We can make a rough estimate of the time remaining at the conclusion of the btc cycle.

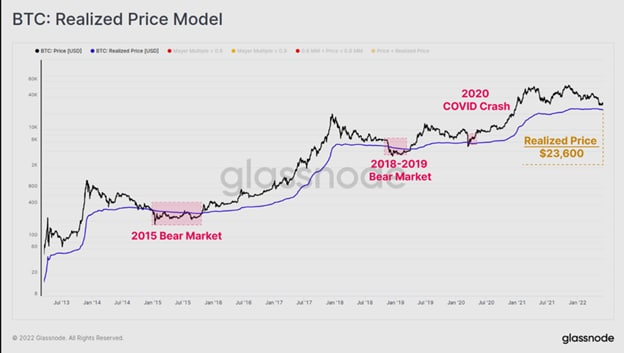

First, the realized price (we saw the chart on June 7) must plateau. In fact, the blue curve has flattened out quite a bit. So this is it.

Next, the btc quote needs to go below the realized price of this cycle, that is, below $23,000 (assuming that rp, now plateauing around 23,600, can go down some more).

When the black curve on the chart (the btc quote) goes below the blue one, how much time will we have left?

We can make a very rough guess with the following chart....

This is the graph of btc's up and down cycles from 2012 to the present.

We can see how the down phases (Bust) last on average about 400 days (the up phases are longer).

I would therefore say that this downturn has reached the halfway point. So the toughest final phase (psychologically speaking) of the downturn, when btc falls around or below $23,000, could last about six months.

Small reflection on the miners, who for the moment are not selling, if they start selling, they could bring the price to test the Ath of 2017 ($20000). There would also be intermediate support at $24200 (which currently turns out to be the average drawdown price of a btc) and just below the very important MA200 on the weekly which in the $22500 area could act as an important support level

Given the global situation, uncertainty in classic markets, war, pressing inflation, and a potential economic recession, the outlook does not appear to be great. What I think is more likely given the overall situation is a return to price levels ranging from 24000 to 20000. One last interesting thought I would like to make is that the average drawdown price of a Btc currently settles around $24000, exactly where we have intermediate static support and just below a very important average (MA200).

So to sum up:

- we wait for btc to fall around or below $23,000.

- we hold out for six months at least

Posted Using LeoFinance Beta