How are the two major chains doing in the last period? Is Ethereum closing the gap, or Bitcoin is growing its dominance? Let’s take a look.

Image background generated with Midjoureny

We will be looking at data for:

- Unique wallets

- Active wallets

- Number of daily transactions

- Fees

- Market cap and BTC dominance

The data is extracted from https://www.blockchain.com/charts and https://ethscan.com/, for the period July 2015 – February 2023.

Bitcoin is around since 2009, but Ethereum started with operation in 2015 and from then forward we will be making the comparisons.

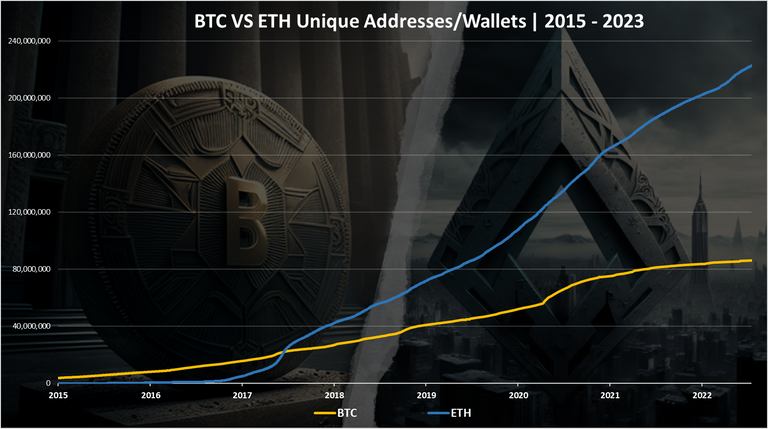

Number of Unique Wallets Created

Here is the chart for the number of unique wallets on Bitcoin and Ethereum.

Ethereum took the lead in the number of wallets back in January 2018 and it has been increasing the lead ever since.

In January 2018 the number of Bitcoin and Ethereum wallets was just above 20M. Today Bitcoin has 86M wallets and Ethereum 223M. Ethereum is leading in terms of number of wallets and has the highest numbers in the industry.

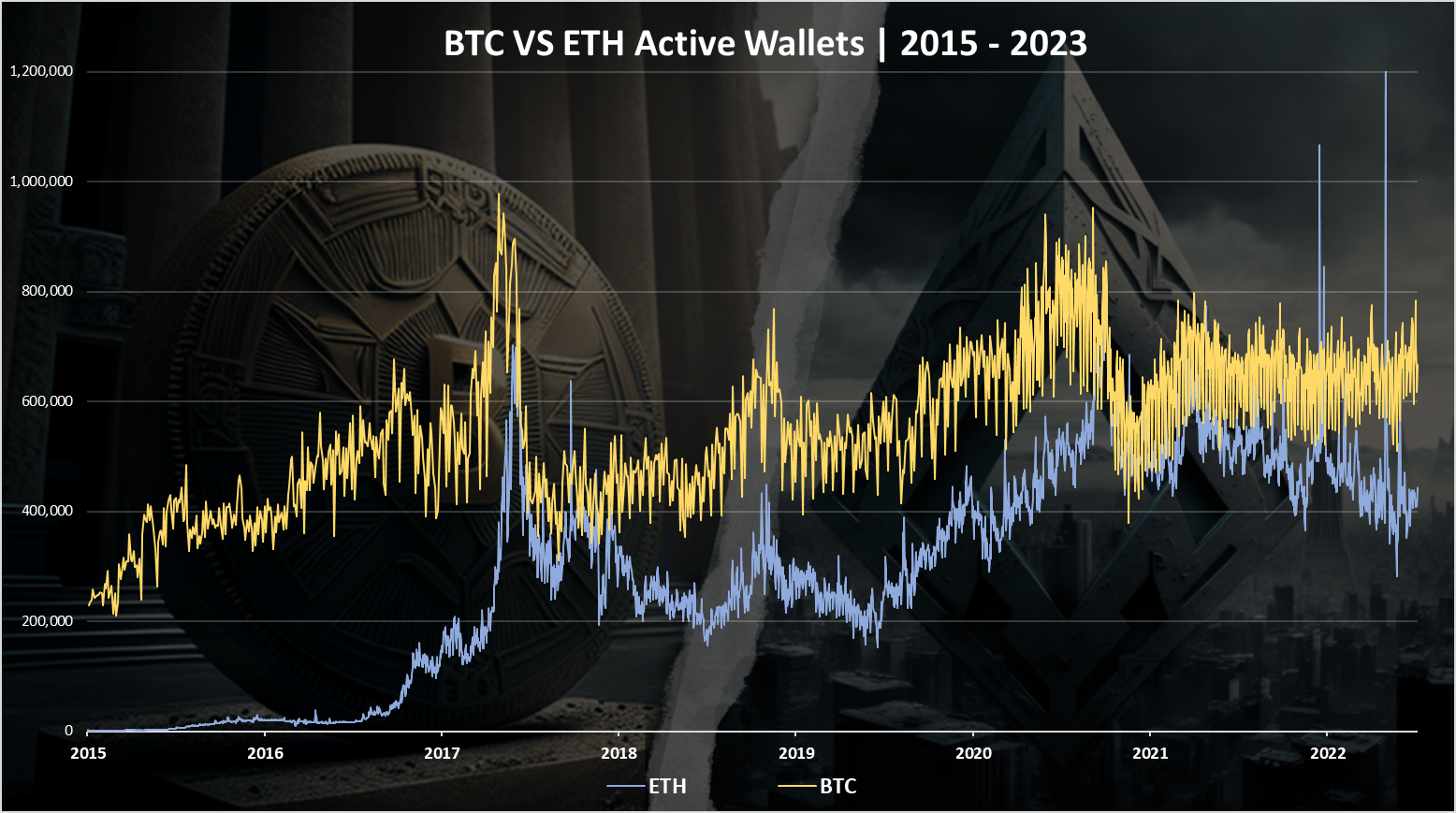

Active Wallets

The above was in terms of wallets created. How about active wallets? How many of those wallets created are actually been used? Here is the chart.

When we look at the numbers of active wallets Bitcoin is in the lead. Ethereum has come close to Bitcoin in the previous bull run, at the end of 2017 and the beginning of 2018. On few occasions ETH has surpassed BTC in number of daily active wallets.

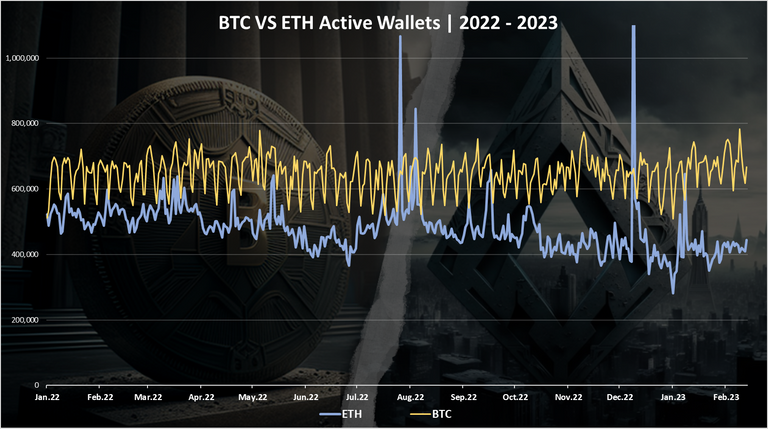

When we zoom in 2022-2023 we get this:

Quite a constant numbers for both of the chains.

Bitcoin is leading and has increased its lead in the last period. Just recently it has come close to 800k DAUs, while ETH is hovering around 400k. The Bitcoin NFTs made some impact on the Bitcoin network and increased the numbers of active wallets in the last weeks.

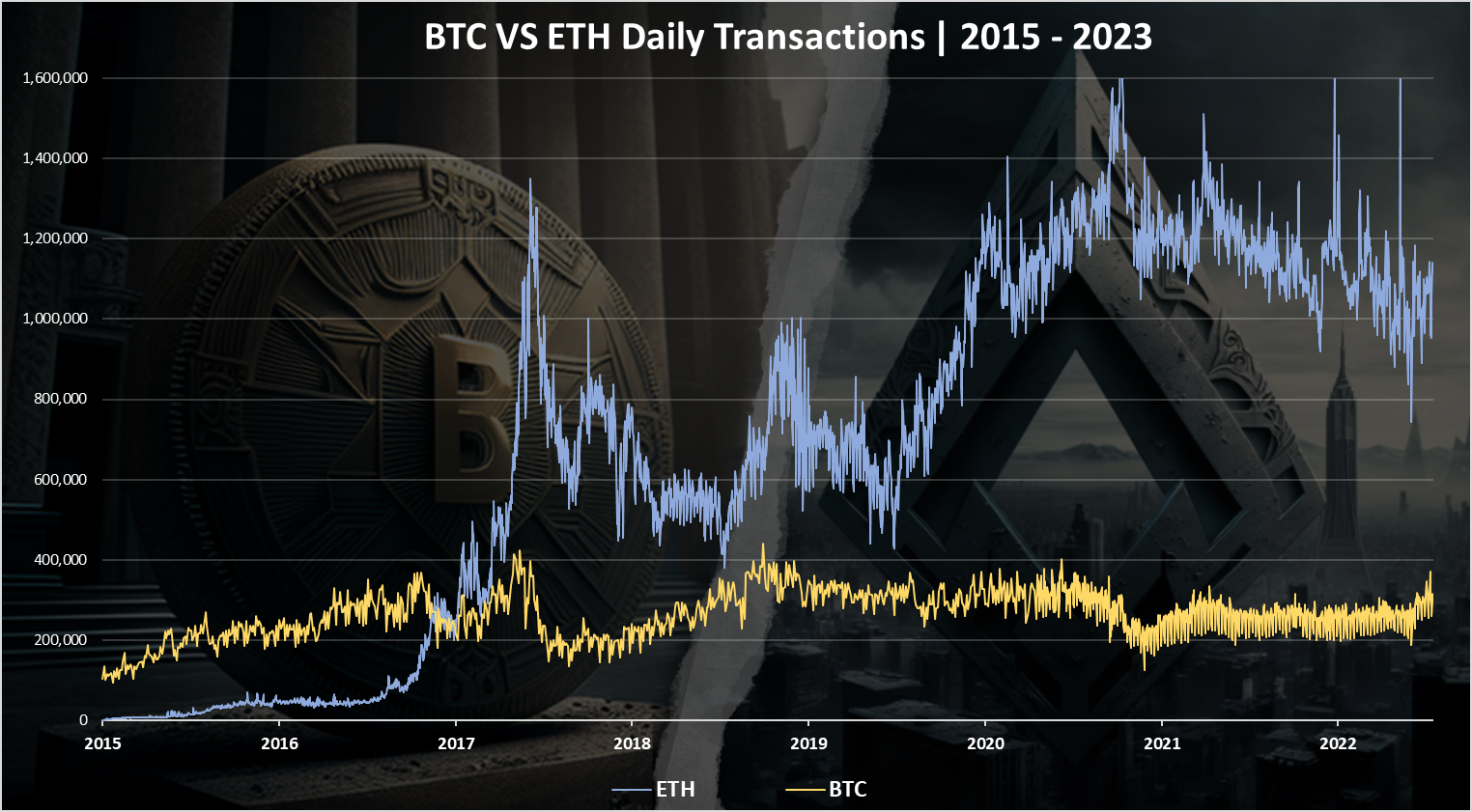

Number of Daily Transactions

Here is the chart for the number of daily transactions.

In terms of daily transactions Ethereum is in a big lead in front of Bitcoin.

Ethereum has overtaken Bitcoin in the previous bull run in 2017 and has been leading since then. In the last period Ethereum has more than 1M transactions per day, while Bitcoin is around 250k transactions per day.

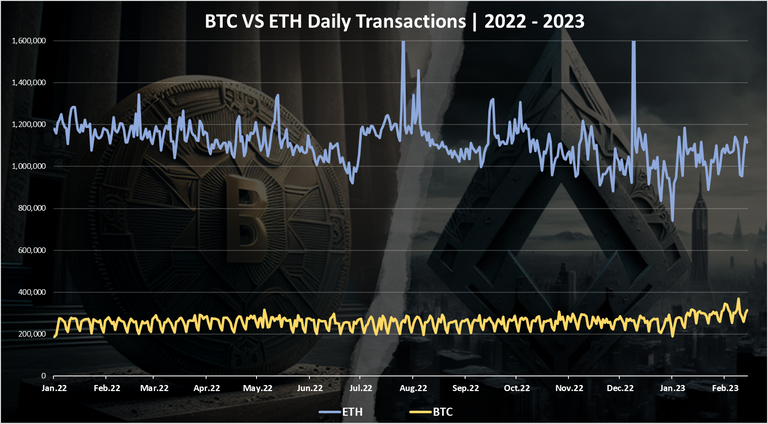

When we zoom in 2022-2023 we get this:

Ethereum has been in the range of 1M to 1.2M transactions, with a small downtrend in the period. Bitcoin has been very steady up until recently when the numbers of daily transactions increased from 250k to more than 350k.

What’s interesting is that the numbers are very steady no matter the decline in price for both of the chains. Seems like they have reached the cap and are working at that level all the time.

As we know Ethereum as a smart contract’s platform has a lot of different operations and transactions that can be made on chain, while Bitcoin is used only for one purpose, and that is transferring tokens from one wallet to another.

Ethereum has a smaller number of daily active wallets than Bitcoin, but obviously those wallets are making more transactions than the Bitcoin wallets.

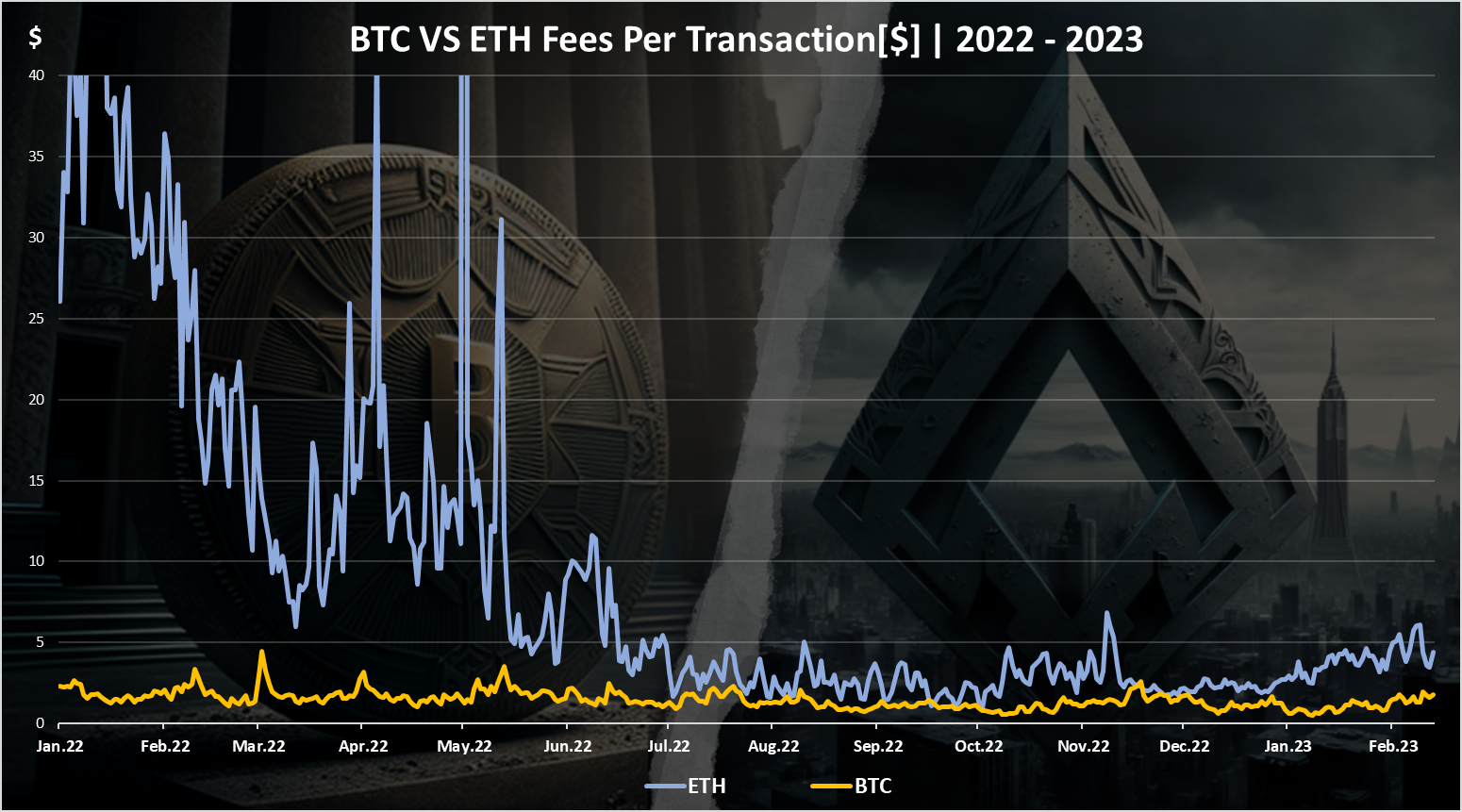

Fees

The chart for the fees in 2022 looks like this.

These are the average daily fees per transaction in $ value.

A significant decline for Ethereum, while Bitcoin remains almost at the same levels.

At the beginning of 2022 Ethereum had fees that were more than 40$ on average, while Bitcoin was in the range of few dollars. As time progressed the fees for Ethereum dropped and both chains are now in the range of few dollars per transaction.

We can notice that in the last weeks the fees has increased a bit on both of the chains, with ETH reaching $5 and Bitcoin around $3.

In the long run fees are essential for the chains as they will be the main source for incentives for miners/validators providing infrastructure.

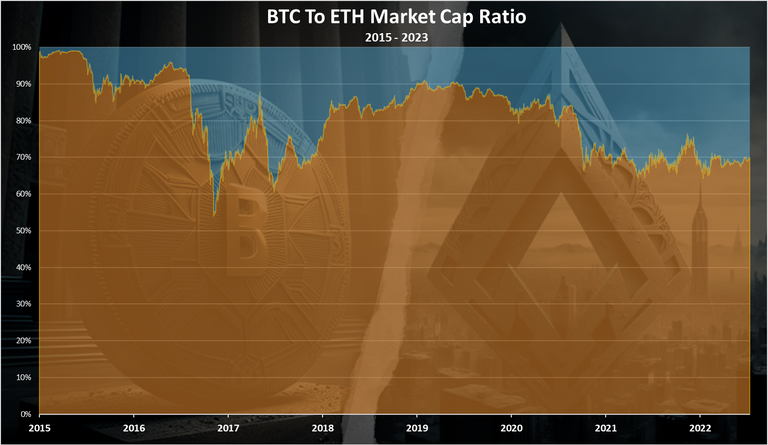

Bitcoin And Ethereum Market Cap

The interesting topic for Bitcoin and Ethereum is the flippening, or will Ethereum surpass Bitcoin in terms of market cap and become no.1 crypto.

Here is the historical chart for the Bitcoin VS Ethereum market cap.

We can see that at first in 2015 Ethereum has a very low market cap compared to Bitcoin. As time progressed in the bull run of 2017 Ethereum has come close to the market cap of Bitcoin on few occasions, but only for a short period of time.

In the last two years the ratio of the market cap for Bitcoin and Ethereum has been in a tight range around the 70%-30% share. It seems that these two are now starting to be more stable when it comes to pricing in BTC vs ETH.

At the moment Ethereum has around 200 billions market cap, while Bitcoin is around 470 billions.

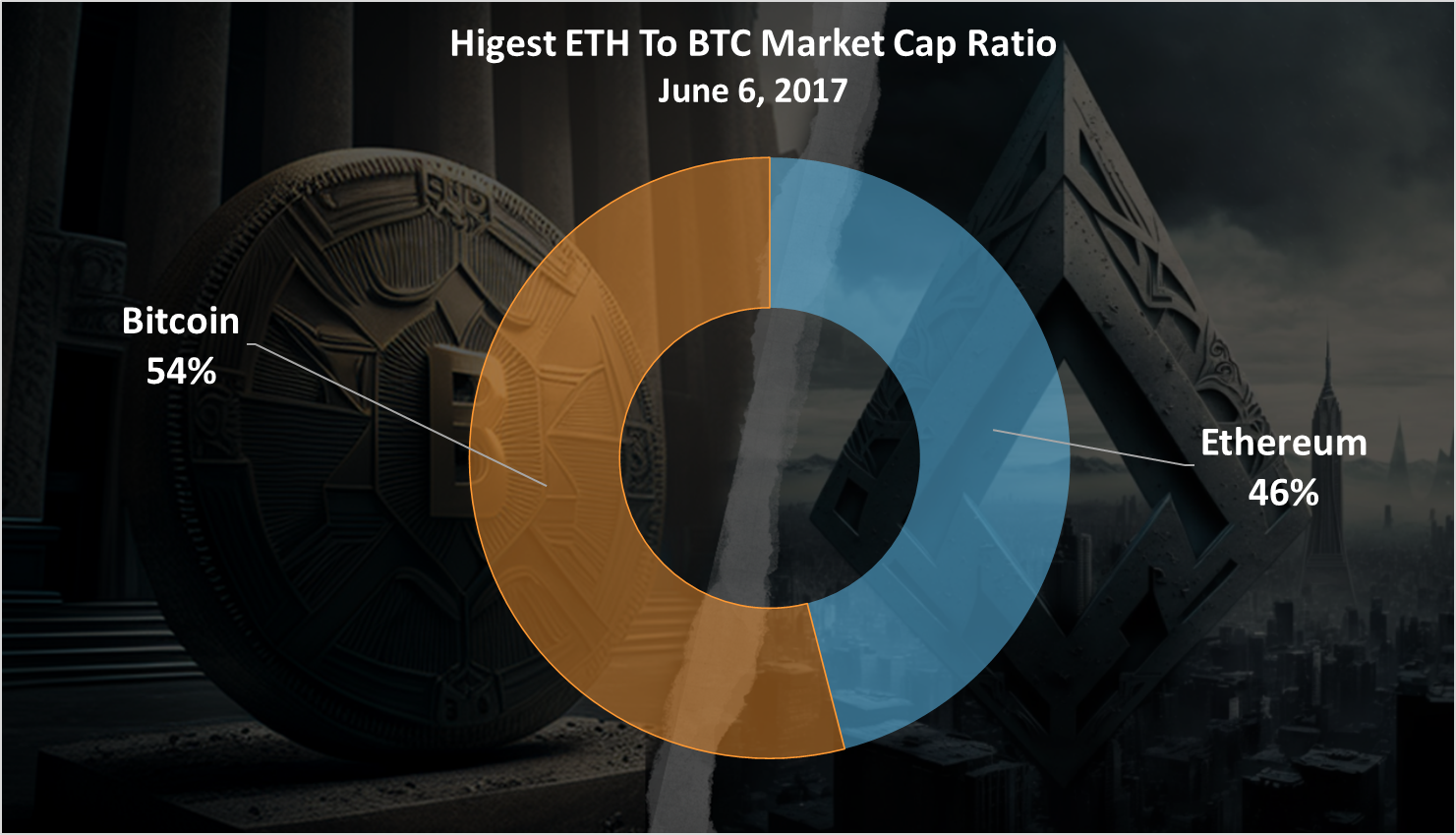

Ethereum came closest to Bitcoin on June 18, 2017

On this date Bitcoin had a marketcap of 43 billion and Ethereum 37 billion. This is before the major bull run that happened late in 2017.

The chart for the share in marketcap on this date looks like this.

The closest that Ethereum came to Bitcoin.

This is pretty close. A 41B to 34B! A 7 billion more ant Ethereum would have flipped Bitcoin. Looks like the flippening is not impossible 😊. A 54% to 46% ratio.

Summary

ETH is leading when it comes to the numbers of wallets created, but the number of wallets active, BTC is in the lead. The number of transactions are higher on ETH, although BTC has seen some increase in activity in the last weeks. The fees these days are relatively low when compared to the previous years and are bellow the $5 on both of the chains.

When it comes to the market cap, it seems that the 70% - 30% is a standard in the last years. There has been some ups and downs, but relatively stable when compared to the previous cycle.

A note at the end that comparing these two blockchains just in terms of the numbers above is quite interesting and useful but might be misleading as well. These two blockchains have taken a different role now. Bitcoin as a scare’s asset a digital gold, while Ethereum as the leading smart contract platform enabling innovations, new dApps and use cases for crypto.

All the best

@dalz

Posted Using LeoFinance Beta