I've been hammering on about the widespread contagion going on in the shitcoin market of late, ever since the fed raised interest rates and risk assets started to sell off drastically, we've seen leverage in the system come undone.

It started with Luna going to zero along with its algorithmic stablecoin UST and then spread to CEFI platforms that were heavily exposed to it either directly or indirectly.

We've seen bankruptcies, we've seen coins retrace up to 90%, we've seen halting of operations and personally, I don't think we're in the clear yet. There was so much leverage and rehypothecation going on in the market during the bull run and some are foolishly trying to hold off liquidations as long as possible.

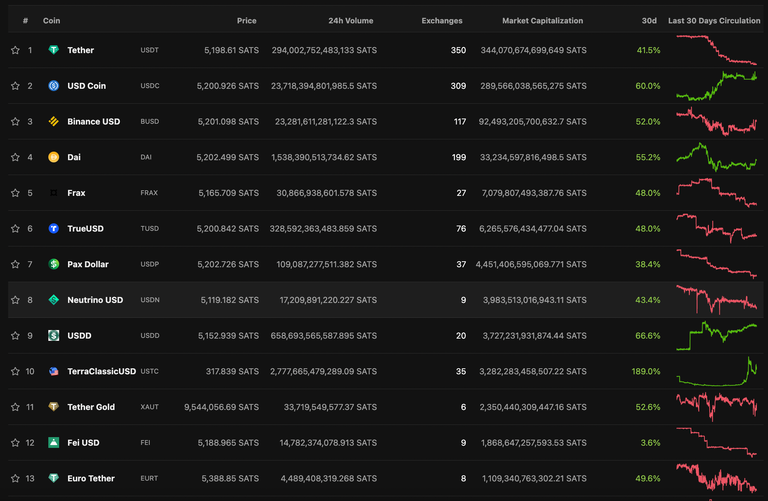

The fear in the market is so high that we've seen massive redemptions of stablecoins that are backed by a centralised body, such as USDT and USDC the premier stablecoins.

The stablecoin market today is well over 100 billion and many think that it's the flight to safety trade, it's where you go when things are crushing but is that really true?

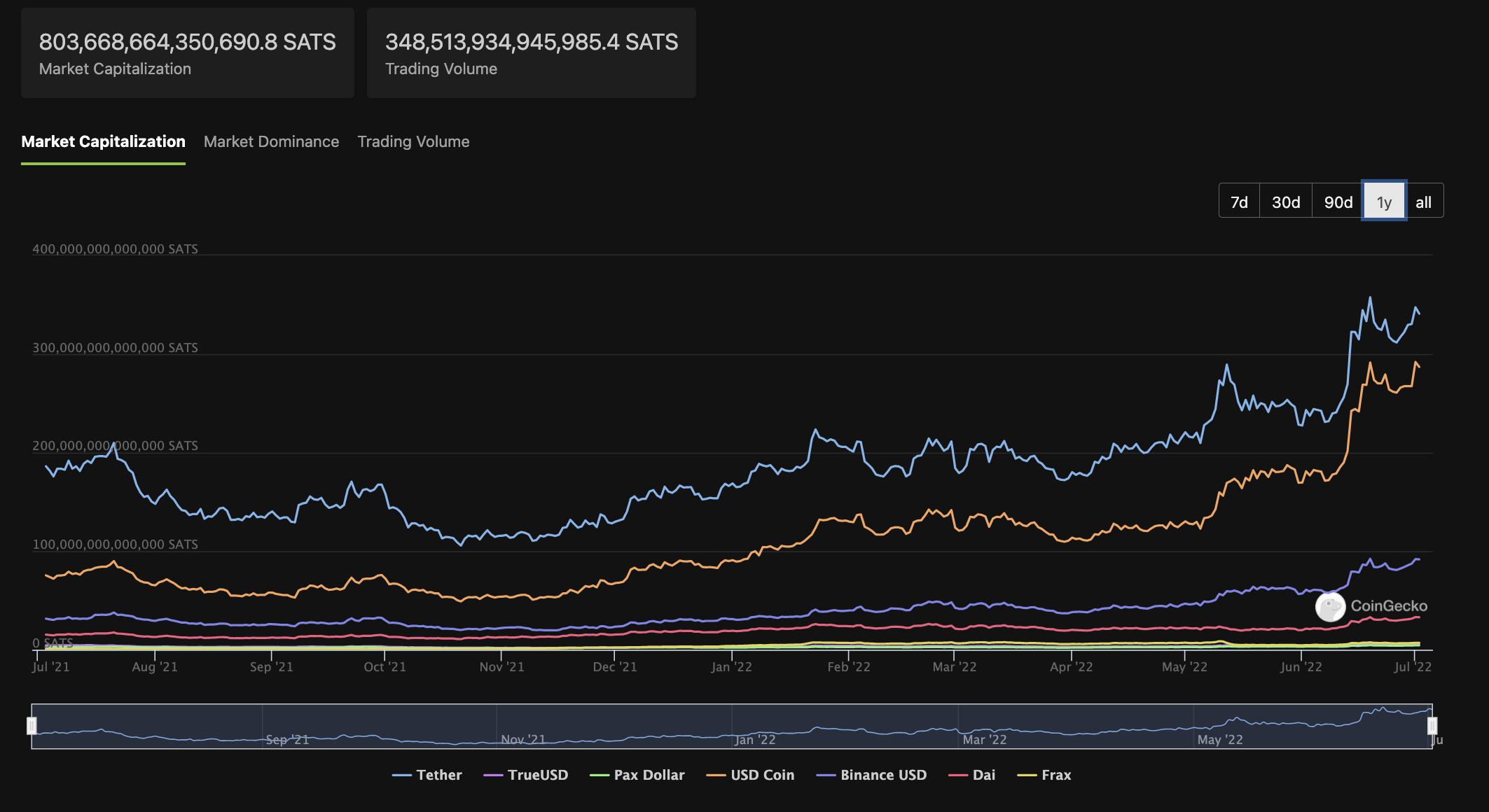

If we have a look at the stablecoin market its overall still trending upward despite recent redemptions.

When we look at who is getting redeemed the most it would be USDT, BUSD, Frax, True USD, and Pax Dollar.

Stablecoins used to be backed 1-1 with cash reserves but you can only make so much money on fees and redemptions so these issuers needed to look for new ways to leverage their capital under management.

Instead of having only cash many stablecoins, including tether instead use a mix of short-term debt known as commercial paper and other less liquid assets. In May, tether said it held about $20bn in commercial paper.

What this means is that if the redemptions on stablecoins continue, they may be forced to sell these assets or call in loans to get the dollars needed to honour their redemptions. This could create stablecoin issues to be forced sellers of these assets and drive the price down as the need for cash increases as people panic.

That means any rush of stablecoin redemptions could easily trickle into the commercial paper market, and spread into traditional markets. In the case of traditional banks authorities would likely step in to help large asset managers in the event of a shock to short-term credit markets, but they are unlikely to do the same for stablecoin providers who I think regulators want to see disappear.

If one of the large stablecoin issuers does go belly up, it won't only be a blood bath in the bitcoin and shitcoin market, but it would spill over into other assets and we could see widespread sell-offs and liquidations.

Stablecoins flock together

Many stablecoins are also paired with one another in protocols, to allow for easier swap between, and if one is impaired it could affect those it is mixed with through various smart contracts or exchange trading pairs.

So you may think you're clever hiding out in stablecoins, but they carry their own set of risks.

Sources:

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Earn Free bitcoin & shop | Earn Free Bitcoin & shop | Claim Free Bitcoin & Shop |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta