So I've had the pleasure of reading up on the new Arb Bot 2.0 docs - both in the monthly report and from the team's other postings about it.

Arb Bot 2.0 takes the arbitrage mechanisms behind the CUB DAO and ramps it up to level 15.

It's actually insane when you start diving into the details of it... From what I've read, the Arb Bot focuses mostly on the bHBD and bHIVE derivatives but it also adds new aspects to the bot.

Namely around HBD and HIVE native trading. It also adds Hive-Engine Swap.Hive and Swap.HBD to the mix.

What does all of this mean? From the Docs, it looks like the Arb Bot has highly efficient pathways that take advantage in milliseconds of price discrepancies across bHIVE, bHBD, HIVE, HBD, SWAP.HIVE, SWAP.HBD.

It's taking all of these various forms of HIVE and HBD and aggregating them on all of the exchanges available for trading these assets.

From there, it arbs away... Printing HIVE and HBD returns to reinvest into the protocol and utilize in CUB DAO buyback and burns.

Last month about $4k was generated from the Arb Bot... The Team says that Arb Bot 2.0 could generate $20k+ per month... just to start... As the liquidity on bHIVE and bHBD grows, this number could get exponentially higher

How is this possible? The Arb Bot adds these new pathways which means it is arbing the markets that have nothing to do with bHIVE & bHBD and then it sucks those returns back into bHBD and bHIVE, creating deeper liquidity.

It's fascinating stuff... things like the internal market are going to be arb'ed to basically print HIVE & HBD returns for the DAO bot and vortex them into the CUB bHIVE & bHBD Protocol.

The future is looking really exciting for CUB. I can't wait to see this live hopefully in January.

Follow along as I report daily on @cubdaily 🙏🏽

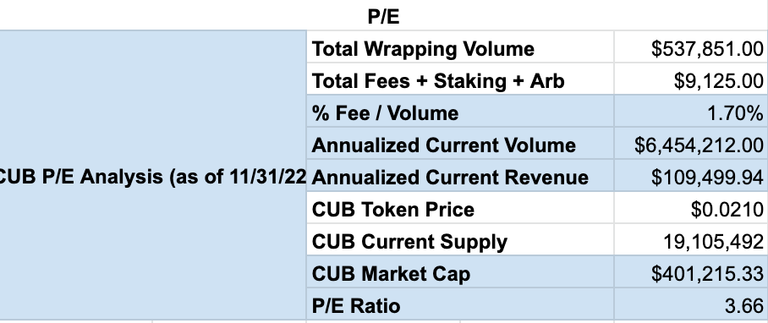

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

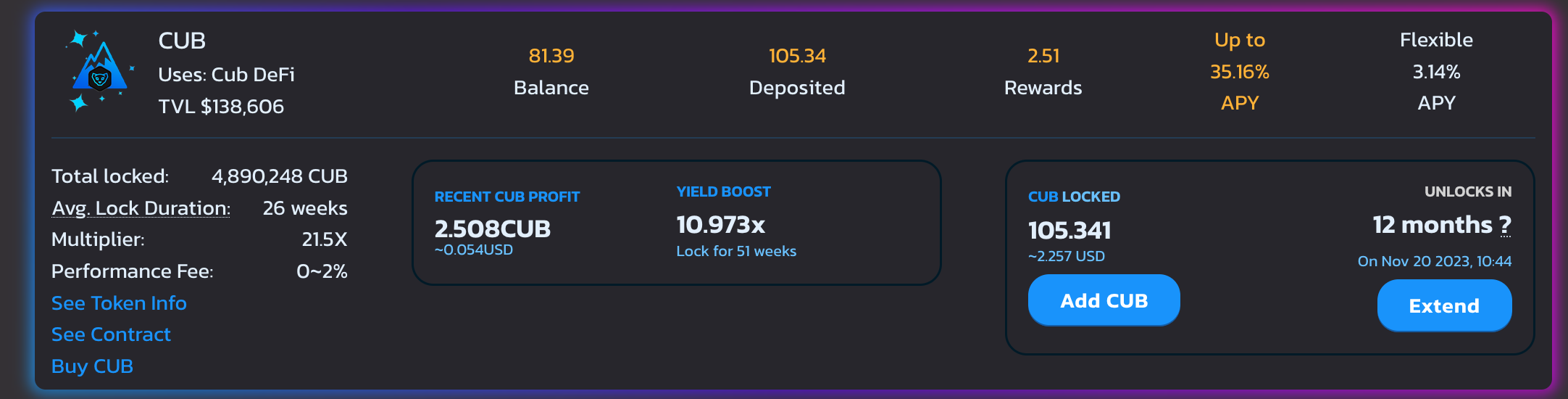

Locked CUB

A new section! The new CUB Kingdom is now live and we can track the amount of CUB locked and how long it is locked for.

- CUB Locked: 5,343,624

- Avg. Lock Duration: 32 Weeks

CUB Token

- Price: $0.018

- Total CUB Supply: 19,564,349

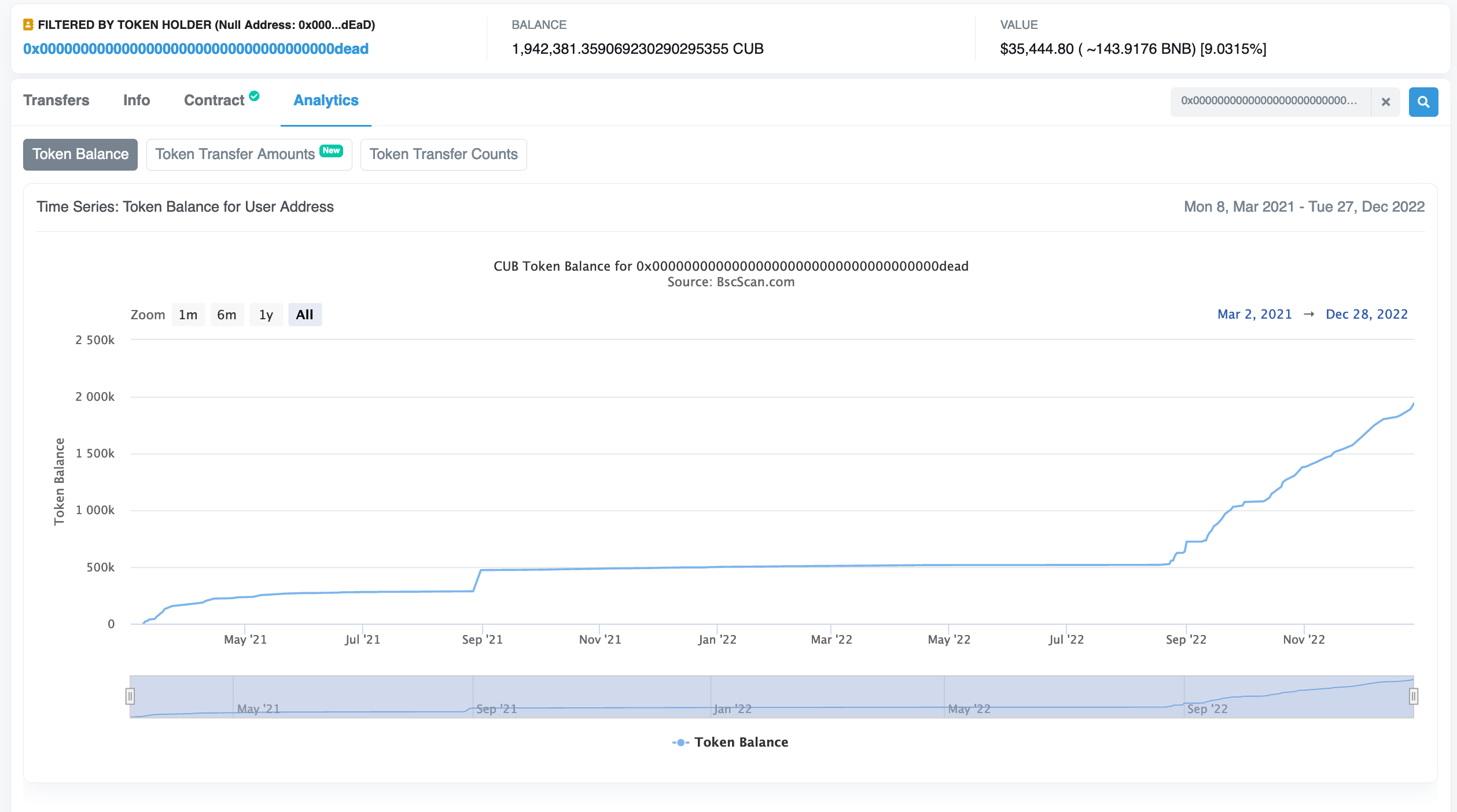

- Total CUB Burned: 1,942,381

- Total Market Cap: $351,483

- Total Value Locked: $1,160,250.90

Multi-Token Bridge Stats

- bHBD-bHIVE: $125k

- bHBD-BUSD: $282k

- bHBD-CUB: $120k

- bHIVE-CUB: $123k

- Total: $650k

CUB Burns

.png)

So close to 2M!

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: https://leofinance.io/@leofinance/cub-monthly-report-or-november-2022-50-of-cub-inflation-bought-and-burned-tvl-continues-to-grow-and-arb-bot-2-0

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.

Posted Using LeoFinance Beta