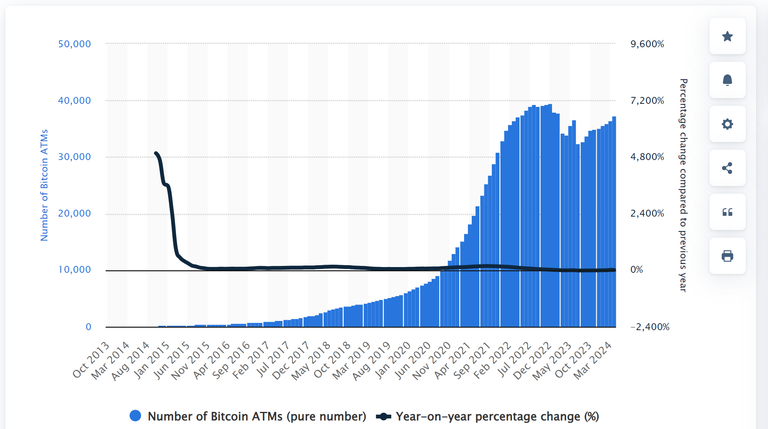

There are nearly 40 000 Bitcoin ATM's globally with over 80% of these based in the US. With the crypto market heading towards the Bull Cycle stage I can see why these numbers are heading back up after dropping off in 2022. I thought it would be interesting to take a closer look into this in case I am missing the point here.

My thoughts are if you have any crypto knowledge you would not be touching these mainly down to the fees being charged. I was reading an article where certain Bitcoin ATM's are charging as much as 22% which sounds a little crazy.

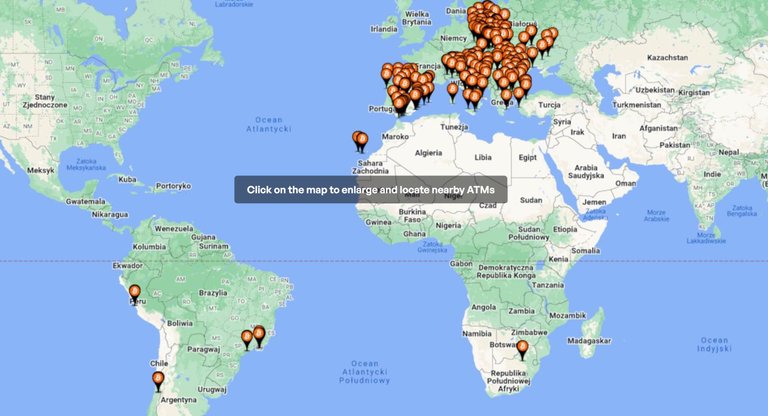

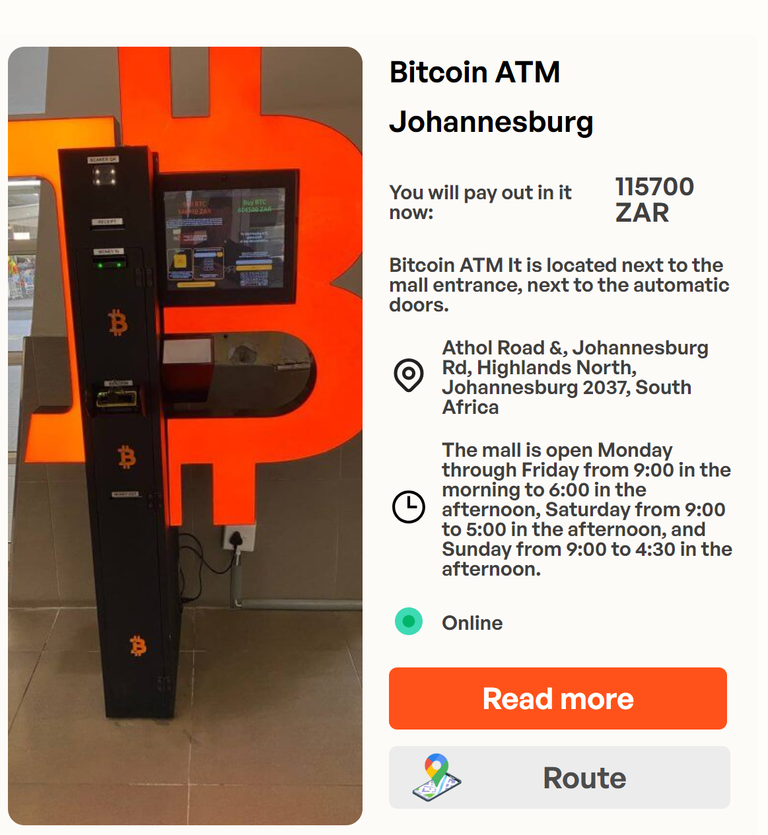

Many years ago I looked at one of these ATM's whilst in Durban and was not tempted to give it a test run. I knew we had a few in Johannesburg which has grown from 3 approximately 4 years ago to 8 currently. Again the problem is the fees that are being charged.

A service fee of R8 ($0.40c) plus 8.7% for the transaction is a total rip off and this is the purchase price and you have to wonder what price you are buying at because they will be making on that as well. The same applies to selling with a fee of 8.3%. At least when dealing with an exchange you know what the fees are and know what price you are paying for your crypto.

There seems to be two companies with Coinflip being the largest ATM provider and Biomat who has undercut Coinflip and the other Bitcoin ATM companies charging what they say s a 4.47% fee. The problem again is n the price of Bitcoin they are offering and you need to know your latest prices or you will be screwed. They highlight how much cash each machines has for those looking to cash out which is a weird scenario because you would need a sports bag just for the value of 1 Bitcoin in South Africa. Who would do that in public?

Someone reported they tried a Bitcoin ATM out and with the $20 they spent buying Bitcoin only ended up with $13 worth. I think this is what you should expect because unless you know what price they are charging for Bitcoin the 8.7% is not the amount you are really paying and they are profiteering on the price. Doing quick search of the profitability of these ATM's they say they average between $4K and $10K monthly so this is between 10 and 20% of 1 Bitcoins price so these machines are not really super busy doing the maths on this. It looks like they are only processing less than 1 Bitcoin per month and there is no volume.

The fees changed from 8.7% to 8.9% whilst writing this article which is kind of worrying knowing these also fluctuate.

I honestly do not see a big future for thee types of ATM's because I can see crypto being incorporated into normal ATM's. MiCA the European Crypto Regulation goes live on December 30th 2024 which should make things a little easier to transact with banks being forced to provide on and off ramps as per regulation.

The way I see t crypto has to have some type of regulation in order for mass adoption to take place and once MiCA goes live it should force other countries outside of the EU to follow suit. Once this happens where is the use case for a Bitcoin ATM because in theory they should be obsolete by then.

Posted Using InLeo Alpha