Silver Price Analysis

Silver prices dropped on Friday, finishing the session down by more than 1% after hitting a yearly record high of $32.71. Buyers' failure to cling to gains above $32.00 exacerbated the drop toward $31.60, but they held to weekly profits of over 1.50% which is good for my portfolio. Both silver and gold have benefitted from the Federal Reserve’s shifting stance on interest rates. Stocks are at recent highs, but there is some underlying pressures on the economy that could benefit metals pushing them to levels we have not seen. I'm waiting to see what effect the election has on metals and markets in general as we get closer to election day.

Silver Chart

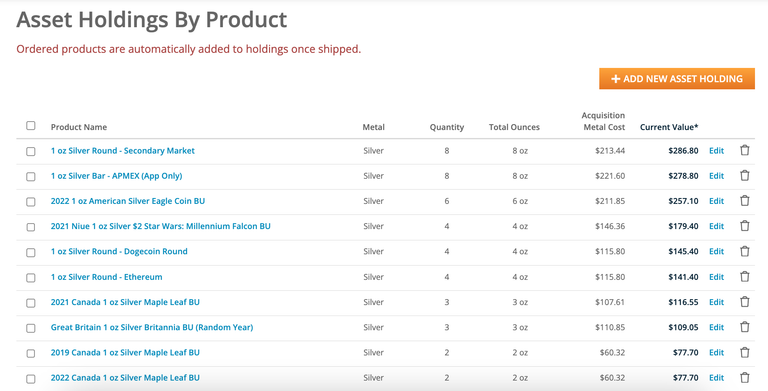

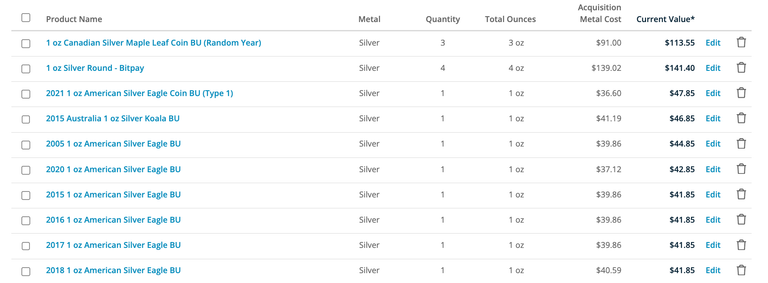

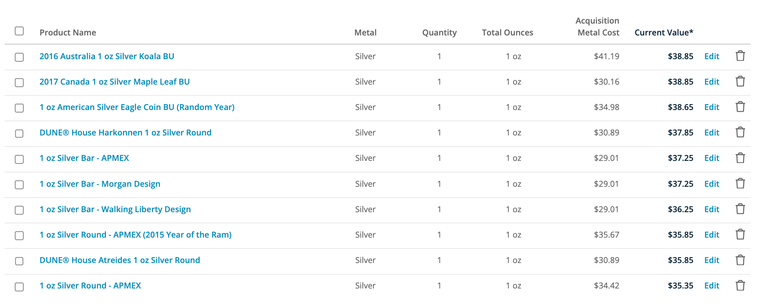

Portfolio Update

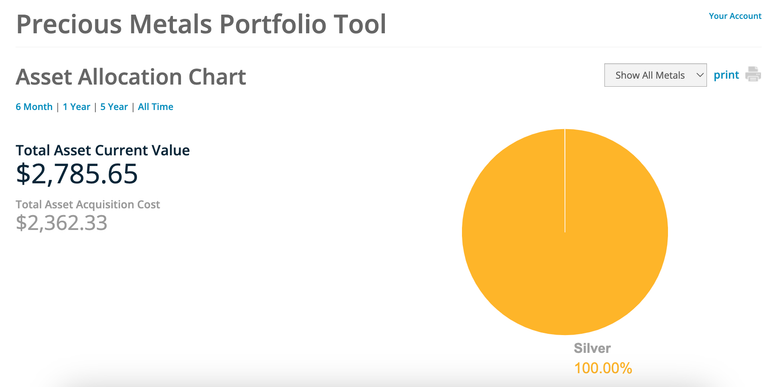

My current assets are valued at $2,785.65 with a total acquisition cost of $2,362.33.

I have been thinking about buying graded slabs as the next evolution of my portfolio. Excuse the Apmex screen shot but I'm look at MS-70 Eagles. Look back historically these seem to be appreciating nicely. I have seen some over the $100 mark. I'm new to grading and it seems like there is a lot to learn. I'm going to have to write a post detailing the difference so I can learn and create a reference guide for future buys.

Asset Allocation Chart

Asset Holding by Product