A lot has been said about the inflation rate of these two.

Bitcoin - sound money!

Ethereum - ultrasound money!

These has been the narratives.

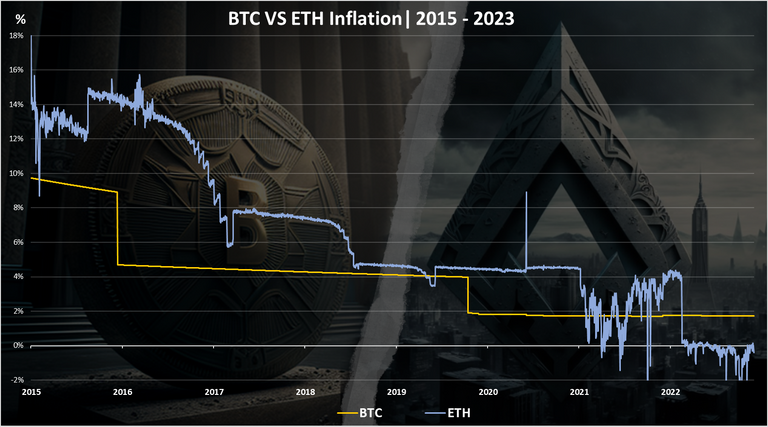

When we plot the yearly inflation for each date since the beginning of the Ethereum chain in 2015 we have this.

The inflation for both of these have obviously went down in the period, and for Ethereum has went down even more.

Actually in the last period the Ethereum supply has been negative, while the Bitcoin inflation is around 1.7%. By the look of this Ethereum is now beating Bitcoin when it comes to inflation. BUT! One thing that is know for Bitcoin is that its inflation will keep going down, and the next year there will be another halving that will bring the Bitcoin inflation bellow 1%.

Ethereum on the other hand has reduced its base inflation from 4% to around 0.4% with the transition to proof of stake, and then additionally depending on the burns that happens from transactions fees this is reduced further and is now in the negative. Bitcoin will go bellow the Ethereum base inflation of 0.4% after the halving in 2028, and will be around 0.3%. On the other hand for Ethereum it is not know what will be the exact inflation at the time, it might be negative but also might be positive depending on the activity on the network. So for the next five years ETH will have edge for the lower inflation for sure, and after that it is unknow. This is what gives Bitcoin the advantage. The predictable model for its supply.