Thorchain is a unique protocol with a goal to enable DeFi using native assets. It is a decentralized cross-chain liquidity protocol that enables the exchange of native layer-1 assets such as Bitcoin (BTC), Ethereum (ETH), and others in a permissionless way.

Unlike most of the other DEXs and DeFi protocols, that are using wrapped versions of other tokens on their network, Thorchain enables native coins to be swapped between each other. For example, the biggest DEX, Uniswap has WBTC (Wrapped Bitcoin) on the Ethereum network and then it allows this Bitcoin synthetic asset to be used on the Ethereum network. This comes with more risk added, as the issuer of the WBTC tokens on Ethereum need to hold the appropriate amount of BTC on the native network at all times. It’s the similar situation for other tokens and networks.

Thorchain allows users to swap assets between blockchain networks without the need for wrapped tokens, essentially serving as a bridge between these networks. The protocol is built on the Cosmos SDK and uses the Tendermint consensus engine.

Recently more use cases were added as Streaming Swaps and Lending, making it a full on DeFi protocol with multiple use cases.

It is worth noting that in the past Thorchain had its issues more than once. There was funds loss, hacks and stopping the entire protocol. More info in the whitepaper.

Here we will be looking at:

- Total value locked TVL (collateral)

- Trading volume

- Transactions

- Top tokens

- Defi protocols rank by TVL

- Price

The data here is compiled from different sources like DefiLama and Runescan.

Total Value Locked

Here is the chart for the total value locked in the protocol.

The TVL for the Thorchain has been on a wild ride. It increased a lot back in 2021 during the previous bull market, reaching more than 500M and then dropped to 100M during the bear market in 2022 and 2023. At the end of 2023 and 2024 the TVL increased again reaching its previous ATH to 500M.

Note that while 500M is a significant number, it’s still significantly lower than the top DeFi apps alike AAVE, Uniswap or MakerDAO, where the TVL is between 5B to 10B.

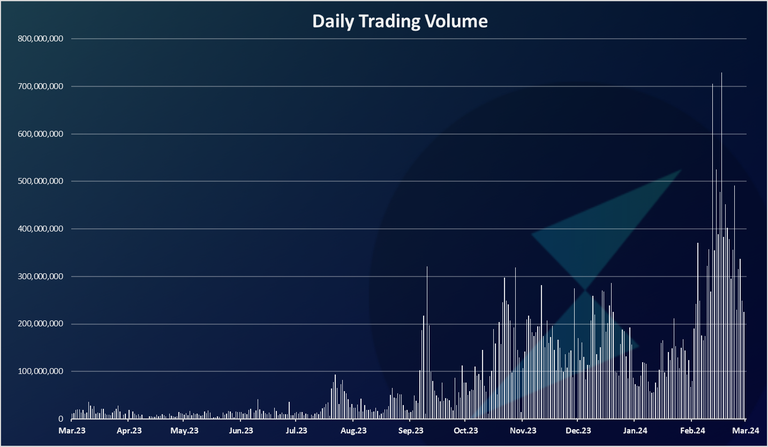

Trading Volume

Here is the chart for the daily trading volume on Thorchain.

We can see the significant growth in the last period in the trading activities on Thorchain. Unlike the TVL where the recent spike is at the levels of the previous bull market, the recent spike in the trading volume is much higher than the previous bull market. Meaning a lot more trading activity has been going on, and the protocol is much more used.

At the recent spikes there was 700M daily trading volume, while the average trading volume has been around 200M daily.

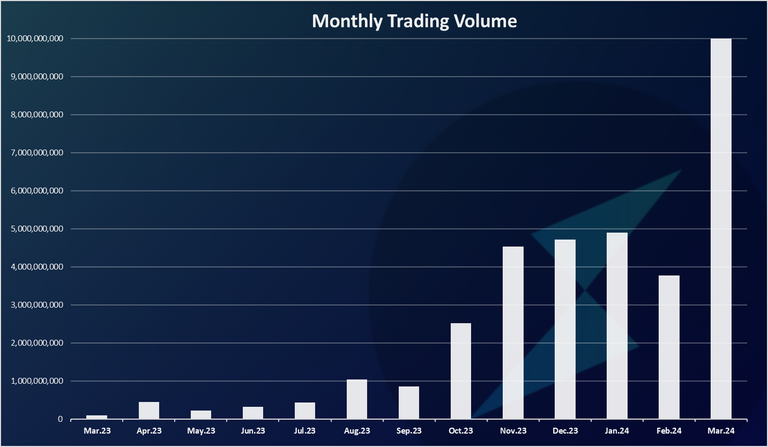

On a monthly basis the chart looks like this:

March is not over yet, but it will most likely end around the 10B mark. The previous months have been in the range of 4B to 5B, starting from November 2023.

When compared to the first months of 2023 the growth in the trading activity and the volume is obvious. From under 100M monthly up to 10B where we are now.

Transactions

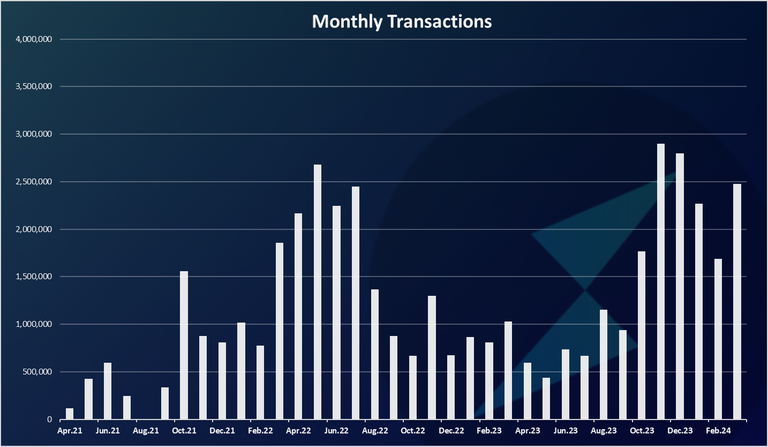

The data for the number of monthly transactions looks like this.

These are monthly transactions.

We can see that when it comes to the monthly transactions, the recent numbers are on the levels of the previous bull market at around 2.5M monthly transactions or close to 100k daily transactions.

Top Coins

Which coins are deposited the most on the Thorchain protocol. Here is the chart.

Bitcoin comes on the top here with close to 170M liquidity, followed by Ethereum with close to 100M, and then the stablecoins USDC and USDT with around 30M each.

AVAX is also ranking high in the liquidity. Other native coins that are supported are BCH, BNB, DOGE and LTC.

Top Defi Protocols Ranked by Trading Volume

How is the Thorchain protocol doing when compared to the other ones? The trading volume is usually one of the metrics these protocols use.

Here is the chart.

This is a 7 day trading volume.

Uniswap is still leading here in terms of trading volume. PancakeSwap is in the second sport, followed by some DEXs on the Solana chain like Orca.

Thorchain comes on the eight spots at the moment. A while ago it reached the third spot for a short period of time. However, the protocol has now entered the top 10 DeFi apps.

Price

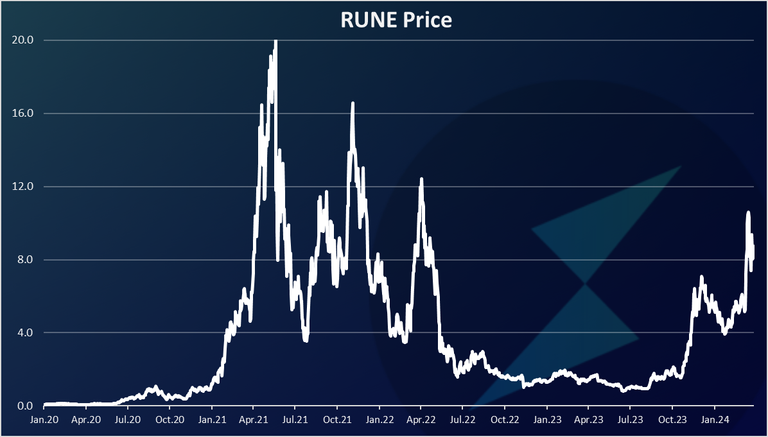

Here is the chart for the RUNE token.

Quite a wild ride for RUNE, going from a few cents in 2020 to $20 in 2021, and down to 0.8 USD.

A sharp recovery in the last few months, heating $10 at one point.

By all metrics Thorchain seems to have survived the brutal bear market and is starting to grow again in 2024. It’s still not at the very top in terms of DeFi apps, but it has a real chance, having in mind its unique functionality, enabling multichain swaps, and use cases as lending. When combined with BTC, things can get interesting. Hopefully there won’t be any hiccups going forward and no hacks.

All the best

@dalz

Posted Using InLeo Alpha