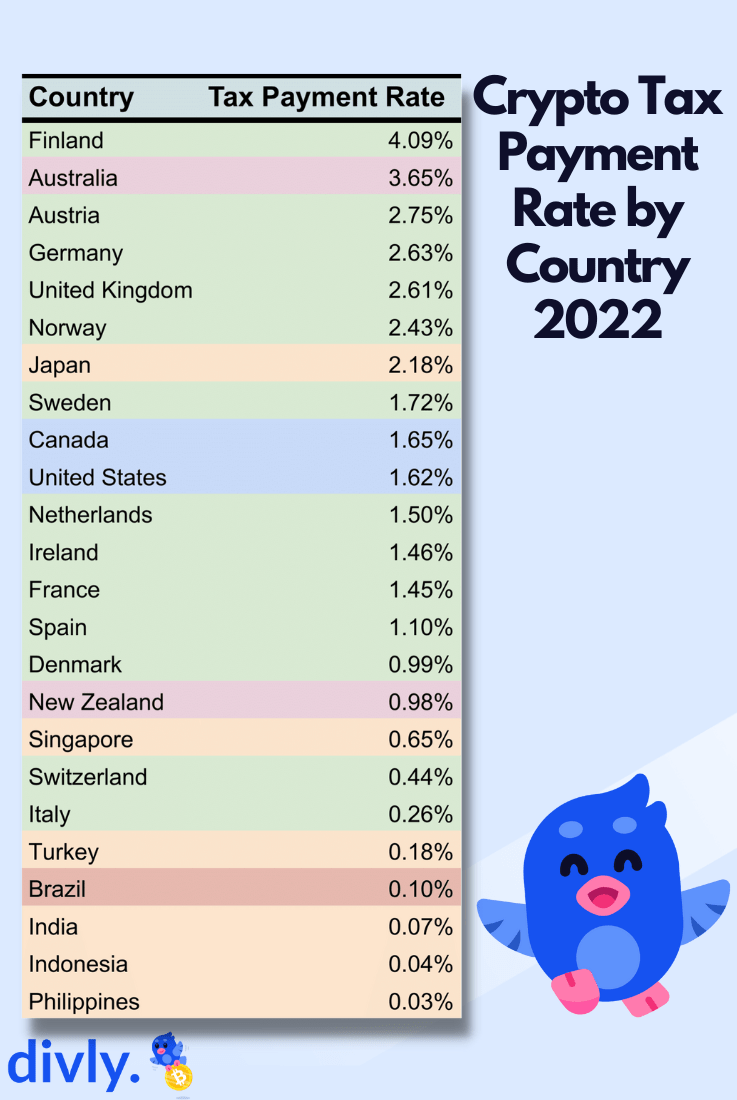

Swedish crypto tax firm Divly has released a report that estimates that only 0.53% of global crypto investors have paid crypto taxes in 2022.

Even in countries with relatively higher tax compliance rates in the crypto space, such as Finland and Australia, the percentage of crypto investors who paid taxes doesn't surpass 5% of the total crypto investor population in those countries.

This is actually quite worrying... because the consequences of knowingly or unknowingly not paying crypto taxes can be quite severe.

Source: Divly

What Can Happen if You Don't Report Crypto in Your Tax Returns

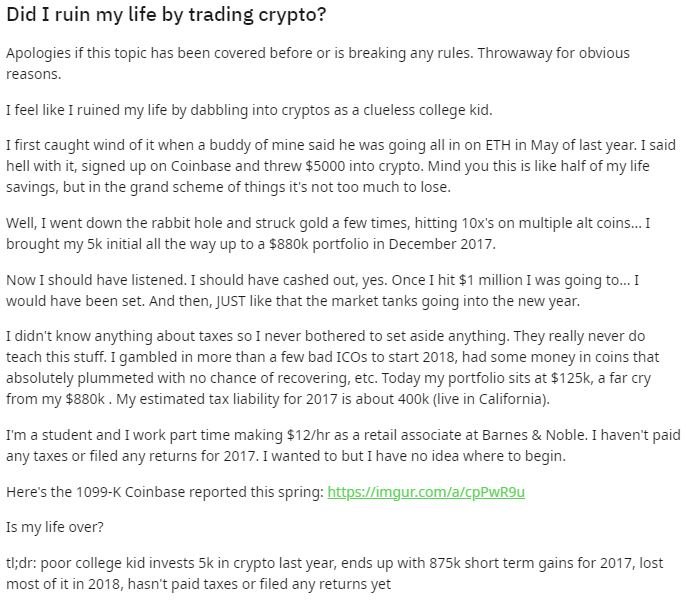

We come across many unfortunate cases of people regretting not looking after their crypto tax obligations.

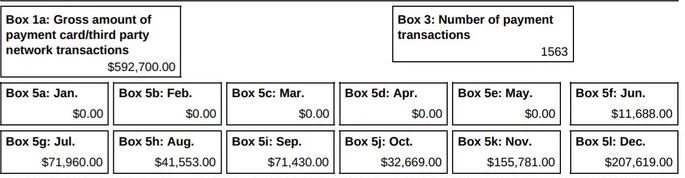

Like this young person, who unknowingly failed to fulfill his crypto tax obligations and the tax office came after him asking for an amount of money he no longer has.

poor college kid invests 5k in crypto last year, ends up with 875k short term gains for 2017, lost most of it in 2018, hasn't paid taxes or filed any returns yet - u/throwaway283921

Source: Reddit

Source: Imagur

There are crypto casual traders who have never invested any significant amount of money in crypto, so in general, their tax obligations are not substantial.

Even if the tax office comes knocking at their door, these people can pay any outstanding tax obligations.

But, there are crypto traders who have made a considerable amount of profits by smart trading or during the bull run.

For this kind of people, the situation usually progresses as follows:

It can be that the person still holds a reasonable crypto portfolio and can pay the outstanding taxes by selling part of his portfolio. Or even using his own traditional savings. Painful, but doable.

Or it can be that the person's crypto portfolio has greatly diminished, for example, due to the bear market, and cannot pay for the profits incurred by trading crypto assets during the bull run.

Failure to understand crypto tax obligations, unknowingly omitting crypto assets from tax reports, and not capitalizing on profits during a bullish market can lead to significant tax-related issues.

How to Calculate Your Crypto Tax Obligations

Calculating the Crypto Tax Obligation is actually relatively simple and even free:

If you are a casual trader, with just a few transactions here and there, an Excel file can do it for you. Still, you will need to know what taxable events are and what taxable events, deductions, and such apply to your country of residency.

If you are an active crypto trader, an Excel file may not be sufficient. Because what about crypto swaps, and airdrops, and crypto interests, and forks, and... how is all that taxed or, even if you know how those events are taxed, how how make the tax calculations without spending tens of hours every year?

Please, do your own research, but you may want to use some of the free* software applications.

- We have highlighted free because even though calculating the tax obligations is free in most cases, creating a tax report will require you to pay for a plan. Regarding the software application you choose, do not forget to check the plan's pricing.

In any case, if you decide to go to a software application to calculate your crypto tax obligations, you can use the free services and then decide if you actually need to use and pay for a plan. Some software that you may consider:

Koinly: Best Overall

CoinTracking: Best free plan

CoinLedger: Best for frequent traders

📌 If it is of any help, we have written an article about 'How to Easily Keep Track of Your Crypto Taxes'.

Congratulations on completing this 5-minute digital safety power-up.

We hope this short article has helped increase your crypto safety knowledge and awareness, and the 5 minutes read was worth the time.

5-minutes crypto and digital safety power-ups

For more 5-minute Power Power-Ups, please consider subscribing to our blog.