The MakerDAO protocol is behind the DAI stabelcoin enabling all the mechanics that works around it. The way DAI is minted is through collateral. Users deposit other tokens like ETH, BTC etc and mint DAI. Usually, the ratio of the collateral is in the range of 200% or more, depending on the token. If the value of the collateral drops below the limit, those users are liquidated.

There are lot of mechanics behind this simple mechanism that enables the stability of the DAI token, like makers, keepers, price oracles, etc, that are making arbitrage all the time, check for market prices or for bed positions for liquidations.

The MAKER token is the governance token that is used for a lot of things when deciding on the protocol positions, like which token can be enabled for collateral, fees and more. It is also the ultimate backstop for DAI, in case of a black swan scenario and needs compensation. This has already happened in the past. The holders of the MAKER token are eligible for fees.

After the TerraUST collapse last year, DAI remains the number one decentralized stabelcoin in the crypto ecosystem. It has been around for a long time now and it has proven itself. It did had a few hickups in its exsitance but overall it remains a solid protocol.

More to read on MakerDAO in there whitepaper on the link.

Here we will be looking at:

- Total value locked TVL (collateral)

- DAI in circulation

- Loan to value ratio LTV

- Top tokens used as colateral

- Defi protocols rank by TVL

- Number of users DAUs

- Price

The period that we will be looking at is 2021 - 2023.

The data here is compiled from different sources like DefiLama and Dune Analytics.

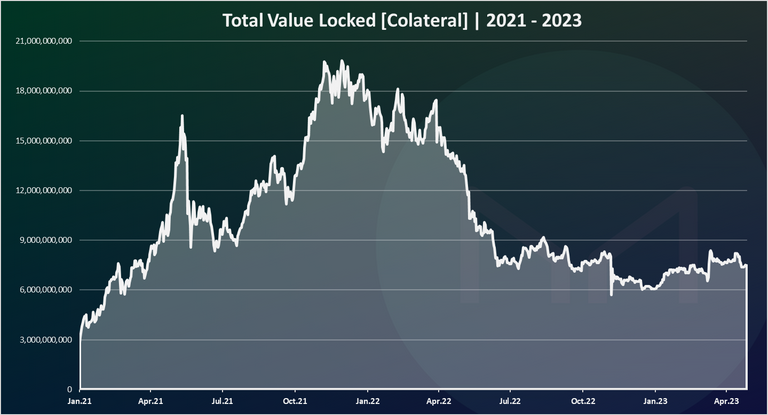

Total Value Locked [Colateral]

In the case of MakerDAO the TVL is the collateral deposited to mint DAI. Here is the chart.

We can see that the ATH for the collateral value in the MakerDAO protocol was reached at the end of 2021 with almost 20B in value. This is a significant number.

There was a huge drop in 2022, as the value of the tokens dropped and with the uncertainty in the crypto market. The drop was very noticeable in May 2022 when the TerraUST collapsed and took the whole market down. In a period of few months the collateral in the MakerDAO protocol went from 18B to 8B, loosing a 10B in value.

In 2023 the collateral value around the 7B mark.

DAI In Circulation

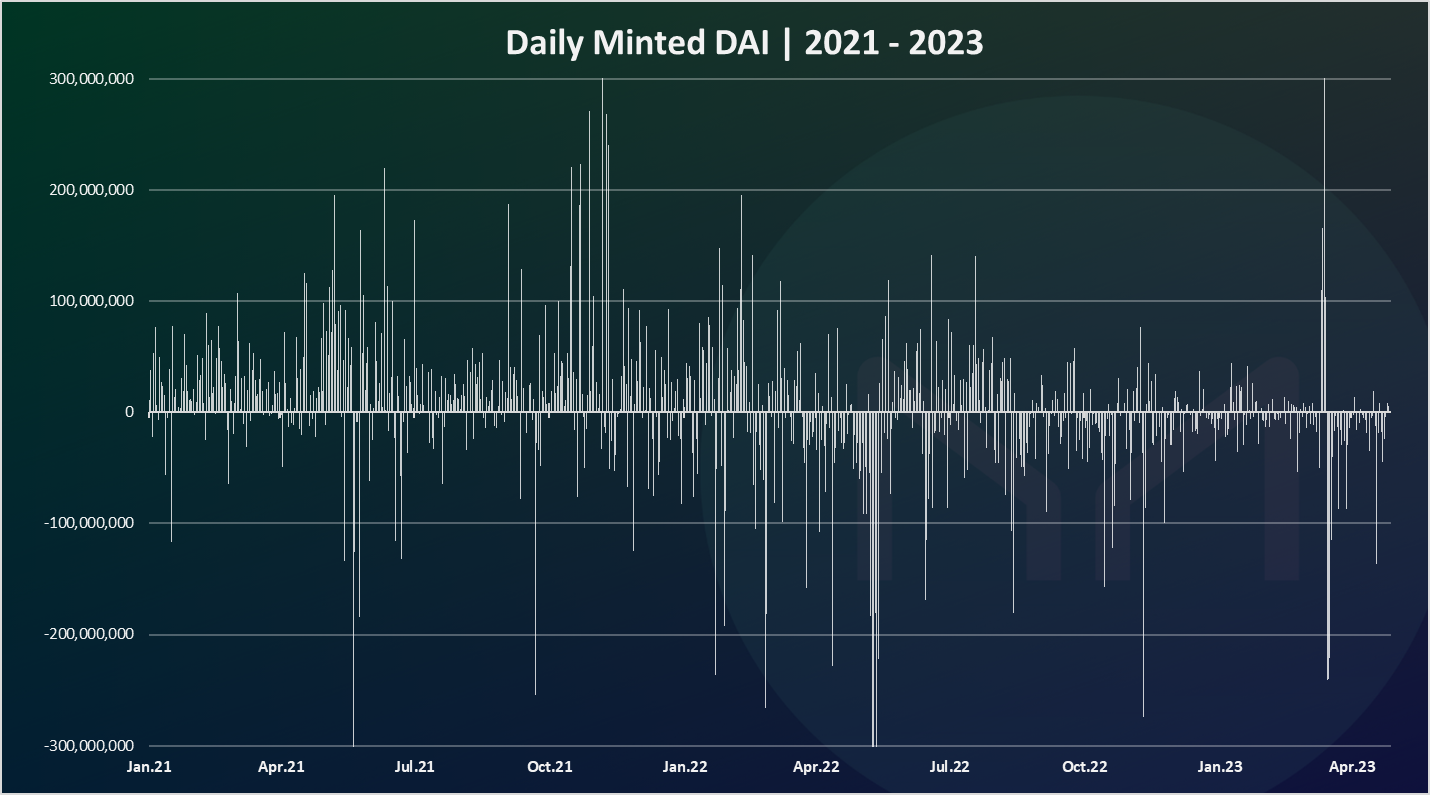

Here is the chart for DAI minted per day.

As we can see there have been days when there was more than 300M DAI minted in a day, or burned, and sometimes these numbers were reaching more than 1B per day. This just show the volatility of the industry but at the same time the speed of the transactions happening in the defi world.

We can notice the spikes that happened recently in March 2023, when the USDC coin was depeging, and a lot of capital flew to DAI, minting more than 1B in a few days. After the USDC situation calmed, the next few days there was large amounts of DAI burned.

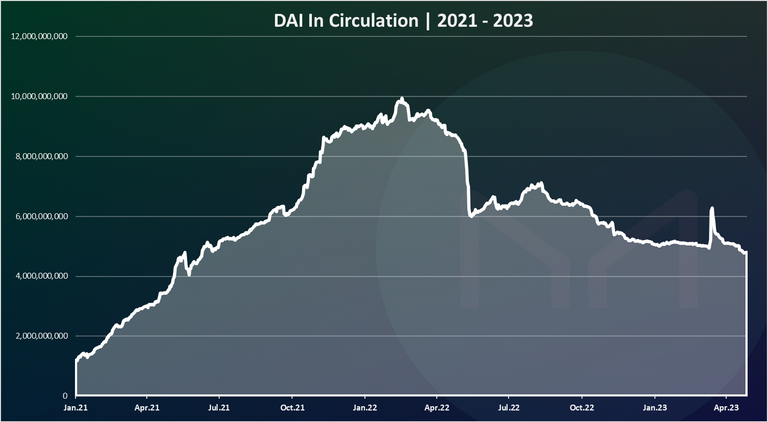

The cumulative DAI in circulation chart looks like this:

This chart follows the TVL chart, just with smaller numbers.

We can notice the spike up and down that happened in March 2023, due to the USDC situation. The ATH for DAI was 10B, at the beginning of 2022. In the last period there is around 5B DAI in circulation.

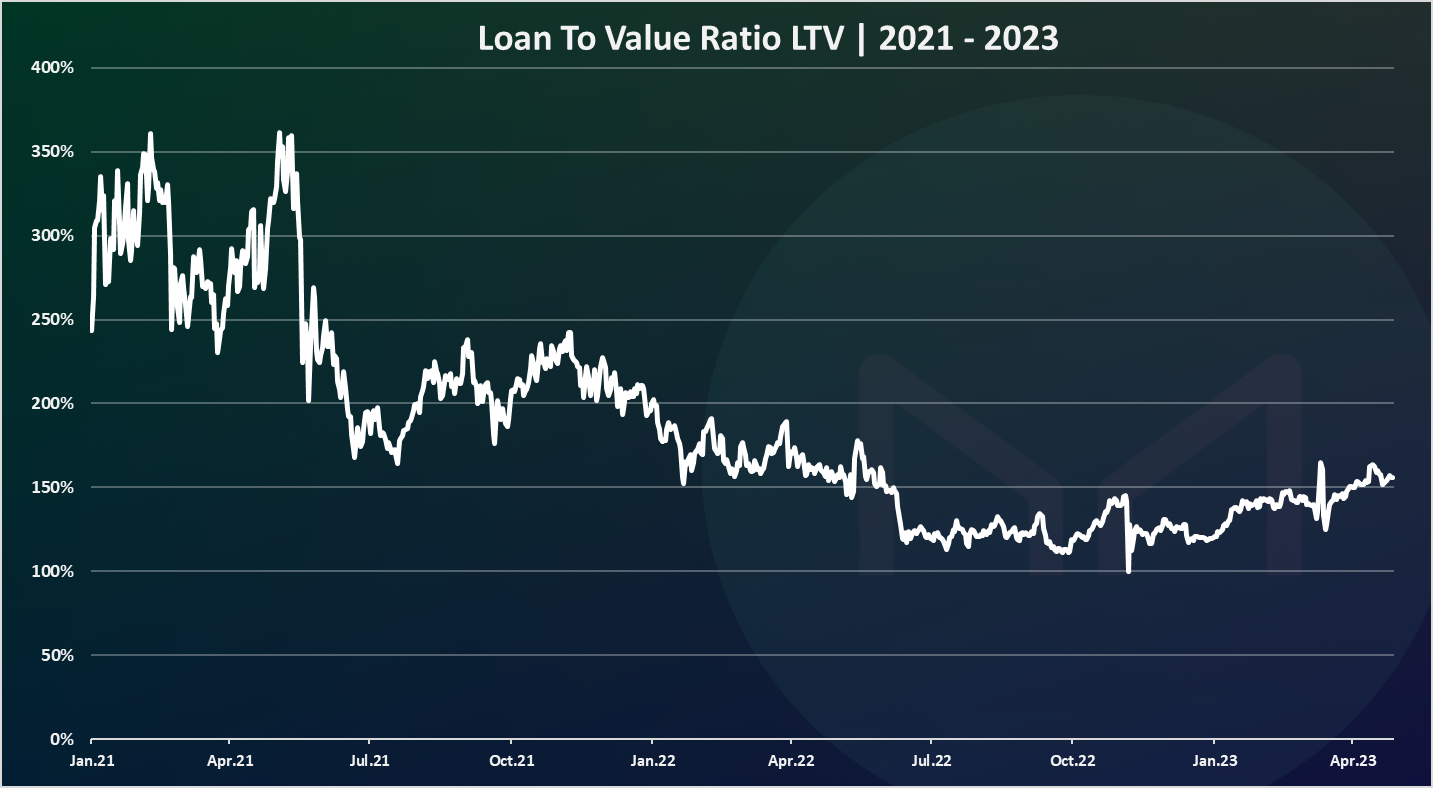

Loan To Value Ratio LTV

The LTV value is often used for MakerDAO and DAI, to access the overall health of the ecosystem and the collateral position. It is a ratio between the value of the collateral deposited and the DAI minted. For example for a 10B in collateral and 5B DAI minted the LTV ratio is 10/5 = 2, or 200% percent. Here is the historical chart.

From the chart above we can notice that the LTV value has dropped over time. At the beginning of 2021 this ratio was at 350%, while in the last year it is around 150% or less.

While this ratio might seems low and might shows that there are a lot of vaults close to liquidation, we should have in mind the type of collateral that is being used over time.

At first ETH was the number one collateral and was dominant. But as time progressed USDC become a large share of the collateral to mint DAI. Since USDC is pegged to the dollar there is no need for overcollateralization like in the case of ETH and users are minting DAI for 1 to 1 ratio. This lowers the overall LTV ratio.

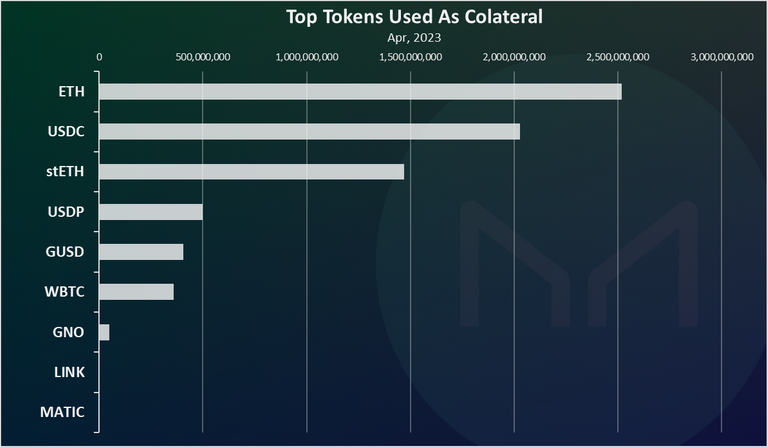

Top Tokens Used As Collateral

Which tokens are used the most when minting DAI. Here is the chart.

Ethereum is still on the top here with 2.5B, and another 1.5B as staked ETH. Cumulative 4B USD in Ethereum deposited for minting DAI, or 54% of the current TVL.

USDC is on the second spot with 2B deposited for minting DAI, or 27% share of the TVL.

More stablecoins in the top Paxos USD [USDP] and Gemini USD [GUSD].

Interesting Bitcoin is down on the list with only 350M deposited as collateral to mint DAI, or around 5% if the TVL.

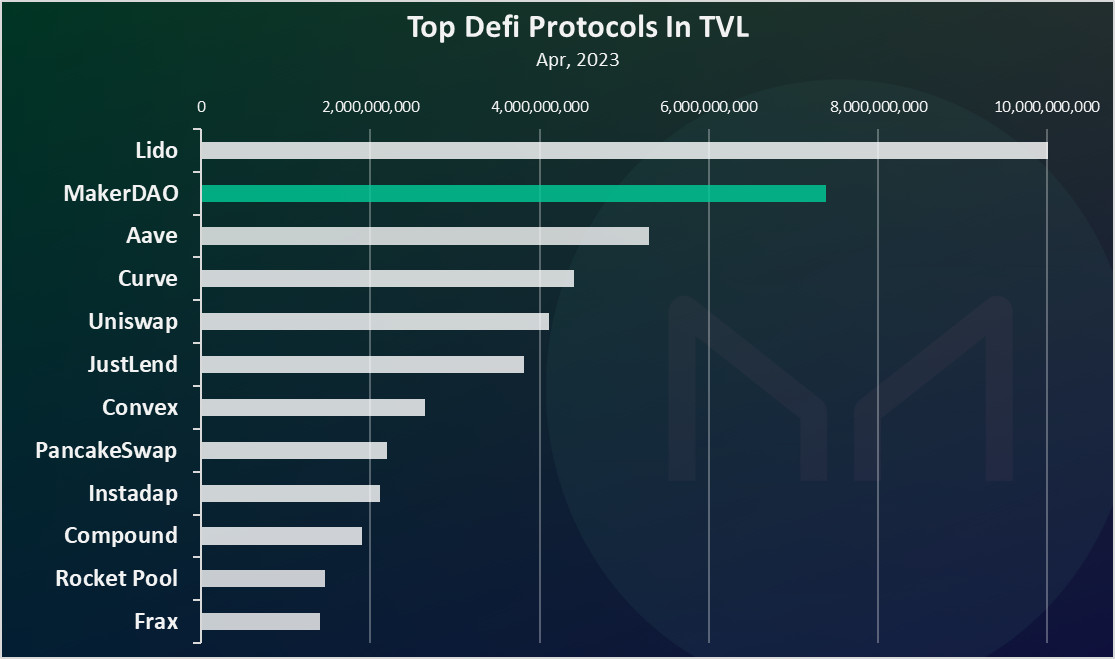

Top Defi Protocols Ranked By TVL

How is the MakerDAO protocol doing when compared to the other ones? The total value locked is usually one of the metrics these protocols use.

Here is the chart.

MakerDAO is on the second spot, ranking just behind the staking protocol for ETH, Lido. Because Lido is a special use case protocol, and not quite defi, we can say that the MakerDAO protocol is on the top of the list, in front of other defi giants like Aave, Curve and Uniswap.

Obviously the stablecoin game is a big deal in the crypto industry.

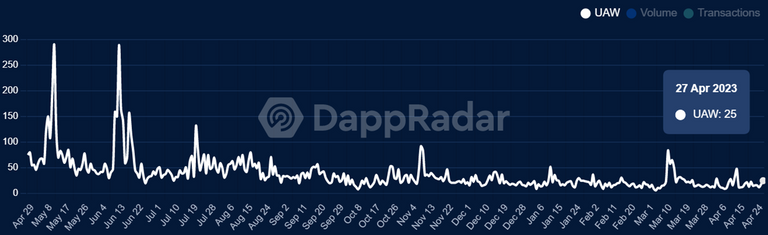

Active Users

How many users MakerDAO has?

This was a bit of a tricky metric to find as there is a lack of data out there. At the end I settled for the Oasis app number of users, since this is the most used frontend to mint DAI.

This is a chart from Dappradar that provide data for weekly users.

From the data here we can see that the number of users is quite small ranging from 20 to 100 users on weekly basis in the last period. This is not the whole data, since there is probably other frontends used for MakerDAO, or maybe just API points and smart contracts. However it goes to show that most of MakerDAO users play with larger amounts and don’t change their positions on a daily basis. It’s a long-term game when you mint stabelcoin and repay it very late or maybe never.

Price

When it comes to prices we will be looking at the chart for the governance token MAKER and the stabelcoin DAI.

Here is the chart for the MAKER token.

Quite a wild ride for MAKER, going from 400 to more than 5k in 2021, and down to sub 1k again in the last year. At the moment MAKER is around 700.

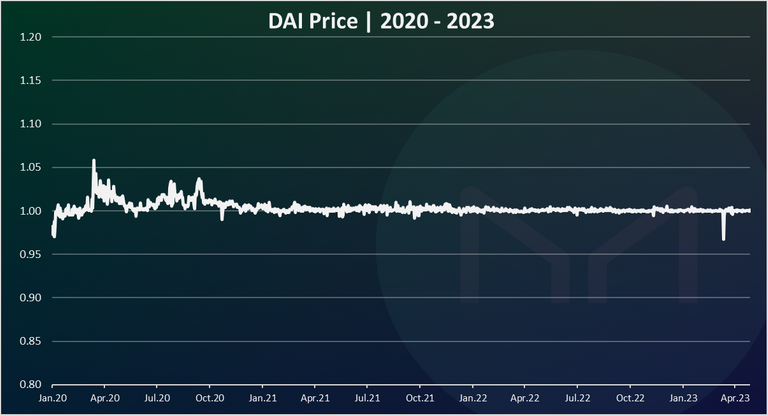

The chart for DAI looks like this.

While the chart for a stabelcoin should be flat, this is not always the case.

As we can see DAI broke the peg on the uptrend back in 2020, and then recently in broke the peg on the downtrend in March 2023, with the USDC situation. The fluctuations were small, but for a stablecoin of this position it is a lot of value.

Summary

We can see the big drop in the collateral and in DAI in circulation in 2022. Since then things have stabilized and there is now around 7B in collateral and 5B DAI in circulation. The addition of USDC has caused the LTV value to drop. Ethereum remains the number one asset that is used as collateral to mint DAI, followed by USDC. It should be noted that even with the smallest amount of USDC used as collateral, the amount of DAI minted from USDC is close to the rank of DAI minted from ETH, since ETH is overcollateralized. The number of users is relatively low, meaning that big players are mostly responsible for minting DAI.

All the best

@dalz

Posted Using LeoFinance Beta