The bear market is in full force now, but the top chains still hold their ground.

Ethereum is no doubt the number one in terms of layer one smart contract chain, but the Binance Smart Chain BSC has giving it a good run in the last bull.

BSC has been fast to implement EVM (Ethereum Virtual Machine) and has gained a lot of traction especially from the users who were priced out from Ethereum due to the high fees.

With the bull market behind us time to revisit this two and see how things stand now.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

- Market Cap

The period that we are looking into is 2022.

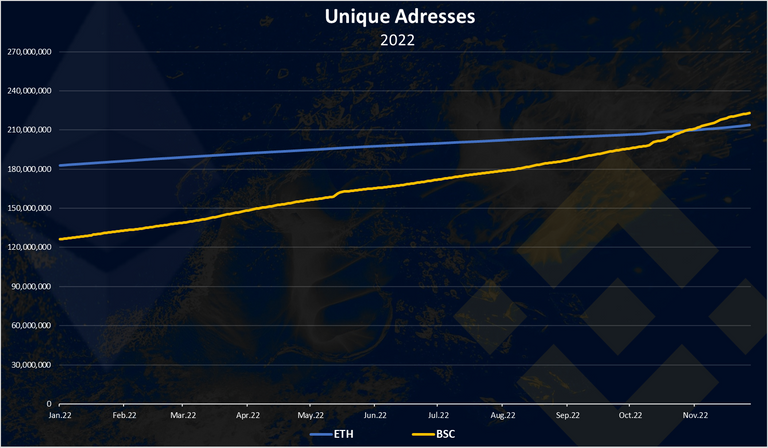

Number Of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

BSC has overcome ETH in total number of wallets!

This has happened at the end of October 2022, when both chains had around 210 million.

Since November BSC overtook ETH and now is the number one blockchain in terms of wallets. At the moment the number of wallets on ETH is 213M, while the number of wallets on BSC is 223M.

The number of wallets on both chains has grown in throughout the whole year on both chains. ETH started the year 183M and now is at 213M, while BSC started the year with 126M and now is at 223M. ETH added 50M wallets in the year, while BSC added almost 100M. BSC has grown twice faster than ETH in numbers of new wallets.

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

BSC is on the top now in terms of active wallets with around 1.3M. ETH is around 400k.

ETH started the year with around 600k active wallets and now is around 400k. BSC stared the year with 1.5M and now is at 1.3M.

Ethereum had quite steady numbers in terms of active wallets with a spike in August, while BSC dropped to 800k in September and now has started growing again.

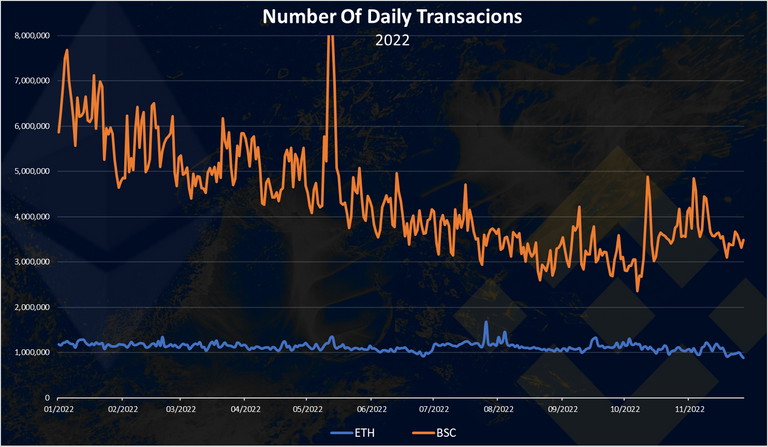

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

BSC is in the lead here again with 3M to 4M transactions per day while ETH has around 1M daily transactions.

The drop in the numbers of transactions is obvious for BSC here where the year started with almost 8M tx per day and now it is around 4M. For Ethereum the number of transactions has been steady around the 1M mark.

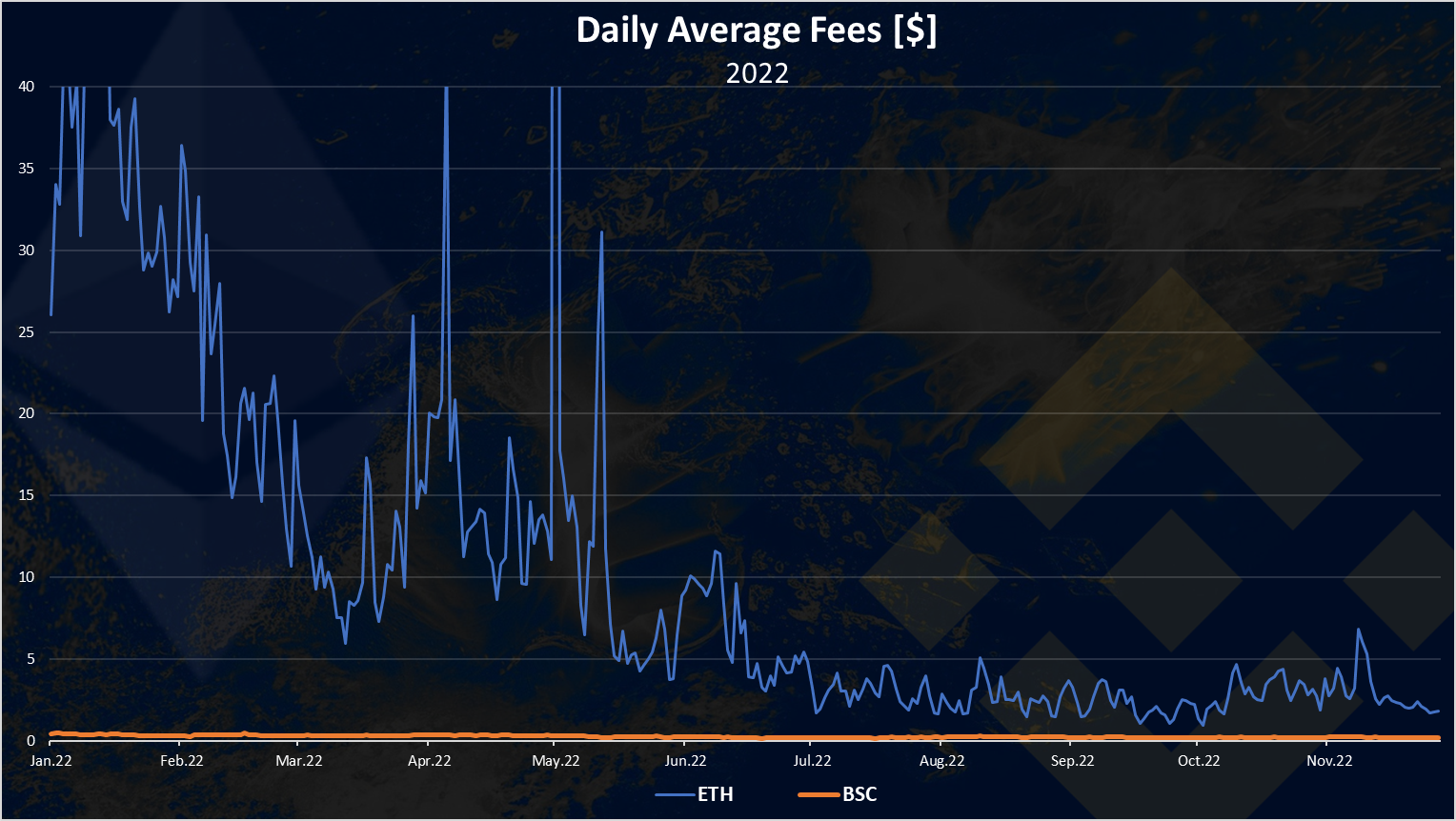

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

The fees are in dollar terms, average for the day.

We can see from the chart that the Ethereum fees has been much higher than BSC. At the beginning of the year the average fee on ETH was more than $50, while on BSC was $0.5.

The ETH fees have dropped significantly in the year and now they are around $2 on average. The fees on BSC are around $0.2. Still much cheaper than ETH.

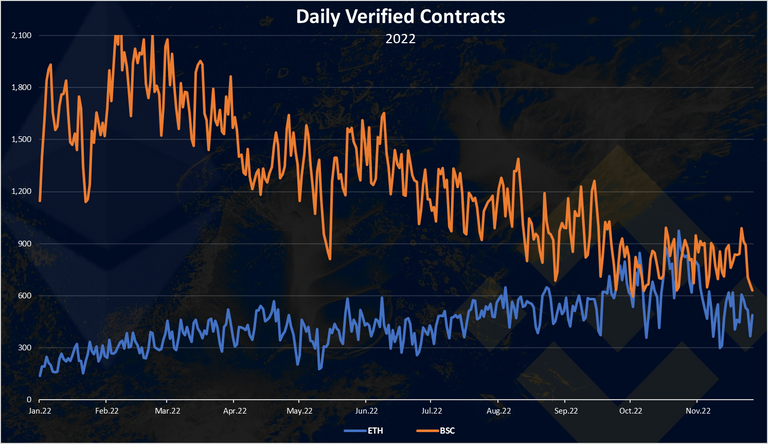

Contracts

These three are smart contract platforms so here is the chart for verified contracts per day.

This is an interesting chart. The number of smart contracts for BSC has been in a downtrend while on ETH in uptrend. They have leveled up in October, but since then the numbers on ETH have dropped and now BSC is leading again, but only by small margin.

At the beginning of the year there was around 1800 daily verified contracts on BSC and around 250 on ETH. Now BS is around 800 and ETH 600.

Market Cap

What about the market cap?

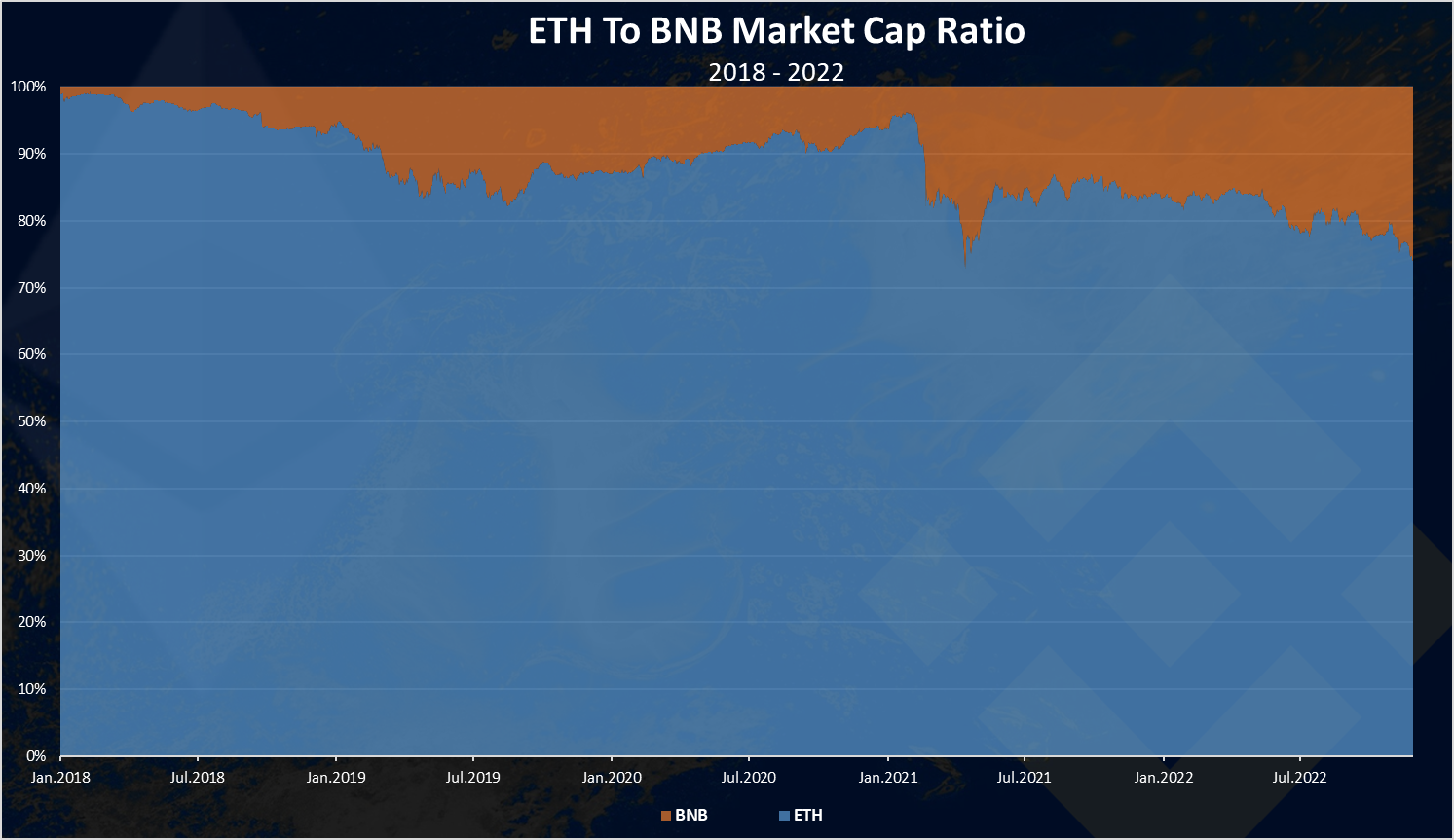

This is the ultimate metric for the chains. Here is the market cap ration between ETH and BSC.

Obviously ETH is leading by a lot here, but we can see a trend for BSC.

Back in 2018 the BSC market cap was less than 10% from the two, and in the recent days BSC has climbed and is more than 20% market share. This is around the ATH for BSC.

At the moment the BSC market cap is 50B, while the ETH around 150B, or a 25% market share.

As cheaper alternative to ETH, BSC has outperformed ETH in terms of wallets, DAUs, transactions and fees.

Still in terms of market cap ETH is leading and is now three times the size of BSC, but there is a small and steady trend for BSC in the last years. Will this continue it remains to be seen.

All the best

@dalz

Posted Using LeoFinance Beta