Shell announced they are pulling out of South Africa after Shell and other large companies have been raising doubts over whether South Africa is investable or not. What one has to understand is what changed over the last few years that have caused such a drastic decision. Black Economic Empowerment is a major factor along with increased labor costs plus load shedding and problems with the ports and rail system. There is actually not much going right and why so many companies are delisting off the JSE. That I will cover in tomorrows post but for now this is about Shell.

This is actually quite complicated and humorous at the same time because the complication is a BEE partner (Black Economic Empowerment) who are a necessity to obtain government contracts in SA, but also have to be seen as a parasite. Remember Star Link was rejected because Musk would not hand over 34% of Star Link SA to government officials and he walked away.

Shell SA in 2002 had a 25% BEE shareholder on board and changed the name to

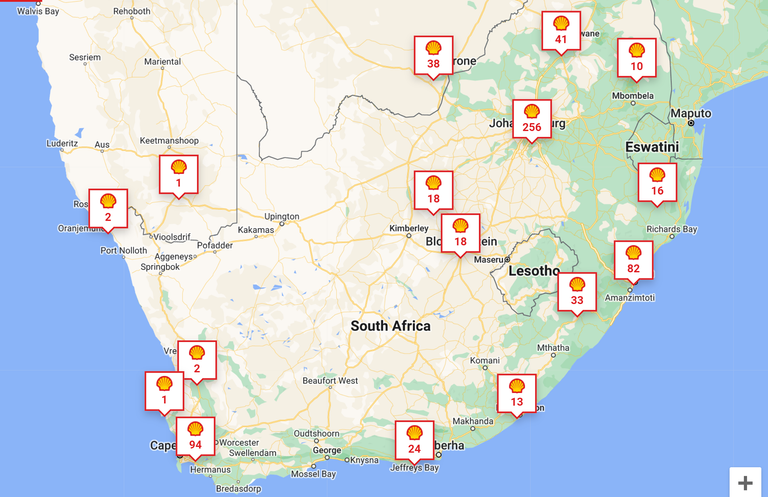

Shell Downstream South Africa in 2015 increasing the BEE share holder to 28%. Shell has around 600 Petrol forecourts in South Africa and not much else. The SAP refinery which Shell owned closed down in 2022 and has never reopened. The Government stipulated they required lower Sulphur readings in the fuel products for January 2023 which basically meant a brand new investment upgrading the entire refinery and Shell refused. Making matters even worse was the Durban floods in 2022 which damaged the refinery so it was out of action no matter what was agreed upon.

Shell has some great forecourt sites that have value on the National main routes which other petrol companies would want to scoop up, but expect massive job losses on the bulk of the sites as they will close down.

The BEE partner called Thebe Investments values their Shell Downstream SA shares being 28% at around $200 million. Shell say the shares are worthless and has shocked the investment company with their valuation. Thebe Investments paid $73 million for their share holding 22 years ago and Shell said that is still way too much and nowhere near the true valuation.

If the refinery was working generating 180 000 barrels of fuel per day the yes there would be share value. Currently all fuel products are shipped as final products mainly because there is no refinery left operating.

In 2022 Thebe Investments tried to push through their opt out clause because they knew their investment was at risk. The new Sulphur regulations plus Shell shutting down the refinery meant the profitability that was once there had been reduced significantly.

Having a BEE partner on board is meant to protect your business interests and the Government change in Sulphur regulation killed any profit immediately. Thebe Investments knew this and wanted to cash out before the valuation dropped and Shell stalled knowing this because no one is that stupid by over paying and handing out free money when there is no real value left.

I actually found this story rather amusing because the parasites have lost their investment in an around about way, but would have done very well over the last 22 years. The cash cow has dried up and can blame themselves for not fighting or delaying the Sulphur reduction regulations.

Posted Using InLeo Alpha