After the recent big pump HIVE is holding up really well and it does not look like we are heading back to 35c. That is what the old HIVE of a month ago would have done, but things have definitely changed in the last few weeks in a big way for HIVE. This is no longer just a pump and dump as traders are expecting more which is reflecting in the price holding around the 55c/56c mark.

Today the market is a sea of red and for once that does include HIVE which has been defying the odds staying green even when the markets were red. This is actually good news as we know corrections are healthy and these are required for more forward upward momentum.

The interesting take from all of this is we are still a good 40% up from where we were a couple of days ago and that would be a massive gain if we can hold these levels. The difference with HIVE today and a few weeks ago is the daily volume being traded which is something we will have to get used to.

In the past we would always look to the Koreans to pump our bags and now it literally can come from anywhere with all these new listings. This is a game changer and many investors and traders now see HIVE as an opportunity to earn money. This is without having influencers shilling and promoting on social media which makes it even more legitimate.

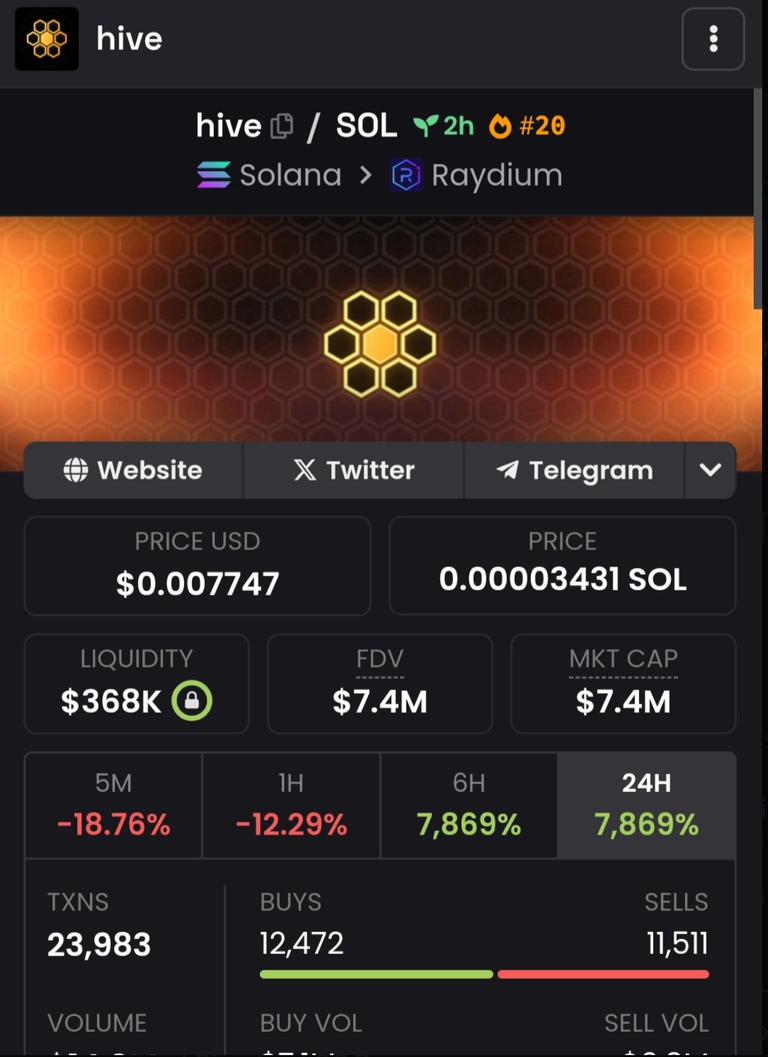

I noticed there is another HIVE token that has popped out of nowhere called HIVE.sol and one can only imagine the reason behind this has to be because the legitimate HIVE is now doing well. This is the part of crypto I hate as it can confuse legitimate investors and muddy the waters thinking that these HIVE tokens are connected in some way.

Riding on our coat tails and you would have to question is this going to be a rug pull at some point which could indirectly give a little more FUD for HIVE. I do think we are fine however as the real volumes and real investors do know where the action is happening and why we have seen volumes exceeding $2 billion which is unheard of when thinking about HIVE.

If I was a betting person which I am not I would expect HIVE to be over $1 by the month end as I do not see this trend stopping any time soon as investors are trading HIVE because they are obviously making money. Any crypto token that makes you money is going to be one of your go to investments and why I believe this is only the beginning and we can all benefit by riding this the whole way up and there is no ceiling to where this can go.

The last time HIVE hit $3.41 was all via the Koreans and this time we have the entire market on a large number of exchanges so this could become a serious money printer over the next 6 months or however long we have left until the peaks. We know once we surpass the ATH there is no resistance as we enter unknown territory which should be fun times. This cycle is going to be so different for HIVE and the daily volume is the big difference and game changer.

Posted Using INLEO