools. Following the price in the liquidity pool until the market becomes dominant will be useful for you to make profitable transactions.

- Instead of entering orders above the prices in the order book, enter orders at different prices. Thus, your orders will stay away from areas where price movement is concentrated and will be executed more quickly.

As an example, we will add a screenshot of the orders we entered using the @centtoken account below.

As you know, liquidity pooling, liquidity provider rewards, etc. We act very proactively on these issues compared to other projects. As mentioned in Cent's white paper, our primary goal is; Our aim is to offer our users a token with high liquidity and sufficient transaction volume. For this reason, we are trying to ensure healthy price formation in the Cent market, as in the liquidity pools. We will continue to offer very attractive incentives to ensure features such as high liquidity and low price slippage. Don't hesitate to ask questions about anything that's on your mind. Follow this account for new event announcements and current news.

Posted Using InLeo Alpha